XRP Price Crash Recovery Hinges on Bitcoin’s Next Move

XRP’s price struggles after losing key support, but Bitcoin’s recovery could trigger a rebound. Can XRP break resistance and resume its uptrend?

XRP recently attempted to form a new all-time high but faced resistance due to market top pressure. The failure led to significant losses for investors as selling pressure increased.

Now, the cryptocurrency’s recovery hinges on Bitcoin’s trajectory, with its price movement influencing XRP’s future performance.

XRP Loses Key Supports

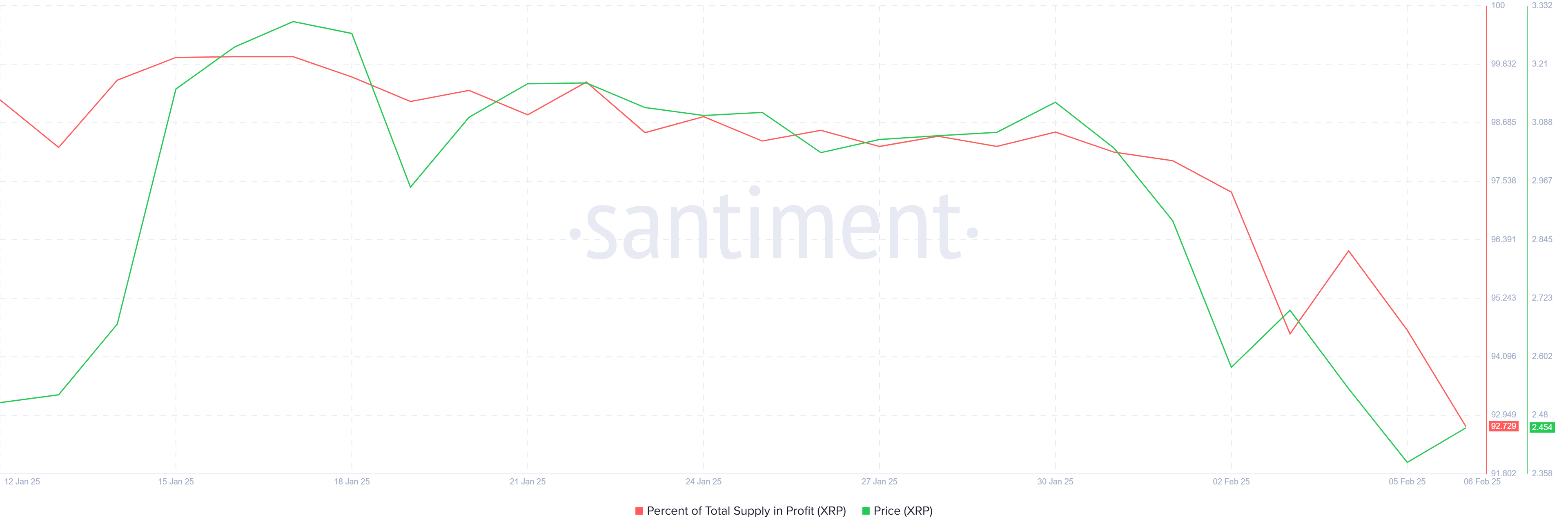

The percentage of XRP’s supply in profit surpassed 95% earlier this week, signaling a market top. This development triggered a wave of selling pressure, resulting in a sharp drawdown. As a consequence, 3% of the profit supply has already been wiped out, increasing concerns among investors.

Declining profits present a significant risk, as more holders may sell to lock in gains. If this trend continues, downward pressure could further drive prices lower. The asset’s ability to retain investor confidence will be crucial in determining its next move.

XRP Supply In Profit. Source:

Santiment

XRP Supply In Profit. Source:

