-

Bitcoin’s recent price movements have sparked interest, as it consolidates above the critical $100,000 mark amid changing market dynamics.

-

Despite the selling pressure from long-term holders, Bitcoin’s derivatives market has shown a marked increase in activity, reflecting cautious optimism.

-

Crypto analyst Ali remarked, “The key support level to watch for Bitcoin is $97,530. Holding above this level is crucial to maintaining the current bullish momentum.”

Bitcoin remains above $100,000 as market dynamics shift. Analysts identify key support levels and rising derivative activities amidst cautious sentiment.

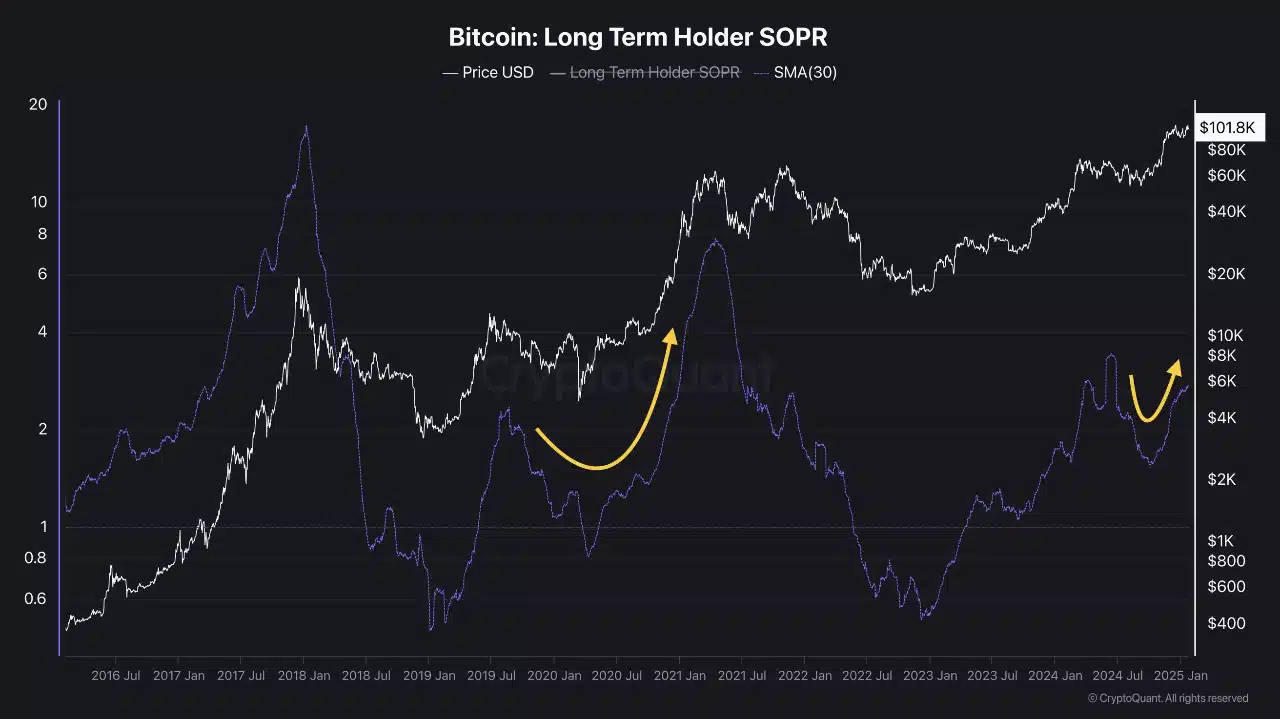

Long-term holders see selling activity

Long-term holders of Bitcoin have begun to sell after a prolonged period of accumulation, as indicated by the Spent Output Profit Ratio (SOPR) data. This trend marks a shift in sentiment following the price surge past $100,000. Previously, these holders demonstrated resilience during the market correction that lasted until March 2024, refraining from selling their assets.

However, as Bitcoin breached the psychological threshold of $100,000, the behavior of long-term holders indicates a strategy similar to that observed in the 2021 bull market. Selling pressure from this group is notable but doesn’t necessarily reflect a loss of faith in Bitcoin’s long-term value.

Source: CryptoQuant

While short-term holders are capitalizing on recent gains, with SOPR ratios indicating that they are frequently taking profits, the broader market sentiment appears to oscillate. The absence of SOPR values above 1.06 suggests that there is potential for further growth before the short-term profit-taking peaks.

Trading and derivatives activity shows market caution

The rise in trading volume and derivatives activity reflects a complex market narrative. According to Coinglass, the trading volume surged by 73.27% to $172.56 billion, suggesting that market participants are actively managing their positions. The Open Interest, which rose by 1.19% to $68.52 billion, further underscores this increased activity. However, while options trading volume also spiked by 74.28%, the gradual decline in funding rates indicates a cautious approach among traders.

This caution is vital, as it reveals a preference for less leveraged positions amid volatile market conditions. The OI-weighted funding rates showed a decrease, settling at 0.0038% on 24 January, 2025, signaling traders’ reluctance to overexpose themselves in the current market environment.

