Key Points

- Global markets including crypto reflected concerns that could reignite inflation.

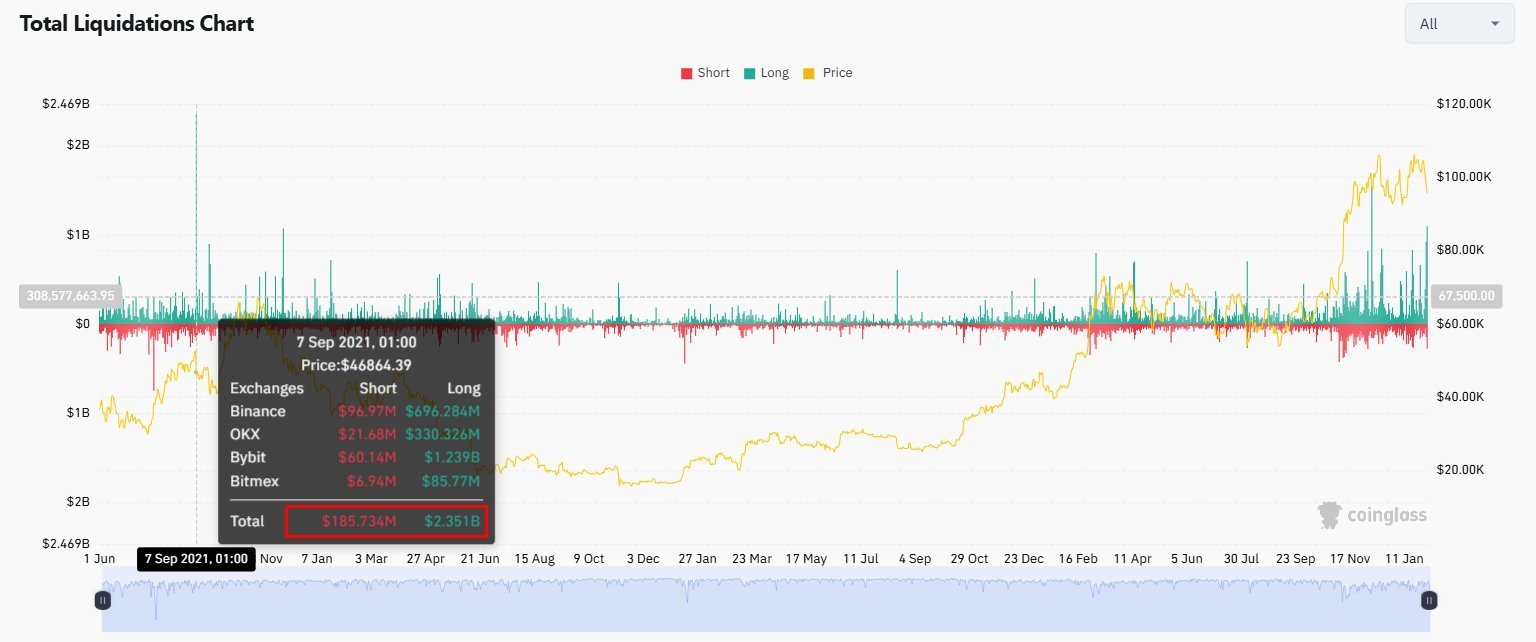

- This was the biggest crypto liquidation day since September 7, 2021, CoinGlass data shows.

As US President Donald Trump imposed significant tariffs on Mexico, Canada, and China, equities sank, gold dropped, oil spiked and the crypto market recorded a huge sell-off. Almost $2.3 billion were liquidated from the crypto market in 24 hours, according to data from CoinGlass.

Crypto Liquidations on February 3rd

CoinGlass data shows that $1.9 billion in long positions were liquidated from the market and over $395 million in shorts were also liquidated in the past 24 hours.

In the past 12 hours, over $1.41 billion were liquidated from the crypto market, $1.13 billion in long positions, and over $286 million in shorts, according to the same data from CoinGlass .

CoinGlass dataToday, Bitcoin price dropped to $92,000 before rebounding above $95,000.

The Kobeissi Letter shared a post via X, stating that the crypto industry witnessed the biggest 1-day liquidation in crypto history, with $800 billion of market cap lost in a matter of hours, and total liquidations hitting around $2 billion.

They noted that not even the collapse of FTX (in November 2022) or March 2020 (marking the debut of the covid pandemic) saw liquidations like this.

Kobeissi Letter via X

Kobeissi Letter via X

However, someone pointed out that on September 7, 2021, the crypto market saw bigger liquidations: over $2.35 billion in long positions and over $185 million in shorts.

