Investors Scoop $300 Million Ethereum In a Day After Price Fails to Breach $3,500

Ethereum’s $300 million inflow boosts confidence in a $4,000 recovery. Active addresses and strong support at $3,327 drive bullish momentum.

Ethereum has recently faced a drawdown that brought its price to $3,300. Despite this decline, the level appears to be solidifying as a support floor for ETH.

With strong investor interest and improving network activity, Ethereum may soon attempt to breach critical resistance and target $4,000.

Ethereum Holders Are Bullish

Ethereum’s active address momentum is currently above its yearly average, signaling increased on-chain activity. This uptick suggests improving network fundamentals as more users engage with the blockchain. The heightened utilization is helping Ethereum maintain its position on the charts despite market volatility.

This sustained activity reflects growing confidence in Ethereum’s potential for recovery. As investors continue to show interest in the altcoin, its resilience is bolstered, keeping it from falling below key support levels. Expanding network utilization is a positive sign of long-term growth.

Ethereum Active Address Momentum. Source:

Glassnode

Ethereum Active Address Momentum. Source:

Glassnode

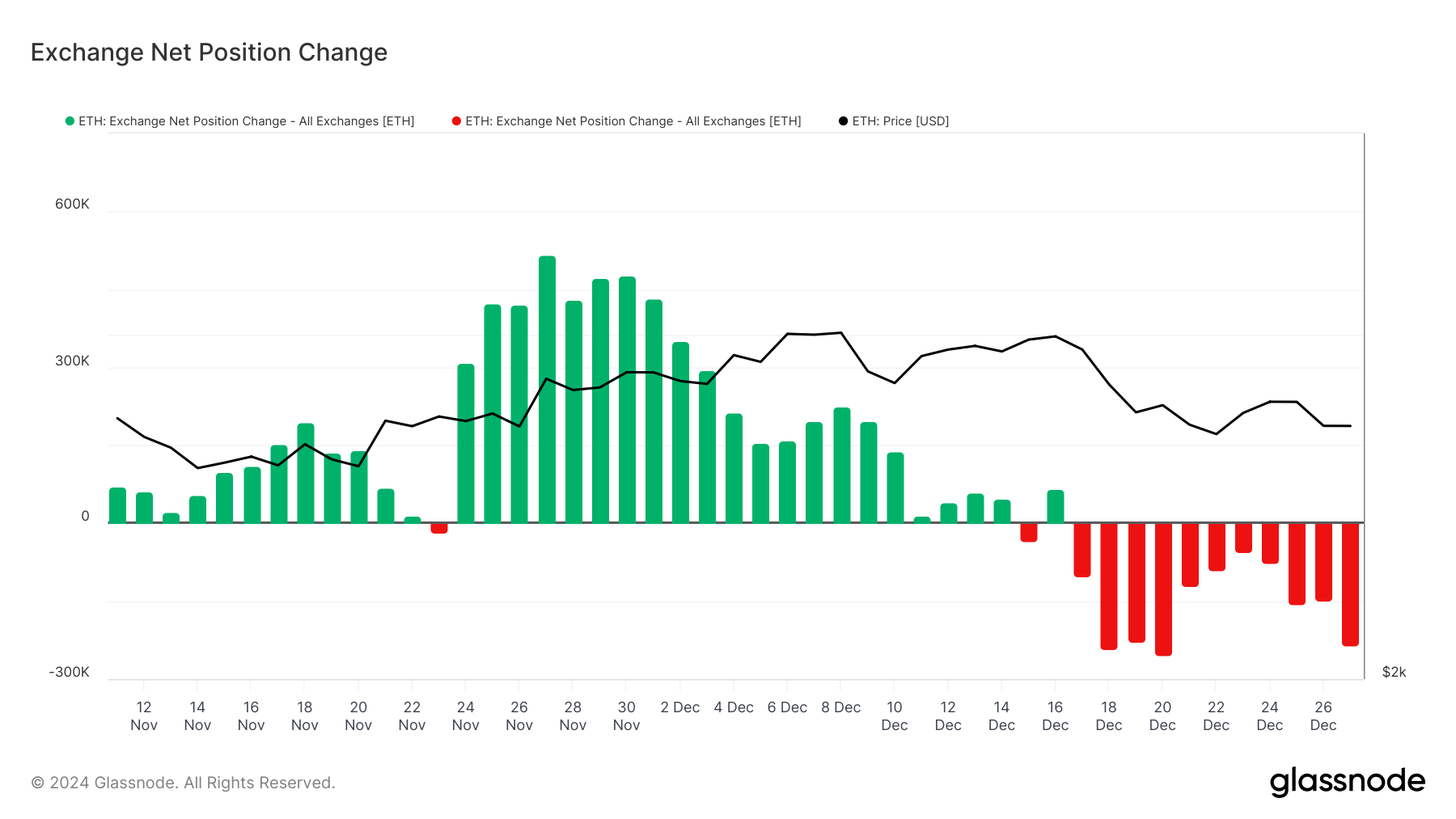

Ethereum’s macro momentum remains strong, supported by significant buying activity. Over the past 24 hours, investors purchased 87,000 ETH, valued at approximately $300 million. This influx of capital aligns with the increased on-chain activity and demonstrates investor confidence in Ethereum’s recovery potential.

