-

Arthur Hayes predicts Bitcoin’s value will drop to $70,000–$75,000 before rebounding to $250,000 by year-end, a significant projection amidst current market dynamics.

-

This decline is attributed primarily to macroeconomic trends, rather than the present turmoil related to DeepSeek, which Hayes suggests could act as a catalyst for future growth.

-

Hayes emphasizes that US monetary policy and global factors will play crucial roles in Bitcoin’s impending pull-back followed by its eventual growth.

Arthur Hayes forecasts Bitcoin dropping to $70K-$75K before surging to $250K by year-end, driven by macroeconomic factors.

Arthur Hayes Expects a Mini-Financial Crisis for Bitcoin

Arthur Hayes, former CEO of BitMEX, has significantly adjusted his short-term outlook for Bitcoin. Earlier this month, he predicted that Bitcoin would peak in mid-March, but recent observations have prompted him to suggest that BTC is already nearing a substantial decline.

He articulates a forecast of a $70,000 to $75,000 correction in Bitcoin, labeling it a mini-financial crisis, followed by a resumption of money printing that could propel Bitcoin to $250,000 by year-end. Hayes communicates this outlook through his professional blog, detailing various global economic factors at play.

According to Hayes, Bitcoin’s immediate downturn can be traced to macroeconomic conditions characterized by tightening liquidity. Influential in this environment are rising US 10-year Treasury yields and the Federal Reserve’s tightening policies, alongside reduced money supply growth in major economies such as the US, China, and Japan.

These elements are creating financial stress that adversely affects fiat-priced assets, including Bitcoin, which Hayes has identified as particularly sensitive to fluctuations in global liquidity.

“Why do I believe in a 30% correction for Bitcoin? These types of pullbacks occur often throughout the bull market, given how volatile Bitcoin is,” Hayes explained, while also referencing historical data that suggests similar patterns following major political events.

Interestingly, while his initial assessments were not linked to the current upheaval stemming from DeepSeek—the AI protocol that has recently shaken the crypto markets—Hayes now perceives the situation as reinforcing his earlier predictions.

Despite Bitcoin ETFs achieving record volumes recently, long-term holders appear to be reacting by liquidating significant portions of their assets. Notably, firms such as MicroStrategy, which have heavily invested in BTC, are also facing challenges in the midst of market shifts.

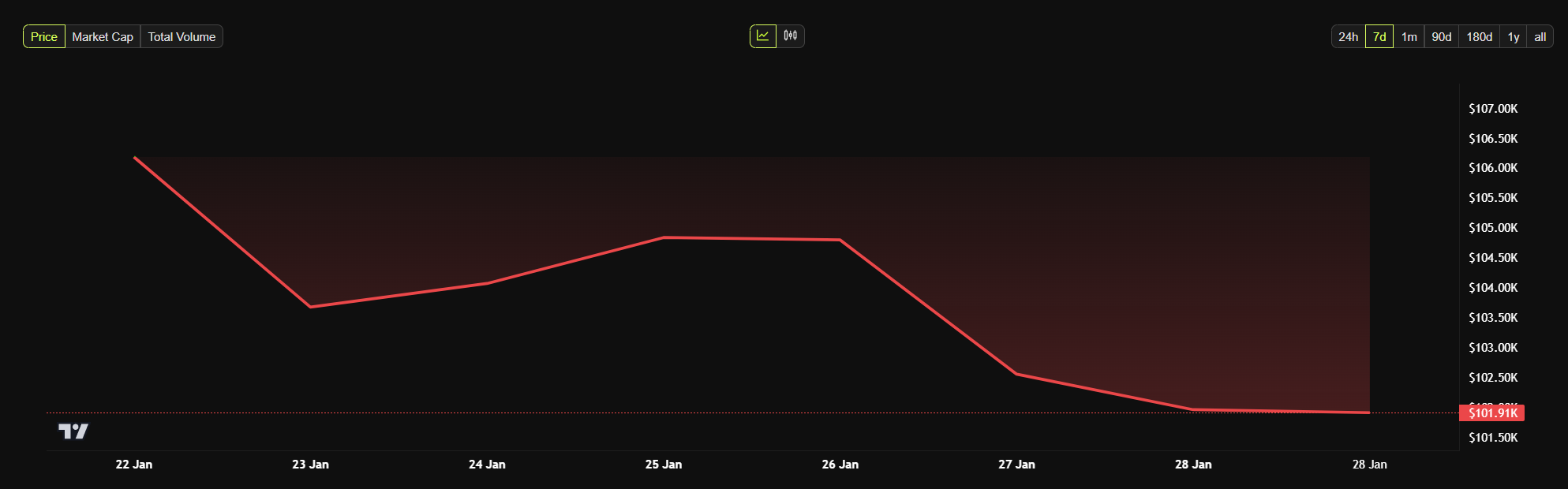

Bitcoin (BTC) Weekly Price Chart. Source: COINOTAG

Despite assurances from political figures favoring crypto-friendly regulatory changes, Hayes cautions that “the Fed will do what it can to frustrate the Trump agenda.” He believes personal biases may interfere significantly with coherent economic policy.

In a broader analysis, Hayes examined varied economic strategies employed by countries and their potential repercussions for Bitcoin’s price trajectory. He remains optimistic that current downturns will only set the stage for more substantial long-term gains.

That said, the upcoming price drops could lead to a challenging period for investors and stakeholders alike.

Conclusion

As Hayes underscores, Bitcoin’s journey is intricately linked to global macroeconomic trends. His forecast of a significant short-term correction, coupled with a long-term bullish outlook, offers a detailed perspective for investors navigating these volatile waters. The key takeaway is the anticipation of a cyclical recovery post-correction, which traditionally precedes robust market expansion.