CoinGlass data

CoinGlass data

On September 7, 2021, the crypto industry saw an important day – it was the day when El Salvador officially adopted Bitcoin as a legal tender.

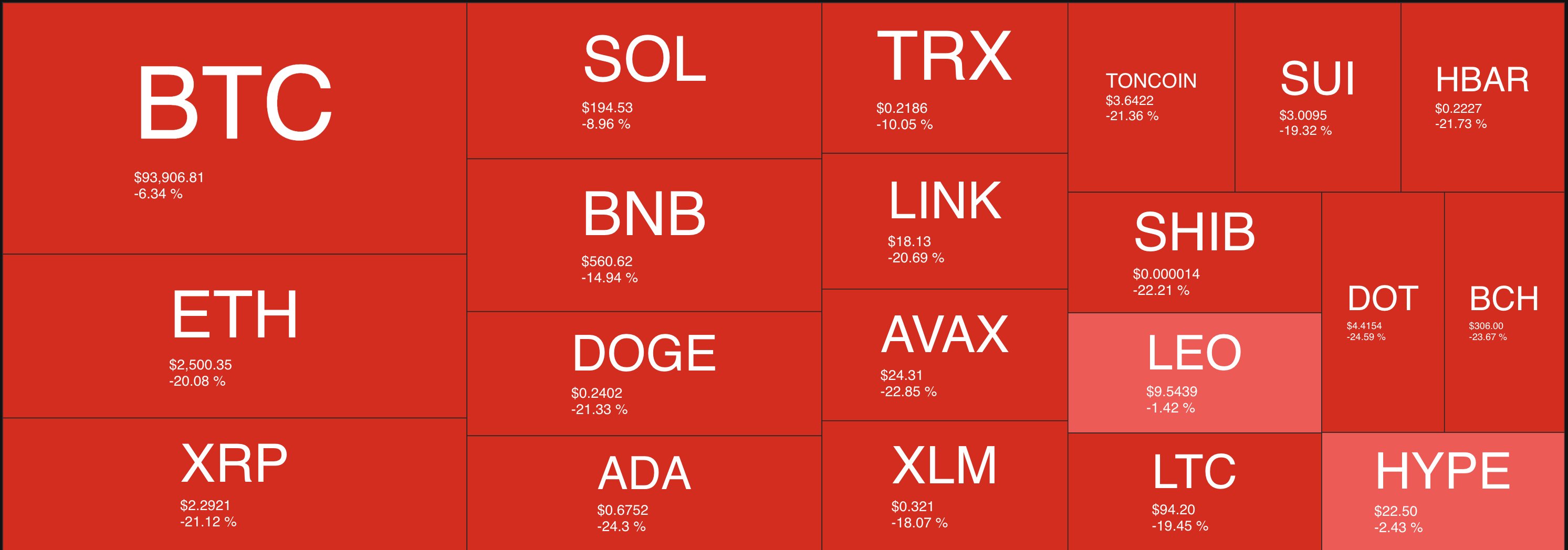

Today, the entire crypto market is down by 7%, sitting at a $3.11 trillion market cap. The significant sell-off came following Trump’s latest moves and ahead of negotiations with Canada and Mexico.

Trump: Americans Could Feel Pain in Trade War With Mexico, Canada, China

According to a Reuters report on February 2, Trump said yesterday that the sweeping tariffs that he had imposed on Mexico, Canada, and China could cause short-term pain for Americans as the global markets reflected concerns that could trigger inflation surges.

Today, February 3rd, Trump will talk to the leaders of Canada and Mexico, which have announced retaliatory tariffs of their own. On Saturday, Trump ordered huge tariffs on goods from Mexico, Canada, and China. According to Reuters, Canada and Mexico saw 25% tariffs, and China, 10% above the current ones.

Trump said that the tariffs are needed to curb immigration and narcotics trafficking and our domestic industries.

It’s also worth noting that China’s initial proposal to tariffs imposed by Trump will center on restoring the Phase 1 trade deal signed in 2020 during Trump’s first term, according to Wall Street Journal sources, cited by Reuters .

Other parts of China’s plan will include the following:

- A pledge to not devalue the yuan

- An offer to make more investments in the US

- A commitment to reduce exports of fentanyl precursors

About Phase 1 Trade Deal in 2020

Trump directed federal agencies to assess China’s performance under the Phase 1 trade deal that he had signed with Beijing in 2020 during his first term at the White House.

Reuters noted that the deal requested China to increase purchases of US exports by $200 billion over a two-year period, but Beijing failed to meet its target when the Covid pandemic struck.

As part of the deal, the US cut by half the tariff rate it imposed back in September 2019 on a $120 billion list of Chinese goods to 7.5%.