-

Ethereum’s recent bullish momentum has sparked excitement in the crypto community, with price movements influencing trading patterns and investor strategies.

-

Despite positive trends, recent whale activity on major exchanges suggests caution as market dynamics shift.

-

According to a COINOTAG report, “Whale movements often dictate market sentiment, signaling possible price corrections ahead.”

Ethereum’s price surge to $3,380 raises important questions about sustainability amid whale activities and market indicators.

Analyzing Ethereum’s performance amidst price fluctuations

Recent fluctuations in Ethereum’s price reveal a complex interplay between market sentiment and macroeconomic factors. Following a modest 4.6% increase in just 24 hours, ETH has demonstrated resilience, climbing to $3,380 as investors reacted to weaker-than-expected CPI data. Notably, its 24-hour trading volume soared to an impressive $26.2 billion, reflecting robust engagement from both retail and institutional players, sustaining Ethereum’s market cap near $407.2 billion.

Furthermore, the recent deposit of 20,000 ETH by a prominent whale raises questions about the sustainability of this rally. Such high-stakes movements, often used as a prelude to profit-taking or strategic repositioning, place additional pressure on Ethereum’s price dynamics.

The role of macroeconomic indicators in Ethereum’s market behavior

The cryptocurrency market is inherently susceptible to broader economic shifts. As Bitcoin, a leading indicator for the crypto space, stabilizes above $95,000, Ethereum traders remain optimistic about potential upside momentum. Factors such as new regulatory developments and inflationary pressures significantly shape investor confidence and demand.

Notably, the evolving landscape with Ethereum staking and the implications of the EIP-1559 upgrade continue to bolster long-term buying interest while instilling caution among traders keeping a close eye on short-term volatility.

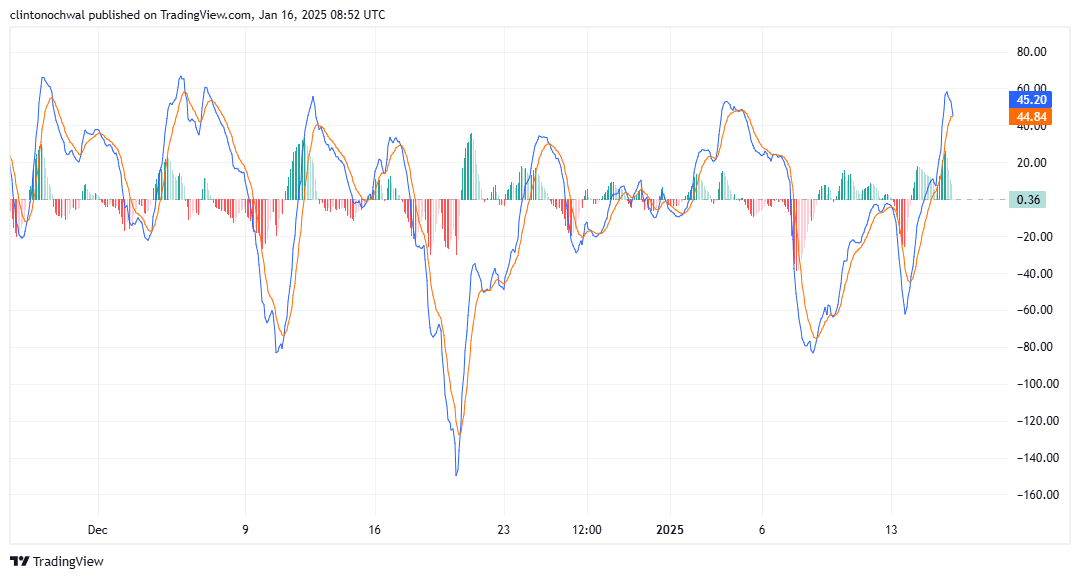

Technical indicators signaling Ethereum’s next movement

Ethereum’s price has displayed substantial volatility, characterized by a trading range between $1,500 and $4,500 over the past year. This variability emphasizes the asset’s capacity for both bullish and bearish swings. Recent technical analysis suggests that Ethereum is now nearing a critical resistance level at $3,400. To challenge higher price points, breaking through this threshold is essential.

If current resistance persists, investors could see a potential revision toward support zones around $3,200 to $3,100, amplifying the importance of vigilance regarding market trends.

