Analysts Name Stagflation ‘The Theme of 2025’ as Bitcoin Faces Critical Zone

U.S. macroeconomics stands to define Bitcoin’s path into the new year as it enters a critical zone, with analysis cautioning “stagflation” as the driving narrative.

Initial jobless claims are due on January 2nd, but stagflation concerns are the real elephant in the room for Bitcoin price projections running into 2025 .

According to a Kobeissi Letter written in an X thread on December 29th, “Investors are worried that we will see a repeat of the 1970s inflation situation. The Fed is cutting rates due to a weaker labor market while inflation rebounds.”

While the Federal Reserve has one month to go until its next meeting on interest rates, markets continue to price out the likelihood of further rate cuts next year.

The beginning of stagflation is here and the Fed has yet to acknowledge it. We could see 4%+ inflation next year.

What Does ‘Stagflation’ Mean for Bitcoin?

This potential stagflation scenario, marked by high inflation and stagnant economic growth, could significantly impact Bitcoin’s performance.

Historically, Bitcoin has been seen as a hedge against inflation, but its correlation with traditional markets and sensitivity to macroeconomic conditions may introduce volatility.

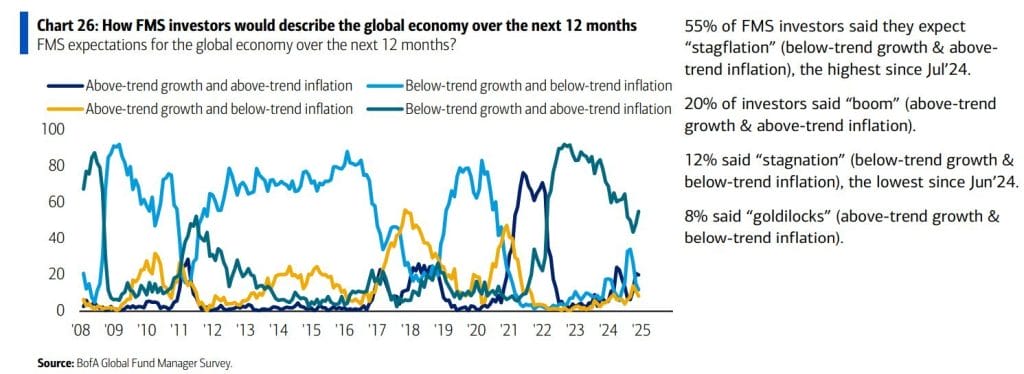

While navigating a potential U.S. recession was the macroeconomic talking point driving price action in 2024, Kobeissi said it expects stagflation to become “the theme of 2025.”

“In fact, 55% of high net worth investors expect stagflation in 2025,” it concluded, referencing data from a survey by Bank of America (BoA).

BoA economic outlook survey. Source: The Kobeissi Letter/X

BoA economic outlook survey. Source: The Kobeissi Letter/X

Bitcoin Faces Critical Bull Market Phase

This all stands to define a critical phase in Bitcoin’s bull market, with the late-month 15% correction over the past week yet to find a decisive floor.

This drawdown is decidedly on the lower end of historical behavior when comparing bull market drawdowns to previous cycles, according to Glassnode data .

While this could allude to a bottom much deeper, Glassnode pointed to short-term holders (STHs) to identify when the market could bounce.

Bitcoin’s Market Value to Realized Value (MVRV) metric, comparing STH supply in profit to that in loss, suggests potential seller exhaustion as it nears a break-even point.

Glassnode notes MVRV as a reliable indicator of “local bottoms in bull markets and local tops in bear markets.” The last time that Point-In-Time Short-Term Holder (STH) Profit/Loss Ratio saw levels below 1 was in early October when BTC/USD traded at $60,000.

This bullish sentiment is echoed by a recent Maxiport report , citing Bitcoin to have “matured” this cycle, with adoption leaving it better leveraged against volatility.

Market dynamics are shifting. Unlike past cycles characterized by sharp 80% drawdowns, Bitcoin’s growing base of dip buyers and institutional support reduces the likelihood of severe corrections.

With these indicators in mind, Bitcoin’s resilience amid current macroeconomic uncertainties highlights its potential to navigate through this critical phase.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Shiba Inu Whale Inflows Surge Over 600%, Suggesting Potential Shift in Market Dynamics

Bhutan Transfers 517 Bitcoin in Strategic Move With Potential Market Implications

Bitcoin Rally Faces Potential Risks Amid Liquidity Concerns and Possible Recession Impact

XRP Faces Potential Overexposure Amid Long Liquidations in August Crypto Rally