The increase in Ethereum spot ETF holdings has slowed down, and the Trump project's heavy position and Vitalik expansion route have sparked discussion

远山洞见2025/01/27 05:43

On January 26th, the multiple dynamics of the

Ethereum ecosystem intertwined, and the market attention continued to rise. In terms of capital flow, last week, the net increase of Ethereum spot ETF holdings was 42,073.29 ETH, with a total inflow of about 139.40 million USD, but the growth rate was significantly slower than that of

Bitcoin ETF. Among them, Fidelity and BlackRock increased their holdings by 5,962.19 and 40,925.1 ETH respectively, while Canary Release ETHE continuously reduced its holdings by 13,449.03 ETH. Data shows that the current ETH Volatility Index (DVOL) is 67.06, and the

ETH/BTC exchange rate is temporarily reported at 0.0318, indicating a strong market wait-and-see sentiment.

On the technical level, Vitalik Buterin, co-founder of Ethereum, once again called for the expansion plan to prioritize the capture of ETH value, proposing to strengthen ecological sustainability through mechanisms such as fee destruction, staking incentives, and blob revenue distribution. He emphasized that Layer2 projects should fulfill their revenue contribution commitments to support the development of the Ethereum mainnet, further clarifying the expansion route of "ETH as the core".

It is worth noting that the position data of the Trump-related crypto project WorldLibertyFinancial (WLF) shows that it currently holds 55,400 ETH (about $185 million), accounting for nearly half of the total investment portfolio (total value of $388 million), and has pledged 19,400 ETH (about $64.11 million) in Lido. In addition, the project also heavily holds assets such as WBTC and TRX, with a remaining $41.81 million in stablecoins to be allocated. Market news believes that the large ETH holdings of politically background projects may inject confidence into the market.

ETF fund differentiation, technical route disputes, and institutional holding trends together constitute key variables in the short-term price game of Ethereum.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

X Layer ecosystem's first chain game SAGE to launch NFT minting, ushering in a new era of "play-to-earn"

Chaincatcher•2025/08/28 09:32

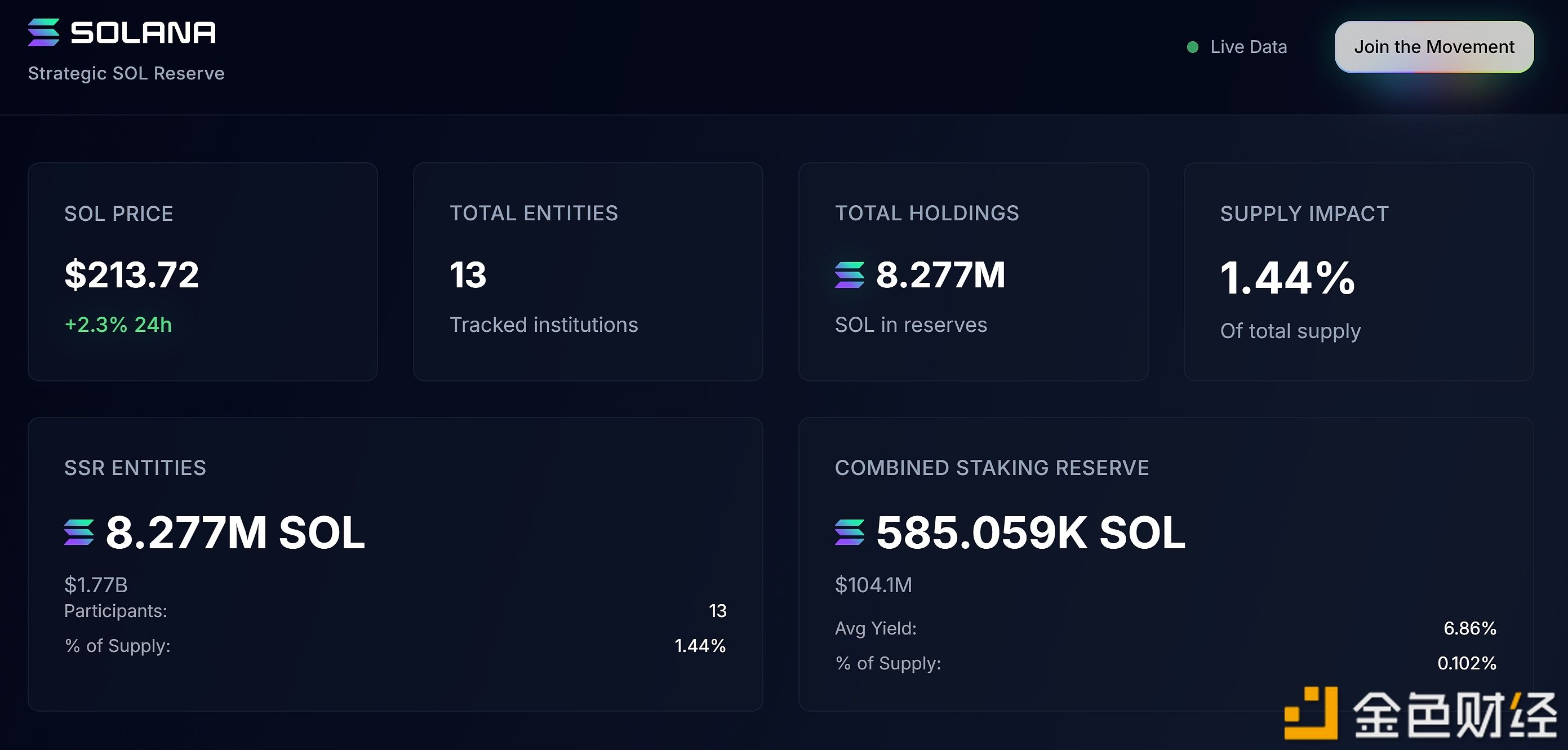

13 institutions hold 8.277 million SOL, accounting for 1.44% of the supply

金色财经•2025/08/28 09:08

Data: An unknown wallet transferred 30,507,683 XRP to an exchange, worth approximately $91.62 millions.

Chaincatcher•2025/08/28 09:07

Fenwick & West law firm denies allegations of playing a central role in facilitating the FTX collapse

ForesightNews•2025/08/28 09:06

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$113,111.91

+1.88%

Ethereum

ETH

$4,598.85

-0.30%

XRP

XRP

$3

-0.40%

Tether USDt

USDT

$1

+0.15%

BNB

BNB

$869.11

+1.15%

Solana

SOL

$213.25

+4.22%

USDC

USDC

$1

+0.13%

Dogecoin

DOGE

$0.2237

+1.35%

TRON

TRX

$0.3494

-0.05%

Cardano

ADA

$0.8686

+0.33%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now