VanEck Argues That a Strategic Bitcoin Reserve Could Slash US Debt 36% by 2050

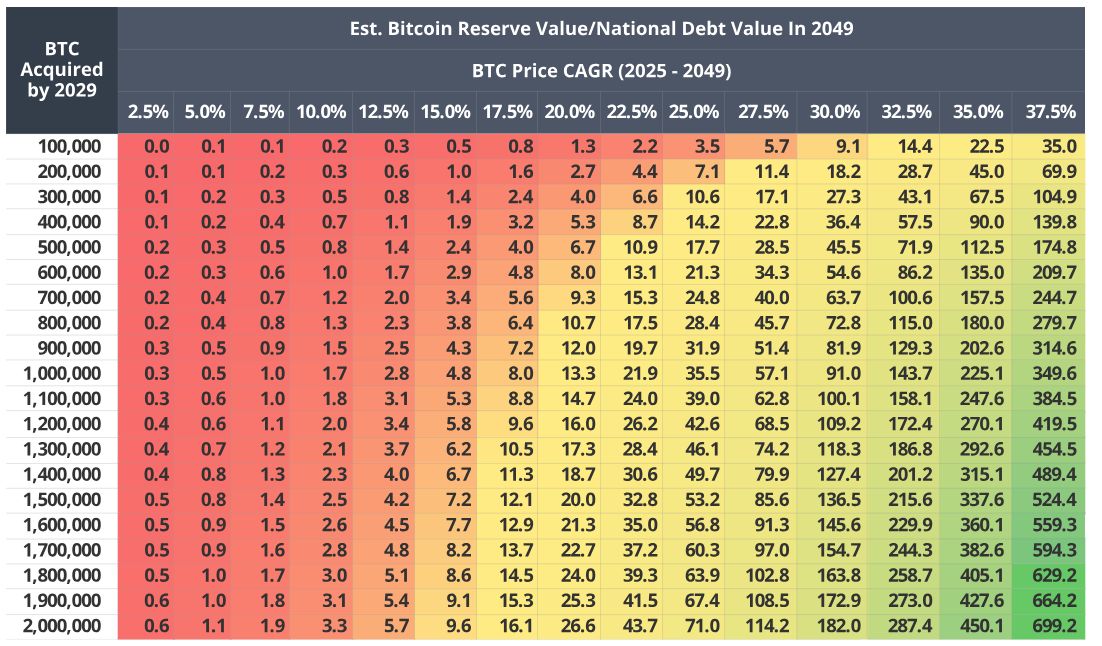

VanEck predicts this move could diminish national liabilities by an estimated $42 trillion by 2049, assuming consistent debt growth and a significant annual appreciation in Bitcoin's value.

VanEck, a leading asset management firm, has recently projected that the United States could significantly cut its national debt by as much as 36% by 2050 through adopting a Strategic Bitcoin Reserve.

This initiative aligns with Senator Cynthia Lummis’s Bitcoin Act, which advocates for the US to amass 1 million bitcoins within the next five years. The lawmaker argues that such a reserve could place future generations on a more stable financial footing, free from debts they did not accrue or benefit from.

How a Bitcoin Reserve Could Transform US Debt Management by 2050

VanEck’s analysis supports this strategy, predicting that such an investment could cut national liabilities by an estimated $42 trillion by 2049. This projection assumes a consistent debt growth rate of 5% and an annual bitcoin appreciation rate of 25%.

In this scenario, Bitcoin’s value would skyrocket to over $42 million, making it a substantial player in the global financial arena by 2049.

“Assuming today’s $900 trillion of total global financial assets compound at 7.0% from 2025 – 2049, Bitcoin would represent 18% of global financial assets in this scenario,” the firm added.

US Bitcoin Reserve Value/National Debt Value in 2049. Source:

VanEck

US Bitcoin Reserve Value/National Debt Value in 2049. Source:

VanEck

Mathew Sigel, VanEck’s head of research, emphasized Bitcoin’s potential role in reshaping the global financial landscape. He suggested that Bitcoin might become the leading settlement currency in global trade – presenting an alternative to the US dollar – especially for countries seeking to sidestep US sanctions.

“It’s very possible bitcoin will be widely used as a settlement currency for global trade by countries who wanted to avoid the parabolic increase in USD sanctions that have been imposed,” Sigel wrote.

To kickstart this ambitious project, VanEck recommends several preliminary measures, including stopping the sale of Bitcoin from US asset forfeiture reserves.

Furthermore, they suggest that adjustments could be made under President Donald Trump’s incoming administration, such as revaluing gold certificates to their current market prices and using the Exchange Stabilization Fund to make initial Bitcoin purchases.

Indeed, these steps could help establish the reserve quickly without waiting for extensive legislative approval.

However, the proposal has met with some skepticism. Venture Capitalist Nic Carter has questioned whether a Bitcoin reserve would genuinely bolster the US dollar. Meanwhile, Peter Schiff proposes an alternative of the creation of a new digital currency called the USAcoin.

“The US could save a lot of money by creating USAcoin. Just like Bitcoin, the supply can be capped at 21 million, but with an upgraded blockchain to make USAcoin actually viable for use in payments,” Schiff suggested.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Nearly 1% of Ether Supply Permanently Lost Due to Bugs and User Mistakes

The amount of Ether (ETH) permanently inaccessible due to user errors and software bugs has now surpassed 913,000 ETH, equivalent to around 0.76% of its circulating supply, according to Conor Grogan, head of product at Coinbase.

Cardano Prepares Audit Amid $600M Allegations

Ethereum Market Cap Surpasses $450 Billion Amid Institutional Interest

Bitcoin Price Stalls at $123K, Approaches $111K Support