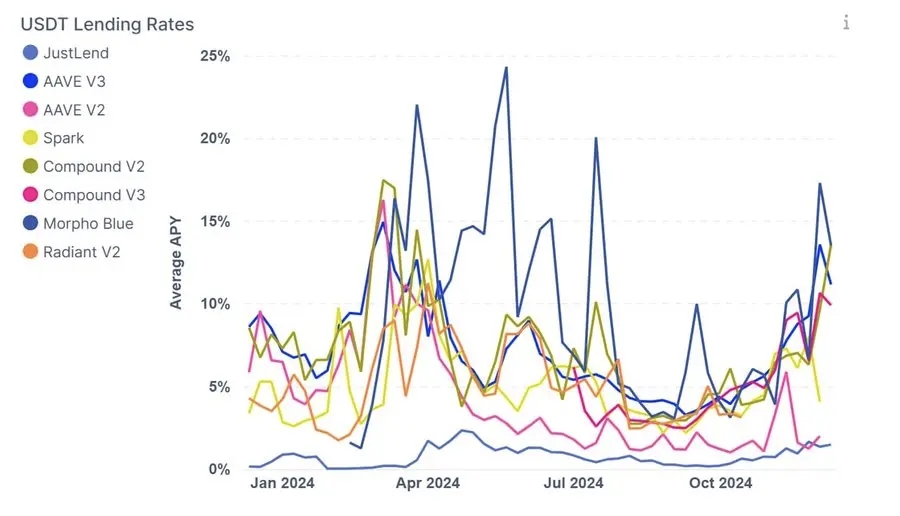

Data: The lending rate in the DeFi market has reached a new high since 2022, with Aave seeing a net inflow of funds reaching 500 million US dollars this week

According to IntoTheBlock data, with users extensively using WBTC and WETH as collateral for borrowing stablecoins, the DeFi lending market has welcomed a new wave of popularity. The lending rate has broken through 10%, with some projects reaching up to 40%, setting a new high since the bull market in 2022. The largest lending protocol on Ethereum, Aave, had a net inflow of funds reaching $500 million this week.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A Whale Withdraws Over 9,000 ETH from CEX in the Past 2 Days

The cumulative net inflow of U.S. Bitcoin spot ETFs surpasses $40.8 billion, setting a new record

BlackRock and SEC Cryptocurrency Group Discuss Staking and Options for Crypto ETFs

$TRUMP Team-Linked Address Transfers 3.5 Million TRUMP to CEX in the Past Half Hour