Why Ethereum (ETH) Could Be Ready For a Break Above $3,500

Ethereum’s price is eyeing $3,500 as holding times rise and traders show bullish sentiment. A breakout above $3,516 could lead to new highs.

Ethereum (ETH) has traded sideways for over a month, with its price remaining under the key $3,500 resistance level.

However, on-chain data has shown that a shift could be underway. This analysis explains the two key factors suggesting a potential breakout might be imminent.

Ethereum Sees Surge in Holding Time

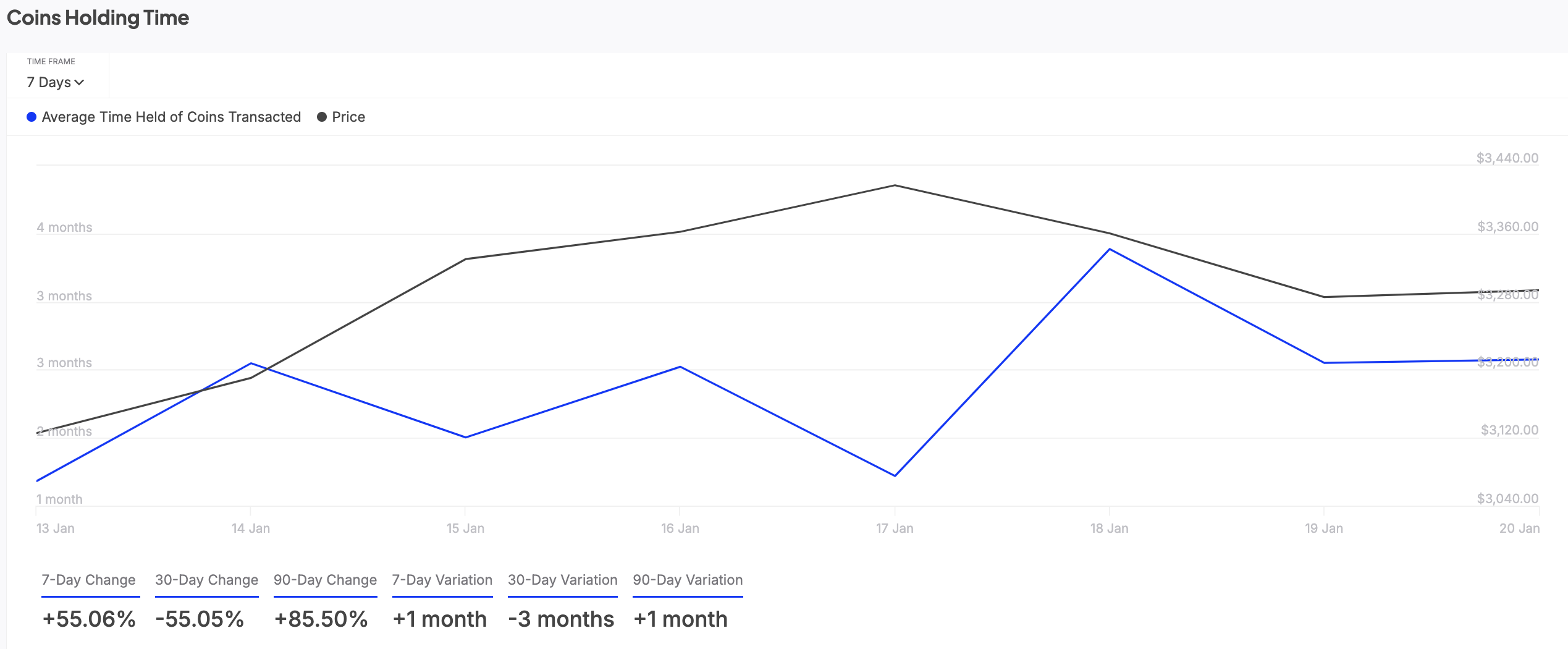

On-chain data has revealed a spike in the holding time of all ETH coins transacted over the past seven days. According to IntoTheBlock, this has increased by 55% during the review period.

The holding time of an asset’s transacted coins represents the average duration tokens are held before being sold or transferred. Long holding periods reflect stronger investor conviction, as investors choose to keep their coins rather than sell. This can help reduce the selling pressure in the ETH market, driving up its value.

ETH Coins Holding Times. Source:

IntoTheBlock

ETH Coins Holding Times. Source:

IntoTheBlock

Further, ETH’s funding rate has remained positive despite its range-bound price movements in recent weeks. At press time, it is 0.019%, reflecting the steady demand for long positions among ETH’s futures traders.

The funding rate is a fee exchanged between long and short traders on perpetual futures contracts to keep the contract’s price in line with the underlying asset’s spot price.

ETH Funding Rate. Source:

Santiment

ETH Funding Rate. Source:

Santiment

Despite its sideways movement, ETH’s steady positive funding rate indicates that more traders are betting on its price going up, signaling bullish sentiment.

ETH Price Prediction: Break $3,516 for a Climb to $3,684, or Risk Pullback?

Waning selloffs could propel ETH above the resistance formed at $3,516. If it successfully breaks above this key resistance level, its price could climb toward $3,684.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

However, if this bullish trend stalls, the coin could fall back within the narrow range or drop toward support at $3,210.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List PrompTale AI (TALE). Come and grab a share of 3,480,000 TALE

New spot margin trading pair — LA/USDT!

AINUSDT now launched for futures trading and trading bots

Bitget releases June 2025 Protection Fund Valuation Report