The Net Exchange Position supports the notion of growing bullish sentiment. Investors are removing Ethereum from exchanges, indicating a preference for holding the asset long-term rather than selling. This behavior suggests optimism about Ethereum’s price trajectory in the coming weeks.

Ethereum Exchange Net Position Change. Source:

Glassnode

Ethereum Exchange Net Position Change. Source:

Glassnode

ETH Price Prediction: Aiming at Highs

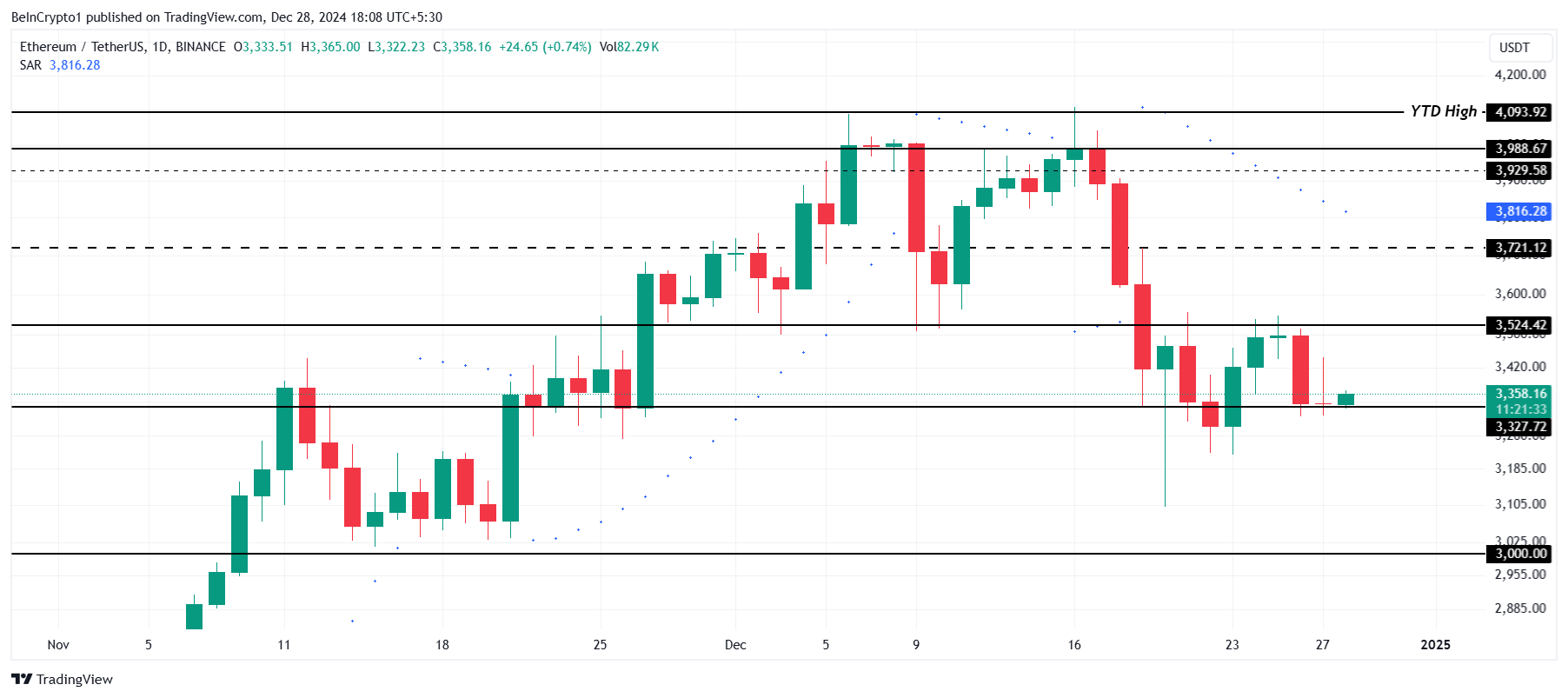

Ethereum is currently priced at $3,358, holding above the critical support level of $3,327. However, the altcoin remains stuck under the resistance at $3,524. Breaching this barrier is essential for ETH to advance toward $3,721 and beyond, signaling a renewed bullish momentum.

If bullish sentiment continues to dominate, Ethereum could secure its path to $4,000. This level represents a psychological milestone and would solidify ETH’s recovery, attracting even more investor interest and network activity.

Ethereum Price Analysis. Source:

TradingView

Ethereum Price Analysis. Source:

TradingView

On the other hand, losing the $3,327 support level could lead to Ethereum sliding toward $3,000. Such a decline would invalidate the current bullish outlook and signal a need for stronger market support to reverse the trend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Notice: Maintenance for VND deposit service

TAUSDT now launched for futures trading and trading bots

Bitget to decouple loan interest rates from futures funding rates for select coins in spot margin trading

Bitget Launches HYPE On-chain Earn With 2.1~4.5% APR