$97,530 identified as crucial support level

Key levels are instrumental for traders navigating Bitcoin’s fluctuating landscape. As highlighted by analyst Ali, the support level at $97,530 is critical. It aligns with periods of heightened activity in the historical price chart, marking a pivotal zone that traders should monitor closely. The implications are significant; should Bitcoin falter below this level, potential retracement to $93,856 or even $90,000 may occur, based on established support tendencies.

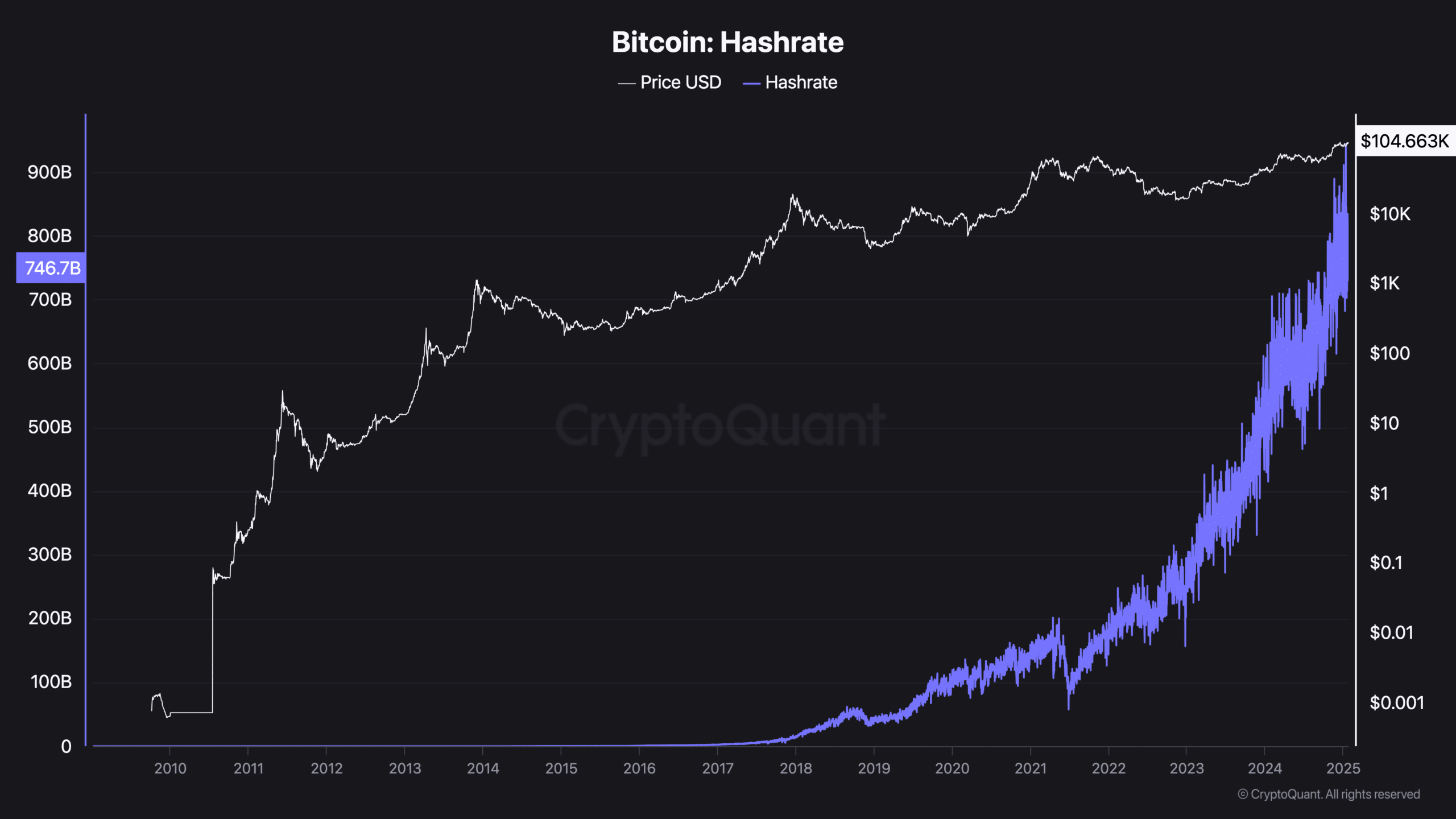

Hashrate shows sustained strength

The hashrate of Bitcoin, which reached 746.7 EH/s at the time of writing, is another indicator of market health. Although not at its all-time high, this sustained level points to robust investment in mining infrastructure and confidence among miners. As Bitcoin’s market price stabilizes around $104,994, the hashrate’s stability suggests ongoing support for the network amidst market uncertainties.

Source: CryptoQuant

Conclusion

In summary, as Bitcoin navigates market consolidation above the critical psychological level of $100,000, all eyes are on key support levels, trader sentiment, and long-term holder behavior. The market shows signs of cautious optimism, but the interplay of selling pressure from long-term holders and the sustained activity in derivatives markets indicates that future price movements will be closely monitored by investors seeking to capitalize on market fluctuations.