Crypto Analyst Says Bitcoin Plunge Below Critical Support Level Could Spell Trouble – Here’s His Target

A closely followed crypto analyst says that Bitcoin ( BTC ) could see a sharp decrease if it fails to hold a crucial zone of support.

In a new strategy session, crypto trader Ali Martinez tells his 110,700 followers on the social media platform X that sell pressure could see the crypto king plunge all the way back down to $74,000 if it fails to maintain the $92,000 price level.

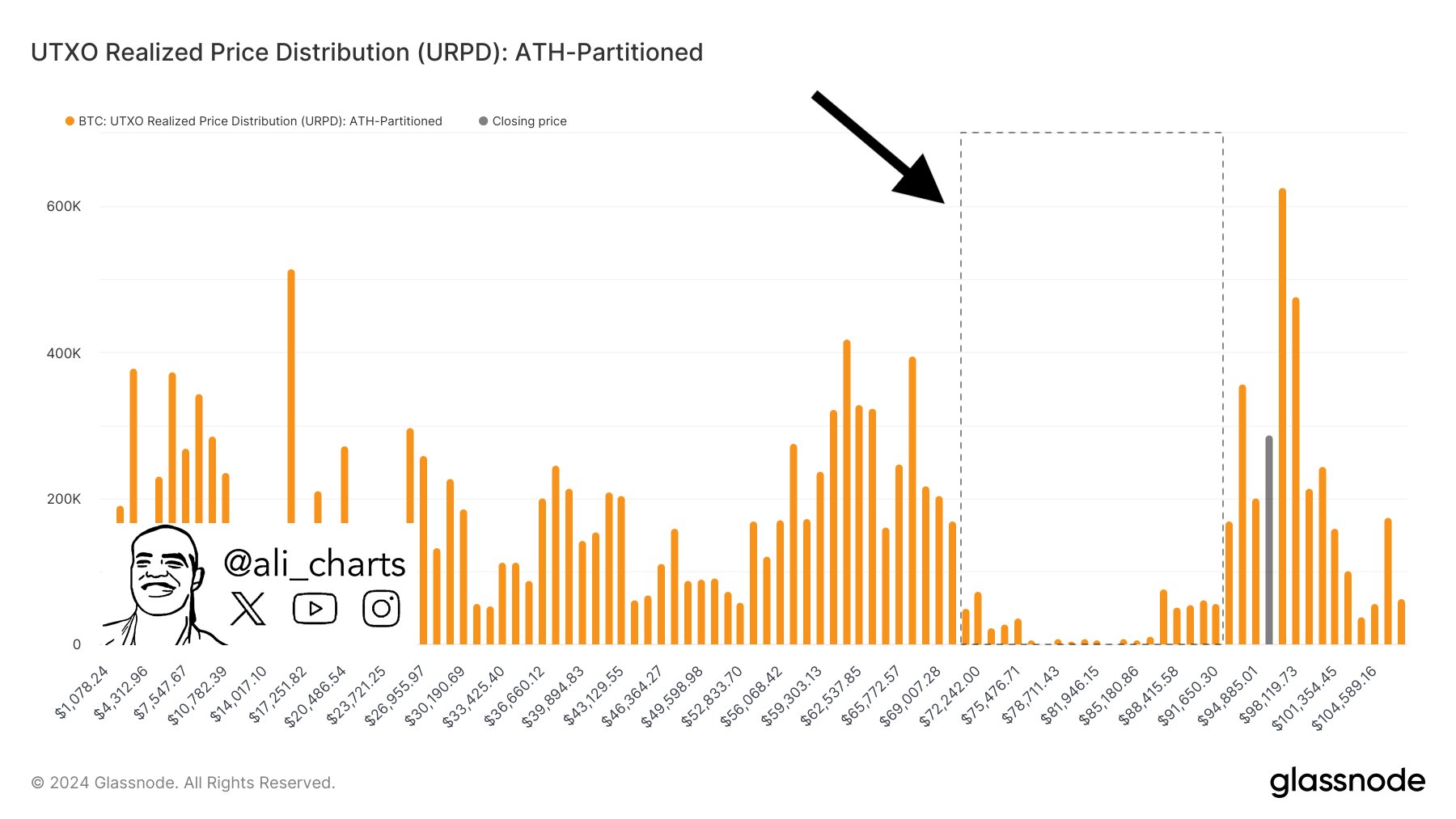

“A surge in selling pressure pushing Bitcoin below $92,000 could spell trouble. Falling past this level opens the door to a steep drop, with little support until $74,000.”

