Morgan Stanley research shows: Trump's shocking social media posts decrease

PANews reported on February 18th that, according to research by JPMorgan Chase, the number of market-impacting social media posts released by Trump has significantly decreased since he returned to office. Compared with his first term, only 10% of the 126 posts involving sensitive topics such as trade tariffs, foreign relations and economy have caused significant fluctuations in the currency market during this term, although this proportion is rising.

The report pointed out that Trump recently posted more than 20 related posts which is twice the average in January but far less than the peak of up to 60 per week during the trade friction period from 2018-2019. JPMorgan Chase stated that posts about tariffs had the greatest impact on markets; nearly one-third of these would trigger market fluctuations. Among them, at beginning of February Trump tweeted that he had used emergency powers to impose a 25% tariff on Mexico and Canada. Although he postponed this measure two days later it led to declines exceeding 2% for Mexican peso and over1% for Canadian dollar respectively.

JPMorgan analysts said trading based on Trump's tweets does not yield high profitability; backtesting shows even under "very optimistic" circumstances expected returns do not exceed4%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

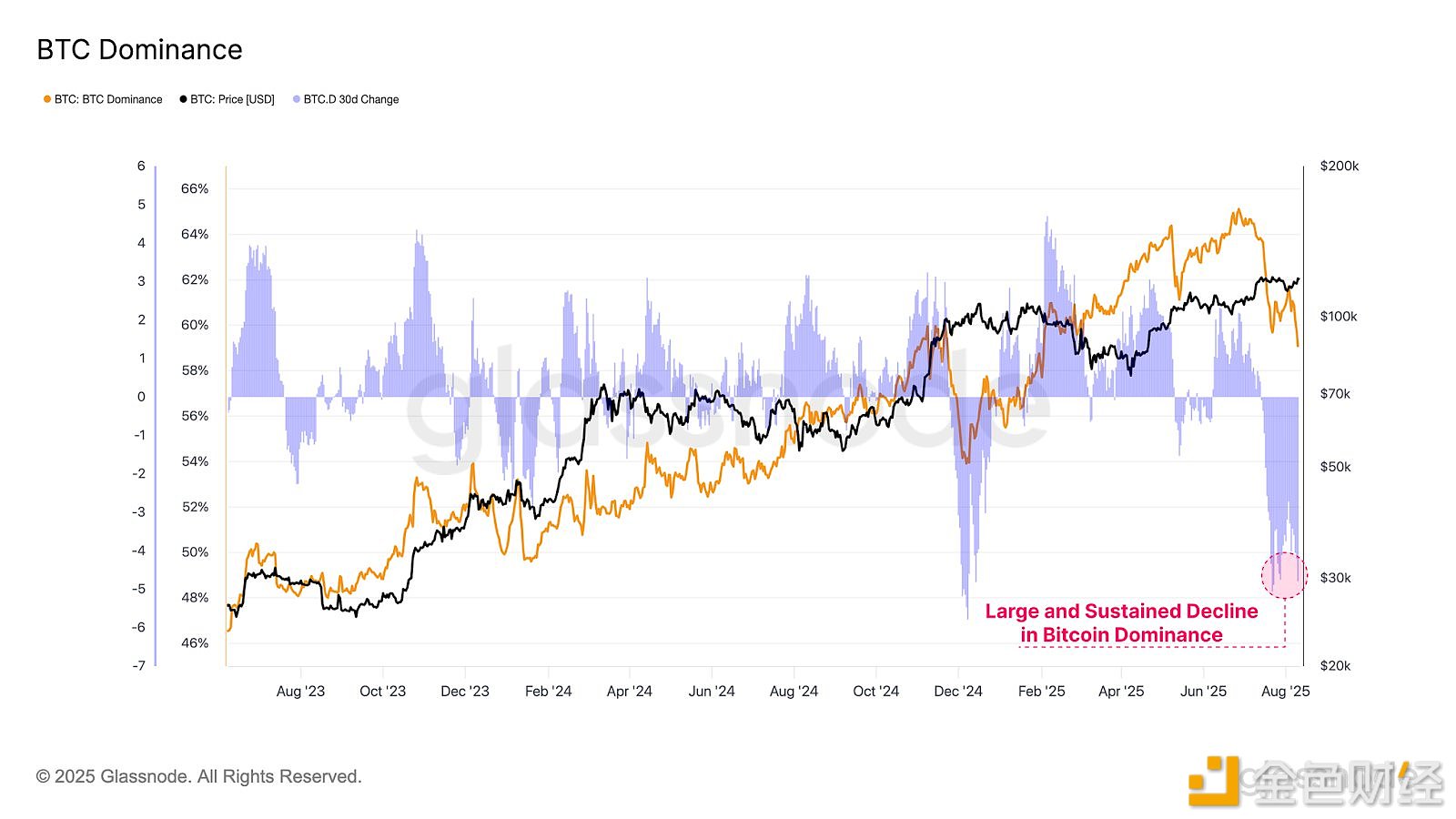

Bitcoin dominance has dropped from 65% to 59% over the past two months

US Treasury Department Calls for Public Comments on Illicit Activities Involving Cryptocurrency

The three major U.S. stock indexes closed nearly flat

U.S. Stocks Close: iQIYI Surges 17%, Intel Falls 3.6%