Santiment

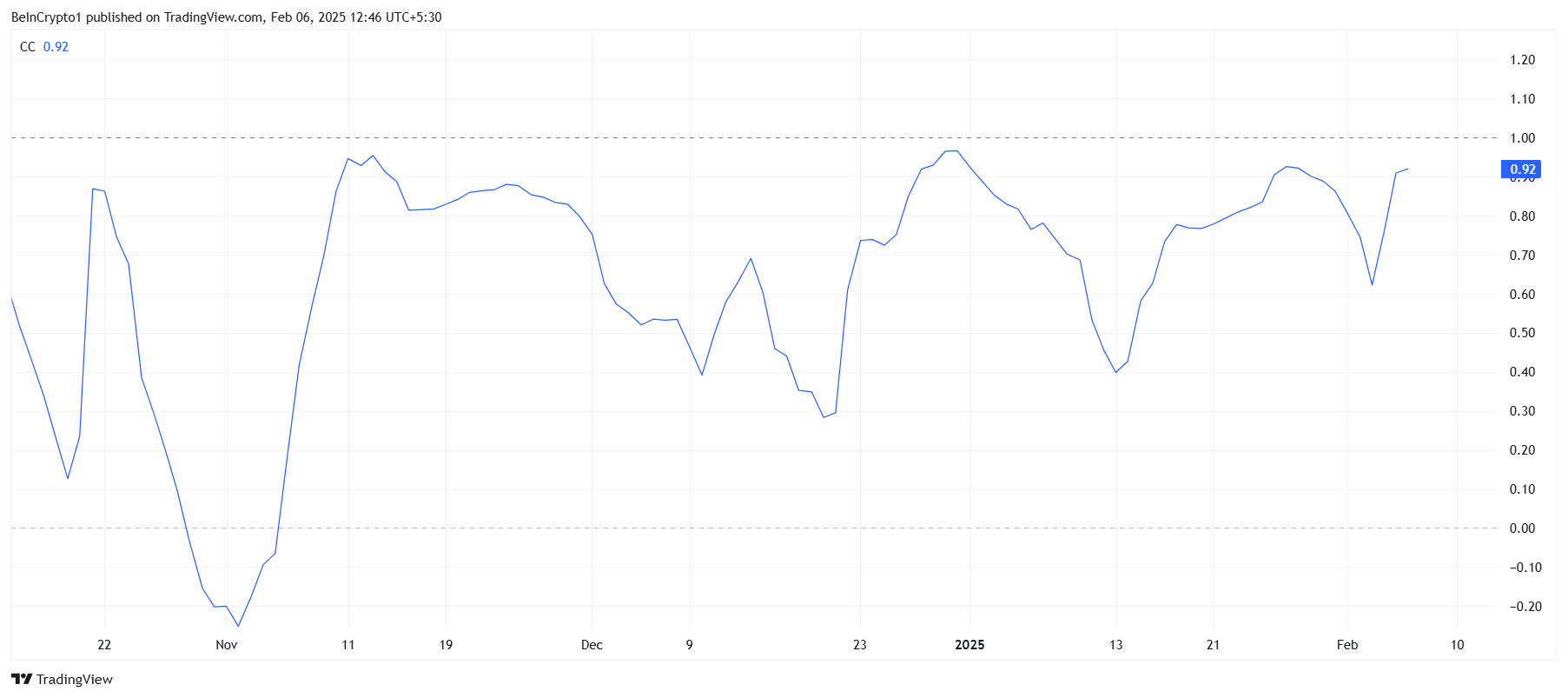

XRP’s macro momentum remains closely tied to Bitcoin, with its correlation now at 0.92. This strong relationship means XRP is likely to mirror Bitcoin’s price movements, which could be beneficial given Bitcoin’s bullish outlook.

Bitcoin appears poised to reclaim support at $100,000, which would likely uplift the broader market, including XRP. If Bitcoin’s price stabilizes and trends upward, XRP could find the support it needs to resume its own recovery.

XRP Correlation With Bitcoin. Source:

TradingView

XRP Correlation With Bitcoin. Source:

TradingView

XRP Price Prediction: Escaping The Bears

XRP is currently trading at $2.46, having dropped below critical support levels at $2.95 and $2.70. The price decline paused when the altcoin tested support at $2.33, preventing further losses for the time being.

The altcoin’s next challenge lies in reclaiming lost ground. However, breaking past $2.70 may prove difficult, as resistance at this level remains strong. Consolidation under this price point is a possible scenario unless stronger bullish momentum emerges.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

If XRP follows Bitcoin’s lead, a significant recovery could be on the horizon. Reclaiming $2.70 would be a key turning point, potentially opening the path for further gains. A move beyond $2.95 would invalidate the current bearish-neutral outlook, paving the way for a full recovery and further upside.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

VIPBitget VIP Weekly Research Insights

Real World Assets (RWAs) bring real-world financial instruments such as bonds, real estate, and credit onto the blockchain, enabling tokenization, programmability, and global accessibility of traditional financial assets. With U.S. interest rates peaking, monetary policy turning dovish, and ETFs paving the way for institutional capital to enter the crypto space, RWAs have emerged as a leading theme capturing growing institutional attention.

VIPBitget VIP Weekly Research Insights

The Base chain has recently seen several major strategic developments: Coinbase has integrated DEX routing for Base on its main app, bridging the gap between CeFi and DeFi liquidity; Shopify has partnered with Base to expand real-world applications and user access points. At the same time, Circle and Coinbase stocks have surged by over 700% and 50% respectively, creating a wealth effect that may spill over into the Base ecosystem—boosting both its TVL and token prices. Recommended projects include: 1) AERO (Aerodrome)—The leading DEX on Base, showing strength despite market downturns; well-positioned to benefit from Coinbase integration. 2) BRETT—A flagship memecoin on Base with over 840,000 holders; likely to lead the next Base memecoin rally. 3) New tokens on Bitget Onchain—Offer early access to emerging Base memecoins while helping users avoid high-risk tokens.

VIPBitget VIP Weekly Research Insights

Recent bullish news surrounding a potential Solana ETF has reignited market optimism. The SEC has asked issuers to update their S-1 filings, signaling that ETF approval could be near. This development has boosted confidence in the Solana ecosystem. As a high-performance Layer-1 blockchain, Solana (SOL) offers fast transactions and low fees, making it a hub for DeFi and NFT activity, while also drawing increasing institutional interest. Jito (JTO), the leading liquid staking protocol on Solana, saw its token surge 17% after JitoSOL was included in a Solana ETF prospectus. Its MEV optimization further enhances network value. Jupiter (JUP), Solana's top DEX aggregator with a 95% market share, recently launched a lending protocol, highlighting strong growth potential. These tokens offer investors early exposure ahead of a possible ETF approval and a chance to benefit from Solana's expanding ecosystem.