Viewpoint: Under the influence of FOMC's pessimistic expectations, cryptocurrencies enter a risk-avoidance mode

According to The Block, due to increased bearish sentiment ahead of Wednesday's FOMC meeting and growing macroeconomic uncertainty, Bitcoin has fallen below $100,000. Meanwhile, breakthroughs in China's DeepSeek artificial intelligence technology have disrupted the tech market, triggering risk-averse behavior and stimulating demand for safe havens.

The cryptocurrency market entered a risk-off mode at the start of this week, with Bitcoin falling below the $100,000 mark for the first time since January 16th. As macroeconomic unease intensified ahead of Thursday's Federal Open Market Committee meeting, Wincent Senior Director Paul Howard said: "The market sell-off was driven by news about the DeepSeek AI model. Some people predict that market prices will even fall further in the coming weeks, especially if macro data shows future interest rate increases."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto card issuer Rain completes $58 million Series B financing

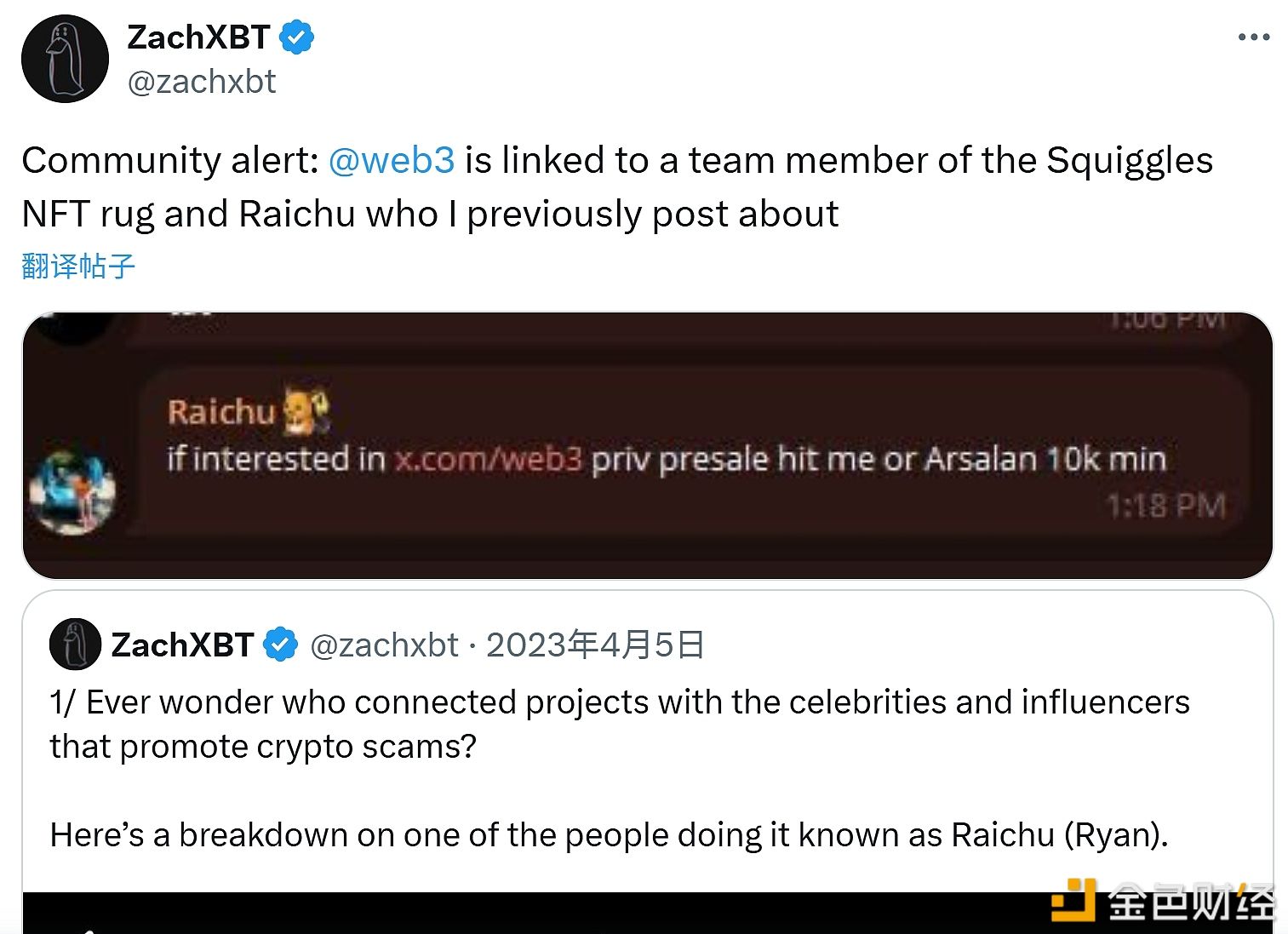

On-chain detective ZachXBT: Web3 member of crypto project linked to scam project