Bitcoin gains despite stock downturn amid strong US jobs report

Quick Take Bitcoin’s price has risen over the past 24 hours, despite a decline in equities, as the U.S. economy added more jobs than expected in December and the unemployment rate unexpectedly fell. However, interest rate traders are betting on a pause in Fed rate hikes in January, while bitcoin futures funding rates are dropping, signaling a potential short-term decrease in bullish sentiment.

Despite a broader pullback in U.S. stock futures, bitcoin traded higher over the past 24 hours, hovering around the $94,600 mark as of publication time. The Dow Jones Industrial Average futures dropped 0.2%, while the SP 500 and Nasdaq 100 futures shed 0.2% and 0.3%, respectively. The market movements come as investors digest December’s stronger-than-expected jobs report, released by the Bureau of Labor Statistics on Friday.

The U.S. economy added 256,000 jobs in December, surpassing economists' expectations of 165,000 and exceeding the 212,000 seen in November. The unemployment rate decreased to 4.1% from 4.2% in November. December marked the largest monthly job gains since March 2023.

Bitcoin's gains over the past day come amid a broader risk-off sentiment in U.S. stock futures, where investors are recalibrating expectations for interest rates. Rising bond yields, particularly the 10-year Treasury yield ticking higher and the 30-year Treasury yield reaching 5%, its highest since November 2023, have contributed to investor concerns. These rising yields reflect market expectations of continued inflationary pressures.

Rising bond yields often signal that the Federal Reserve may maintain tighter monetary policy for a longer period. This can reduce liquidity in the financial markets, dampening investor appetite for risk assets.

However, some market observers view Friday’s jobs report as a positive signal for the digital assets sector.

"Strong jobs numbers like today actually means the bull run can likely go a lot longer than thought," Capriole Fund founder Charles Edwards posted on X.com. "This was the best reading in six months and puts to bed a potential for a bottoming in unemployment for now."

21Shares Crypto Research Strategist Matt Mena echoed this optimism, saying the combination of a robust labor market, diminished recession fears, and the potential for bullish policy developments under a Donald Trump administration creates a highly favorable environment for bitcoin’s continued rally.

"With market sentiment firmly in risk-on mode, Bitcoin appears well-positioned for further price discovery in the coming weeks," Mena said in an email sent to The Block.

However, Grayscale Head of Research Zach Pandl said bitcoin seems to be held back by strength in the U.S. dollar, which is rising due to more hawkish Fed policy and the threat of tariffs. "After the U.S. election, the correlation between bitcoin and the dollar was briefly positive, but the correlation has turned negative again, and today’s strong jobs report reduces the chances of Fed rate cuts, further supports the Dollar, and may weigh on the price of bitcoin temporarily," Pandl said.

Interest rate traders anticipate a more hawkish Fed in 2025

There are still expectations of a more hawkish Fed in 2025. Before the jobs report's release, markets were pricing in a 5% chance of a rate cut at the Fed's January meeting, according to the CME FedWatch tool .

Notably, after the report, the interest rate traders lowered their expectations of a rate cut in January to 2%. Also, CME Group data shows interest rate traders have priced in just one quarter-point cuts from the Federal Reserve this year.

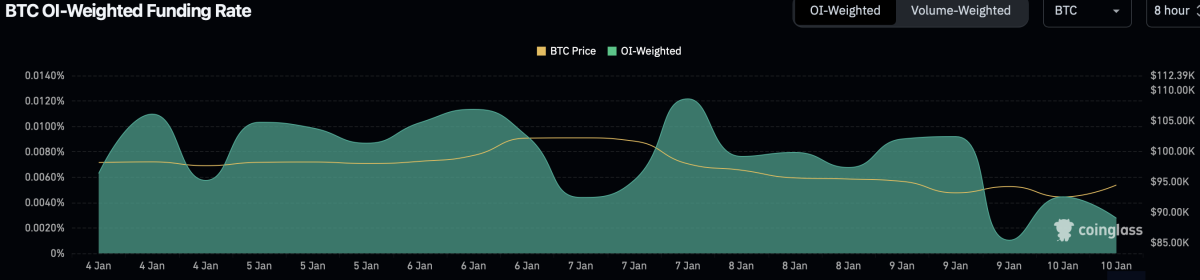

According to Coinglass data , bitcoin’s open interest-weighted funding rate has fallen since the beginning of the week, dropping from 0.0122% to 0.0028%. This decline suggests that investors are pulling back from bullish positions, signaling a reduced expectation for a short-term price increase in the digital asset.

Bitcoin open interest-weighted futures funding rate has declined in the past days. Image: Coinglass.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Announcement on Bitget listing MSTR, COIN, HOOD, DFDV RWA Index perpetual futures

Bitget to support loan and margin functions for select assets in unified account

[Initial Listing] Camp Network (CAMP) will be listed in Bitget Innovation and Public Chain Zone

XPLUSDT now launched for pre-market futures trading