Source: Ali Martinez/X

Source: Ali Martinez/X

The trader’s chart – which uses UTXO Realized Price Distribution (URPD), a metric that analyzes the distribution of BTC’s realized price based on the amount of Bitcoin left over after transactions – shows a massive gap between $92,000 and $74,000. According to Martinez, this is Bitcoin’s “free fall” territory.

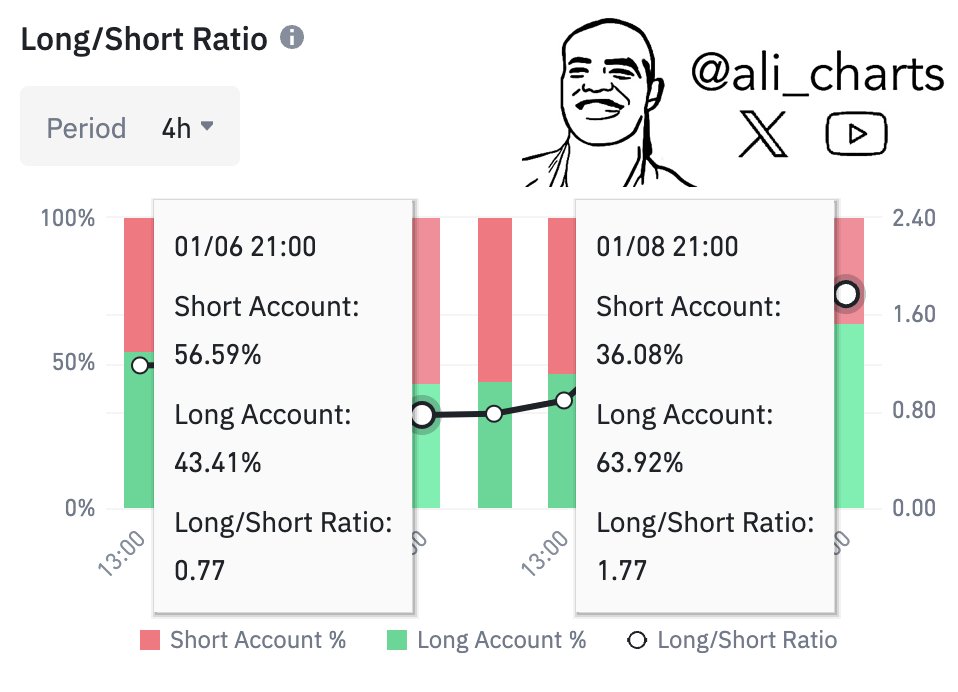

The analyst goes on to note that when the top crypto asset by market peak hit a price of $102,000, the majority of traders on Binance began to short the asset. However, now that it dipped back down to $93,000, investors are doing the opposite.

“On Jan. 6, with Bitcoin at $102,000, 56.59% of traders on Binance were shorting. What followed was a 10% [drop], sending BTC down to $93,000 today. But now, 63.92% of traders on Binance are going long.”

Source: Ali Martinez/X

Source: Ali Martinez/X

The flagship digital asset is trading for $93,918 at time of writing, a 1.3% decrease over the last 24 hours.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X , Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SOMIUSDT now launched for pre-market futures trading

Fiat 48H Flash Deal: Buy crypto with 0 fees via credit/debit card!

Celebrate the launch of Bitget RWA futures and predict NVIDIA's price to share 1000 USDT!

Bitget to decouple loan interest rates from futures funding rates for select coins in spot margin trading