Real-world asset TVL rises to $7.3 billion as government securities dominate

Quick Take Government securities now account for about two-thirds of the RWA market. The following is an excerpt from The Block’s Data and Insights newsletter.

Total value locked across real-world-asset (RWA) protocols has reached $7.3 billion, marking a more than 200% increase from a year ago, with government securities protocols capturing an expanding share of the market. Usual Protocol and Hashnote USYC lead the sector with approximately $1.48 billion TVL each.

Hashnote is a regulated digital asset management platform offering innovative investment strategies with transparency, while Usual Protocol is a decentralized stablecoin issuer that tokenizes real-world assets and redistributes value to users through governance tokens.

The composition of RWA TVL has shifted significantly toward government securities, which now represent approximately two-thirds of total RWA TVL, up from 36% a year ago.

This shift suggests increasing confidence in regulated, government-backed digital assets and indicates a maturing market as protocols focus on traditional financial instruments.

Market dynamics are being influenced by potential policy developments in the United States with President Trump's reported plans to issue an executive order making crypto a " national policy priority " post-inauguration. There have also been proposals to create crypto advisory councils, which could provide the industry with greater representation in policy discussions. These developments may further legitimize RWA protocols, particularly those dealing with government securities.

The sector's growth trajectory warrants attention as the substantial increase in TVL suggests growing institutional acceptance of blockchain-based financial instruments. With so much focus on government securities, it may indicate a preference for lower-risk, regulated assets in the current market.

This is an excerpt from The Block's Data & Insights newsletter . Dig into the numbers making up the industry's most thought-provoking trends.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Meta faces antitrust probe in Italy over AI integration in WhatsApp

Share link:In this post: Italy’s antitrust watchdog (AGCM) is investigating Meta for integrating its AI assistant into WhatsApp without user consent. The regulator suspects the tech firm abused its dominant position by forcing users toward its AI, potentially harming competitors. AGCM warns that this integration may limit consumer choice and distort market competition under EU law.

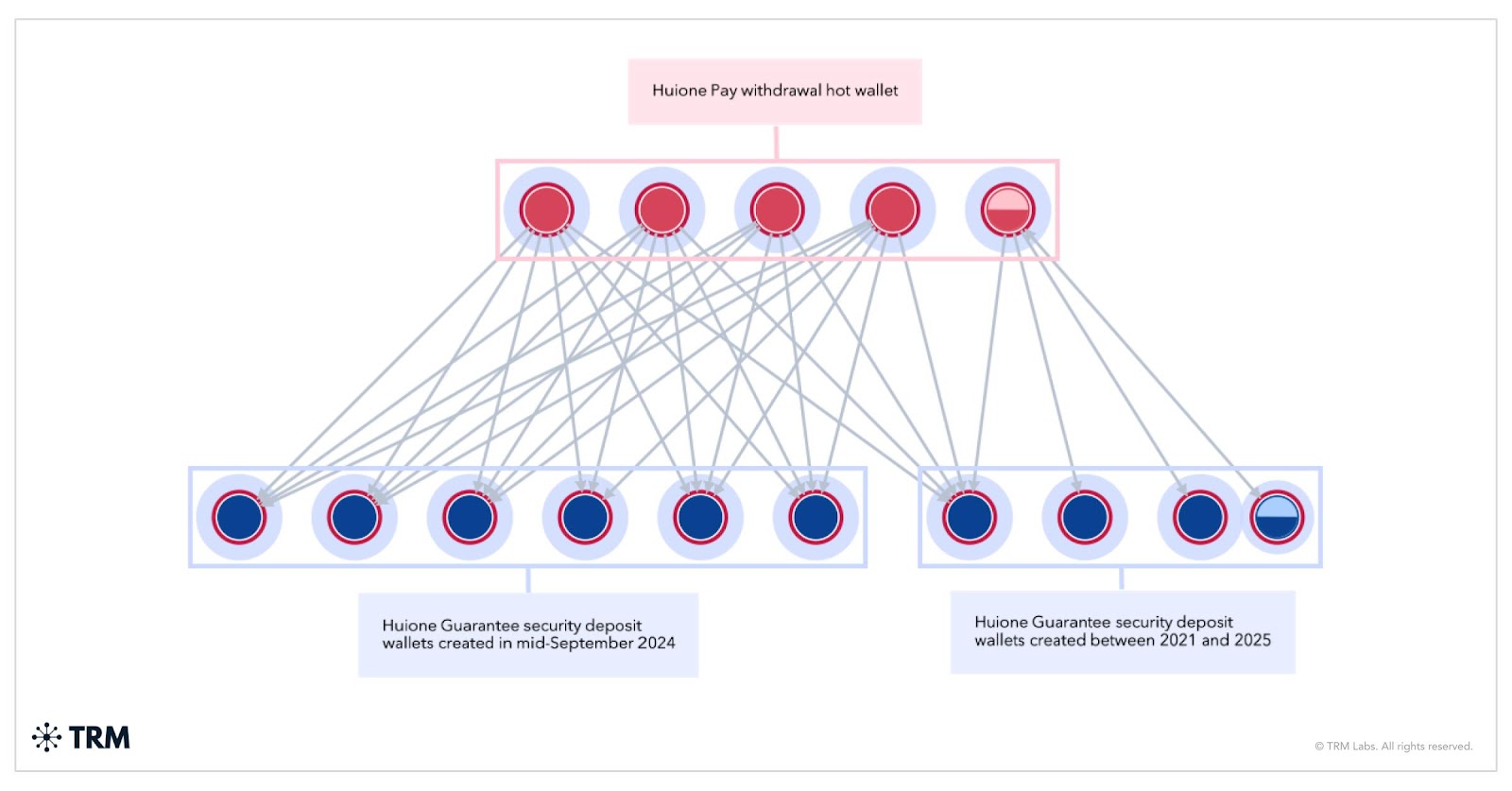

Telegram-banned $35B scam marketplaces find life away from US regulators

Share link:In this post: Telegram banned Huione Guarantee and Xinbi Guarantee after a $35B scam crackdown, but operations quickly shifted to Tudou Guarantee. TRM Labs and Elliptic revealed Huione vendors migrated to alternate platforms, with Tudou seeing a 70x surge in daily transactions. Despite US sanctions and enforcement, Huione Pay, USDH stablecoin, and affiliated services continue operating under new Telegram identities.

Polygon Labs calms fears about reports that its network went down for hours

Share link:In this post: Polygon Labs confirmed its network remained active despite Polygonscan showing no new blocks for over an hour. The issue was caused by a display glitch during a backend update on Polygonscan, not an actual network outage. The incident sparked renewed concerns about overreliance on third-party tools like explorers and RPC providers.

Federal Reserve keeps interest rates unchanged again, as expected

Share link:In this post: The Federal Reserve kept interest rates steady at 4.25% to 4.5%, delaying any cuts until at least September. Trump criticized the Fed’s decision, blaming tariffs for rising costs and demanding lower rates. Borrowers face high rates on credit cards, mortgages, car loans, and student loans, with no relief in sight.