-

Cardano (ADA) faces a critical resistance as active addresses decline, impacting market liquidity and posing challenges to its recovery efforts.

-

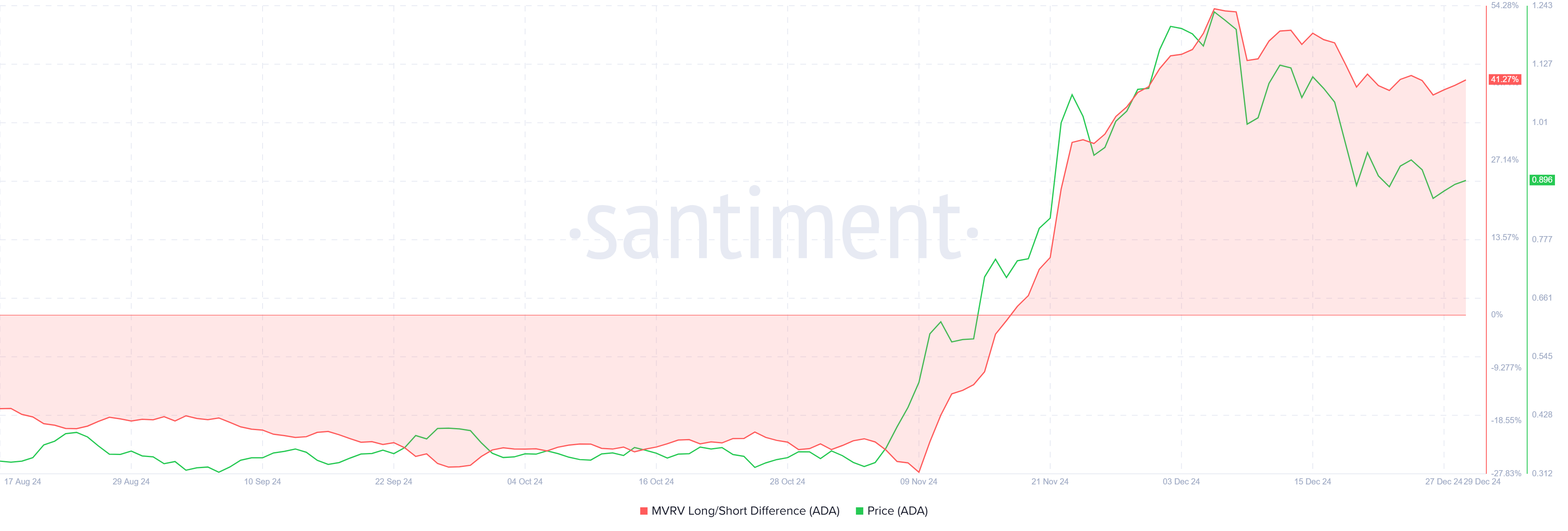

The presence of long-term holders, who dominate with a significant 41% MVRV Long/Short Difference, suggests resilience despite waning short-term trader participation.

-

To maintain upward momentum, it is essential for ADA to hold the $0.87 support level; breaching this could risk a decline to $0.77.

This article analyzes recent developments in Cardano’s market dynamics, focusing on address activity and MVRV metrics as key influencers in ADA’s price trajectory.

