- Bitcoin drops to $95K, facing renewed market uncertainty after failing to reclaim $100K.

- Social media sentiment shows a surge in FUD, with negative comments outweighing positive ones.

- Historical patterns indicate that extreme pessimism could signal a potential bullish reversal for Bitcoin.

In the last 24 hours, after coming close to reclaiming the $100K level once again, the price of Bitcoin plummeted to $95K. The initial recovery toward the six-figure level came after a crash to $92K last week. However, the recovery rally failed to sustain as the market is tanking again.

Bitcoin FUD Now at Historic Levels

Meanwhile, Bitcoin’s recent price slump has triggered a wave of fear, uncertainty, and doubt (FUD) among traders, reaching the highest levels of negativity recorded this year.

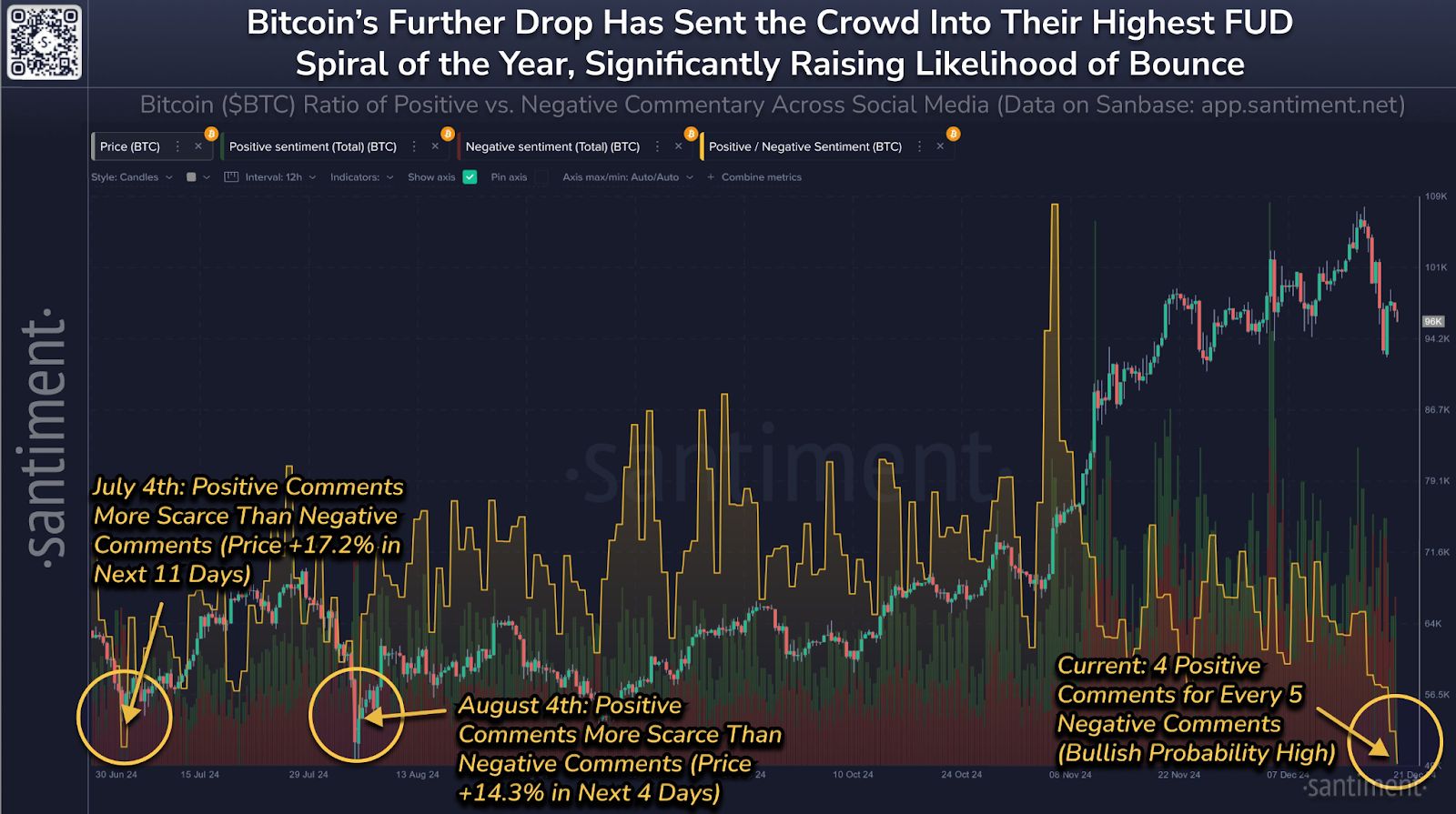

According to a report from market intelligence platform Santiment, social media sentiment metrics now reveal a striking imbalance between negative and positive commentary, which could signal a more sustainable rebound for the cryptocurrency.

Santiment’s data shows that for every four positive comments about Bitcoin, there are five negative ones—a stark indicator of market pessimism. Historically, such sentiment extremes have coincided with bullish turnarounds.

For example, on July 4, similar negative sentiment preceded a 17.2% price surge within 11 days. Likewise, on August 4, a comparable wave of negativity was followed by a 14.3% rally in just four days.

A Promising Sign for Bitcoin?

These patterns align with the contrarian view that markets often move in the opposite direction of retail sentiment. When traders exhibit excessive FUD, it frequently indicates overselling and a potential reversal as smart money steps in.

Santiment emphasizes that the sharp increase in negativity could be a promising setup for a bullish recovery, potentially mirroring past scenarios where the market defied the crowd’s bearish expectations.

For seasoned investors and contrarian traders, this could represent an opportunity to capitalize on the heightened uncertainty in the market. Whether history will repeat itself remains to be seen, but the sentiment metrics suggest that Bitcoin’s next move could catch many off guard.

Notably, the overall crypto market fear and greed index has dropped to 59, a neutral point, compared to a greed score of 77 observed last week. The market was even at extreme levels beyond 92 as of last month.

At press time, Bitcoin is hovering around $96,500, still posting a loss of 2.5% over the last 24 hours.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.