U.S. 10-Year Inflation-Protected Treasuries Winning Yield Highest Since 2009

The U.S. Treasury issued $20 billion of 10-year inflation-protected Treasuries (TIPS), with the winning bid yield quoted at 2.243%, the highest since January 2009 and 1 basis point above pre-issue trading levels at the time of the bid closure, suggesting that demand was slightly lower than expected. Primary dealers were allocated 10.2%, lower than the previous time, while direct bidders were allocated 23.3% and indirect bidders were allocated 66.5%. Bid multiples were reported at 2.48x, compared with the previous three-time average of 2.39x.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stellar Foundation Invests in UK’s Archax to Drive Asset Tokenization

Nvidia CEO Jensen Huang Sells 150,000 Shares

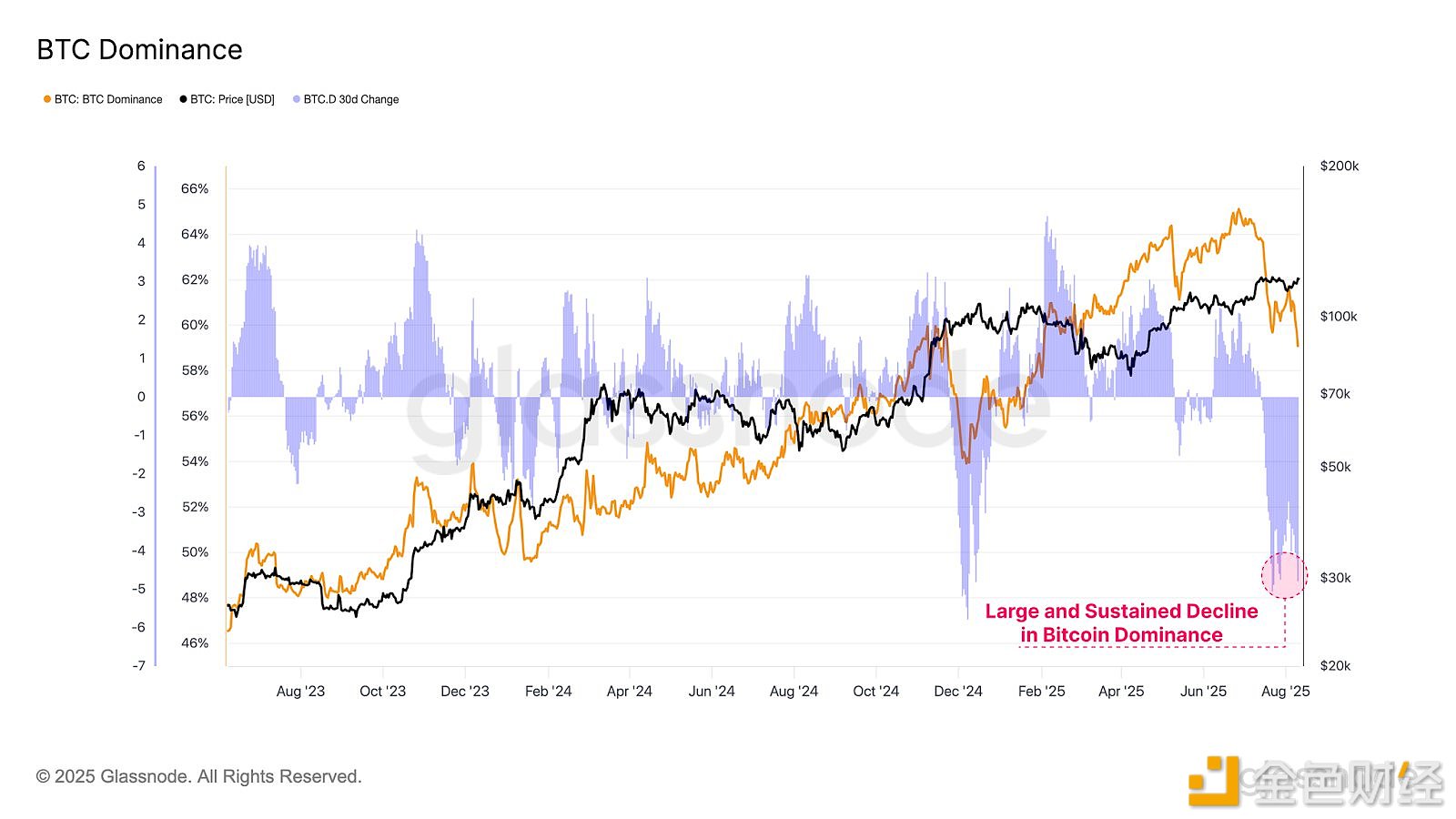

Bitcoin dominance has dropped from 65% to 59% over the past two months