Decline in Investor Participation and Its Implications for Cardano

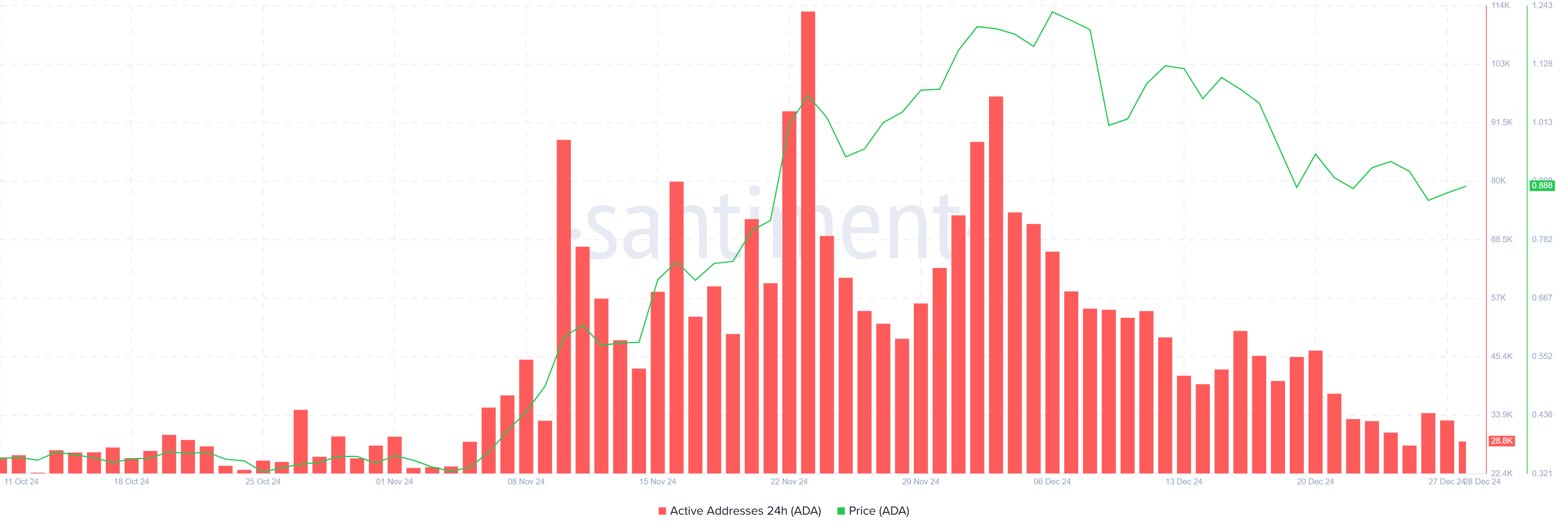

The Cardano blockchain has witnessed a marked decrease in active addresses, signaling a growing apathy among investors towards ADA’s potential recovery. This downturn is critical as high participation rates are often directly correlated with robust market liquidity.

The reduced activity from both retail and institutional traders suggests a cautious sentiment enveloping the market, hindering Cardano’s ability to rebound from its current price levels. Consequently, the diminishing liquidity positions ADA at a disadvantage, making any upward price movement increasingly challenging.

Despite these hurdles, the long-term holders (LTHs) continue to exhibit remarkable endurance in the face of market turbulence. The MVRV Long/Short Difference at 41% indicates that LTHs are generally profitable compared to their short-term counterparts. Their steadfast presence could provide the necessary stability to counteract the less optimistic market sentiment among traders.

By remaining committed during these downturns, LTHs might effectively ward off further declines, allowing ADA some breathing room for a recovery attempt.

ADA’s Price Movements: Critical Levels to Watch

As of now, Cardano is trading at approximately $0.89, finding itself precariously positioned above the crucial support level of $0.87. This threshold is vital for ADA to avoid further descent and to catalyze a potential rally towards the $1.00 mark—an important focal point for both traders and investors.

To spur a turnaround, ADA must convert the $1.00 resistance into support. Successfully breaching this level could pave the way for a targeted price recovery towards $1.23, restoring faith among investors and enhancing overall market confidence.

Conversely, if ADA fails to maintain the $0.87 support, the cryptocurrency could plummet towards $0.77, deepening the pessimism surrounding its market outlook. The ability to stay above this critical level will be crucial for ADA to avoid a lengthy downtrend.

Conclusion

In summary, Cardano’s market dynamics reflect a complex interplay between declining trading activity and resilient long-term holder participation. Maintaining critical support levels and attracting renewed investor interest will be essential for ADA to stabilize and potentially recover in the coming weeks. Investors should closely monitor these developments while engaging with the market cautiously.