-

Solana (SOL) has surged by 12.3% in the past day, driven by a vibrant memecoin ecosystem and rising speculation around futures trading.

-

As large investors, or whales, accumulate SOL, retail traders are facing challenges stemming from transaction delays and market fears.

-

According to a recent COINOTAG analysis, “The surge in Solana’s price is significantly linked to the enthusiasm surrounding memecoins like TRUMP.”

Solana experiences a 12.3% price jump driven by memecoin activity and speculation about futures contracts, attracting both retail and institutional interest.

Memecoins Fuel Network Activity and Price Action

One of the primary catalyzers behind Solana’s recent upswing is the burgeoning influence of memecoins such as Official Trump (TRUMP). The immense hype surrounding these cryptocurrencies has triggered a notable increase in Solana’s network transactions.

This heightened activity has led to some transaction delays, creating a mixed response within the trading community. While certain retail traders express dissatisfaction, others view this as a promising sign of Solana’s increasing relevance and adoption within the memecoin sector.

Frustrated by the delays, some retail investors have begun to offload their SOL holdings, inadvertently creating opportunities for larger investors to buy in at lower prices. This behavior is mirrored in recent on-chain data, indicating that larger wallets are taking advantage of the sell-off to position themselves for possible long-term gains.

Source: Dune Analytics

Solana Futures Listing Rumors Add Fuel

Complementing this momentum is the emergence of rumors regarding the possible listing of Solana Futures contracts. A leaked image depicting a beta page for potential XRP and Solana (SOL) Futures sparked optimism among traders, suggesting that a major exchange might introduce these contracts soon.

Despite indications that this screenshot could be a speculative mock-up lacking confirmation, the market has reacted favorably, with Solana’s price responding positively to this speculation.

Traders are eager to see increased institutional interest as futures contracts could offer broader exposure to Solana, enhancing its already active trading landscape.

Shifting Sentiments

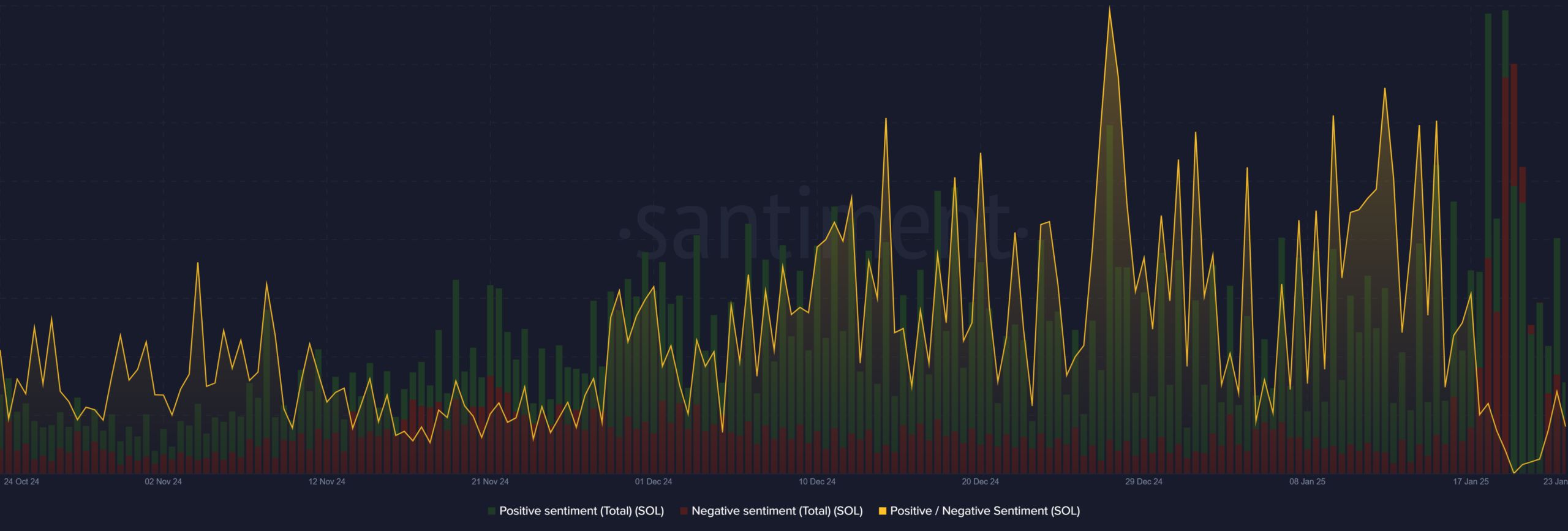

The sentiment analysis for Solana reveals a dynamic landscape within its community. Recent data indicates a significant uptick in positive sentiment, particularly during the meme coin frenzy and amidst discussions about Futures contracts.

Source: Santiment

While the community sentiment reveals a mix of both positive and negative reactions, the prevailing optimism suggests traders maintain confidence in Solana’s future, despite short-term challenges such as transaction delays and market uncertainties.

Key Levels to Watch

As of the latest trading session, Solana’s price stands at $247.71, experiencing a 3.70% decrease after reaching a high of $258.35. The price trend is indicative of a broader upward movement, reflected in Solana’s ability to remain above crucial moving averages.

The 50-day moving average at $211.08 has been a reliable support level, further enhancing the bullish outlook. In contrast, the 200-day moving average, situated at $177.55, underscores the strength of Solana’s recovery trajectory.

With a trading volume exceeding 552,000 SOL during the last session, it’s evident that market activity is heavily influenced by memecoin transactions and the rumors of Futures trading.

Source: TradingView

A critical support level lies at $244, which Solana must maintain to prevent slipping into a consolidation phase. Should the price break the $260 barrier, further gains could target the $280-$300 range in the coming weeks.

Navigating the Hype and Speculation

Solana’s recent performance exemplifies both resilience and the capacity to thrive amid market fluctuations. However, this enthusiasm is encumbered by potential risks associated with speculative behavior.

The current hype surrounding memecoins, while it drives short-term price increases, raises concerns about speculative bubbles that could lead to increased volatility.

Moreover, if the Futures listing rumors are unsubstantiated, a subsequent market correction may occur as speculative traders exit their positions.

Is your portfolio aligned with these market movements? Check out the Solana Profit Calculator to gauge your potential returns.

On a positive note, the whale accumulation trend, accompanied by a rise in network activity, indicates growing long-term confidence in Solana’s ecosystem. Should the Futures contracts become a reality, the potential influx of institutional players could further solidify Solana’s market stature.

Conclusion

In summary, Solana’s recent price movements are emblematic of a complex interplay between market enthusiasm, speculative behavior, and foundational support from larger investors. With crucial support levels in sight and increasing interest from institutions, Solana’s future appears promising despite immediate challenges.