In the last seven days Bitcoin fell by 12,16%, which had a negative impact on investor sentiment and triggered an outflow of funds from spot bitcoin ETF , traded in the United States.

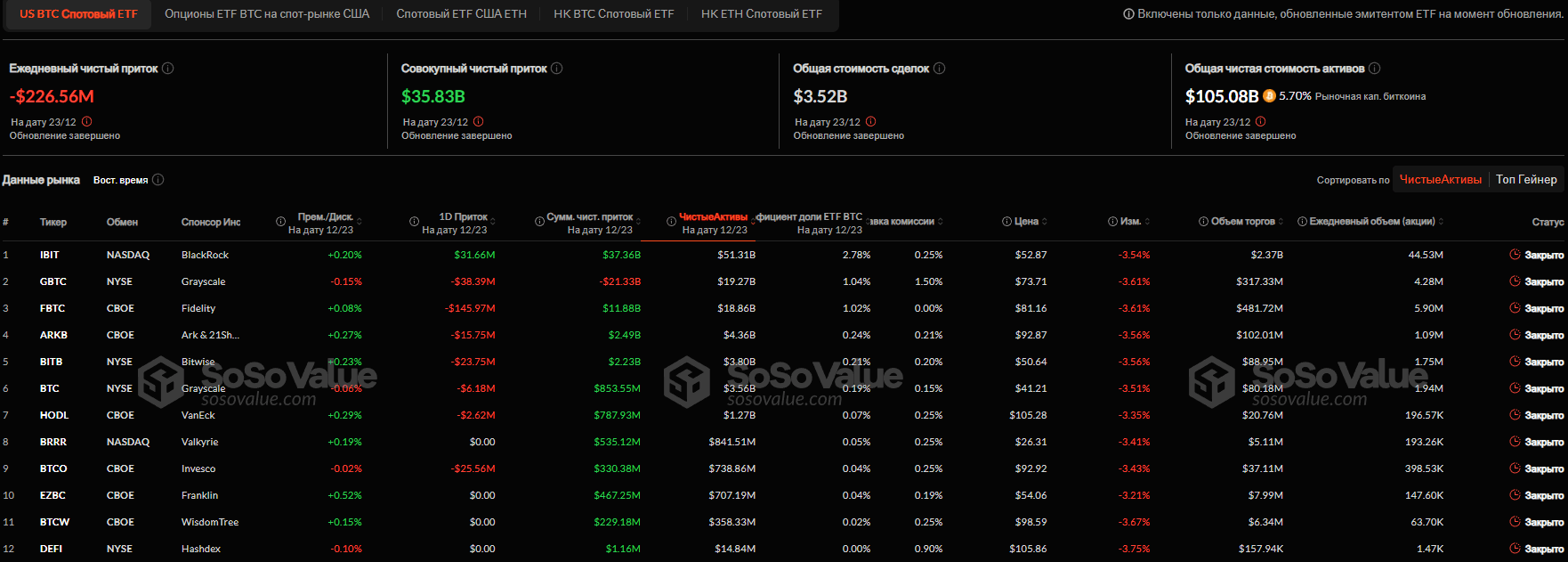

According to data from the SosSoValue platform, exchange-traded funds have lost more than $1,18 billion in just three days. The total outflow of funds over the past trading day exceeded $226 million.

Inflow of funds into spot Bitcoin -funds

Investors withdrew the most money from Fidelity’s FBTC — about $145,97 million. Grayscale’s GBTC fund lost $38,39 million, Invesco Galaxy’s BTCO — $25,56 million, Bitwise’s BITB — $23,75 million, and ARKB — $XNUMX million. ARK and 21Shares — $15,75 million, Bitcoin Grayscale's Mini Trust lost $6,18 million, and HODL $2,62 million withdrawn from VanEck

BlackRock's IBIT is the only one bitcoin ETF , which recorded an inflow of funds of $31,66 million.

As of December 23, the total net asset value of Bitcoin ETFs reached $105,084 billion. This is approximately 5,7% of the market capitalization of the flagship cryptocurrency.

Spot issuers Ethereum - ETF , on the contrary, reported an influx of funds. On Monday, December 23, investors poured more than $130,76 million into the funds. The cumulative net inflow since launch was $2,46 billion.