Ondo Finance Unveils Layer-1 Blockchain with Support from Major Institutions

Ondo Finance introduces Ondo Chain, a Layer-1 blockchain designed to streamline real-world asset tokenization with institutional backing. Despite ONDO’s price drop, major investors remain bullish on its long-term potential.

During the anticipated Ondo Summit, asset tokenization firm Ondo Finance unveiled its own Layer-1 (L1) blockchain called Ondo Chain.

It comes just days after the Ondo Global Markets announcement, with both launches marking a major step towards institutional-grade Real World Asset (RWA) adoption.

Ondo Finance Develops Layer-1 for RWA

Based on the announcement, the new blockchain will bridge the gap between traditional finance (TradFi) and decentralized finance (DeFi). It would provide an infrastructure that ensures regulatory compliance while maintaining blockchain’s open-access ethos.

Reportedly, Ondo Chain has already garnered significant support from industry heavyweights. Financial institutions such as Franklin Templeton, Wellington Management, and WisdomTree have joined as design advisors. These organizations, among others, would add credibility and expertise to the project, potentially solidifying Ondo Finance’s place in the RWA sector.

The announcement of Ondo Chain comes when public blockchains struggle to meet the requirements of tokenized assets at scale. Ondo Finance identified five major challenges hindering RWA adoption.

“Incompatibility with DeFi…fragmented cross-chain liquidity…high and volatile transaction fees…inadequate network security models…and institutional regulatory concerns,” an excerpt in the announcement read.

The network designed the Ondo Chain to address these hurdles. It introduces enhanced security, with validators able to stake RWAs instead of native crypto tokens, reducing volatility-related risks.

Moreover, the presence of Donald Trump Jr., a surprise keynote speaker, added to the excitement of the Ondo Summit.

“We’re delighted to announce our surprise closing speaker at the Ondo Summit: Donald Trump Jr! The future of RWAs in the US is bright, and new leadership has the potential to make the US the global center for crypto,” the network shared on X.

His appearance highlights digital assets’ growing political and regulatory significance in the US market. Following the announcement of Ondo Finance’s L1 launch, World Liberty Financial (WLFI), the Trump family’s DeFi project, purchased $470,000 worth of ONDO tokens. This brought the total value of ONDO tokens collected to date to nearly $700,000.

“World Liberty Financial swapped 470,000 USDC to 342,000 ONDO 20 minutes ago. ONDO has dropped 15% in the past 7 days, but they seem very bullish on the altcoin, continuing to buy the dip,” Spotonchain reported.

ONDO Price. Source:

BeInCrypto

ONDO Price. Source:

BeInCrypto

Indeed, Ondo Finance’s powering token continues to trade with a bearish bias. According to BeInCrypto data, ONDO price is down by almost 5%, trading for $1.35 as of this writing.

Nevertheless, the launch of Ondo Chain is pivotal for the network. Recently, it announced an ambitious initiative, Ondo Global Markets (Ondo GM).

Last week, the firm also revealed plans to launch a tokenized US Treasury fund on the XRP Ledger, signaling its broader commitment to expanding the RWA ecosystem across multiple blockchains.

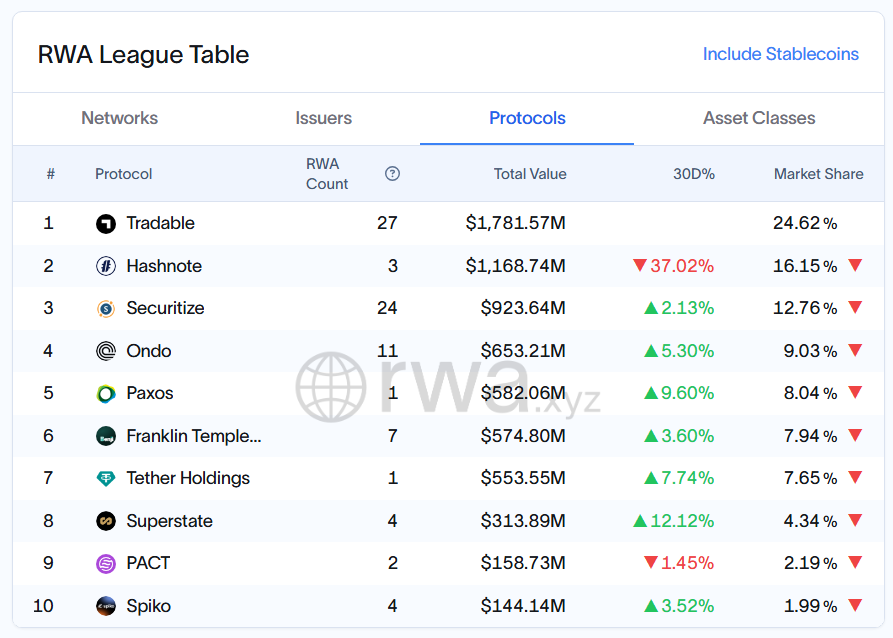

These developments suggest the network’s effort to establish itself as a major force in the RWA space. According to data on rwa.xyz, it ranks the fourth-largest protocol in total RWA value, with over $653 million in tokenized assets.

Ondo Finance Rank Among RWA Protocols. Source:

rwa.xyz

Ondo Finance Rank Among RWA Protocols. Source:

rwa.xyz

The overall RWA market is approaching $17 billion in value, reflecting the increasing institutional demand for on-chain financial products.

Ondo Chain and Ondo GM initiatives could further accelerate this growth, making it easier for institutions to leverage blockchain technology for asset tokenization while maintaining compliance with regulatory frameworks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List PrompTale AI (TALE). Come and grab a share of 3,480,000 TALE

New spot margin trading pair — LA/USDT!

AINUSDT now launched for futures trading and trading bots

Bitget releases June 2025 Protection Fund Valuation Report