Source: TradingView

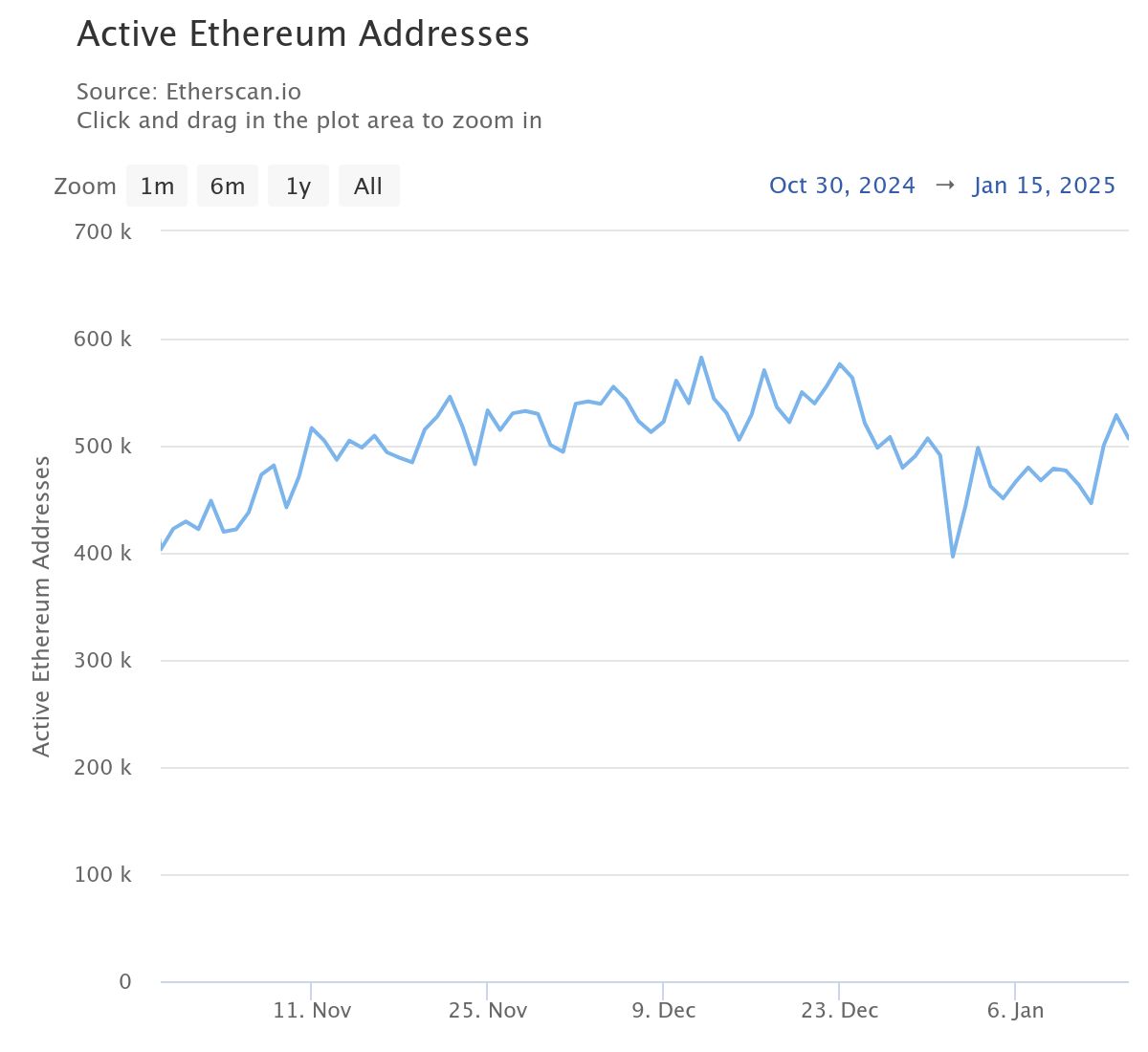

Evaluating Ethereum’s network activity and its implications

Ethereum’s recent network data reflects a sustained increase in active addresses, averaging around 400,000 daily. This uptick signals active participation across its ecosystem, historically correlating with rising price trends. For instance, recent spikes in active addresses coincided with Ethereum’s price surge to $3,380.

Understanding the dynamics around active addresses is crucial, as a downturn might signify reduced engagement and potential downward pressure on prices. Ethereum’s persistent innovation and its vibrant developer community suggest that network activity will remain a reliable indicator of market health.

Source: Etherscan

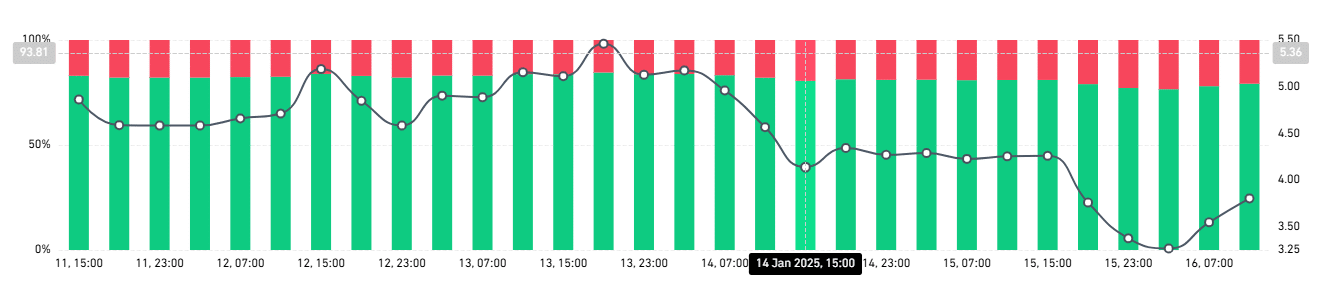

Ethereum’s derivatives market activity and implications for future trading

The recent fluctuations in open interest (OI) surrounding Ethereum serve as a barometer for impending market movements. With OI currently recorded at $1.52 million across major exchanges, this notable uptick indicates heightened speculation among traders seeking to capitalize on market volatility.

As historically observed, a surge in open interest often precedes significant price movements, reflecting increased participation and leveraging. Coupled with recent whale deposits, Ethereum traders may experience diverse trading conditions in the immediate future.

Source: Coinglass

Future Outlook and Conclusion

In summation, Ethereum’s trajectory will likely be determined by an interplay of technical indicators, market sentiment, and macroeconomic influences. Given the current MVRV ratio indicating long-term holders in profit, caution remains vital as potential sell pressure looms on the horizon.

As the market evolves, Ethereum’s combination of technological advancements and investor activity signifies that vigilance is necessary to navigate upcoming volatility. Proactive measures, including risk management, will be key in harnessing the potential for future gains while mitigating downside risks.

Source: Coinglass