-

The recent influx of Tether (USDT) into cryptocurrency exchanges raises questions about Bitcoin’s potential recovery amidst prevailing market volatility.

-

With BTC’s trading patterns historically linked to USDT supply changes, this significant movement could be indicative of future price movement if real demand follows.

-

According to a COINOTAG report, “The latest USDT supply surge could provide the liquidity Bitcoin needs to break its current stagnation if correctly capitalized.”

This article explores whether recent USDT inflows signify genuine market demand for Bitcoin or merely increased leverage, impacting BTC’s future stability.

Potential for Bitcoin’s Rebound: Analyzing Tether’s Role

The relationship between USDT inflows and Bitcoin’s price movement has become a focal point for traders and investors alike. In February, a staggering $450 million in new USDT entries marked a pivotal moment, signaling a potential turnaround for BTC amid ongoing bearish trends.

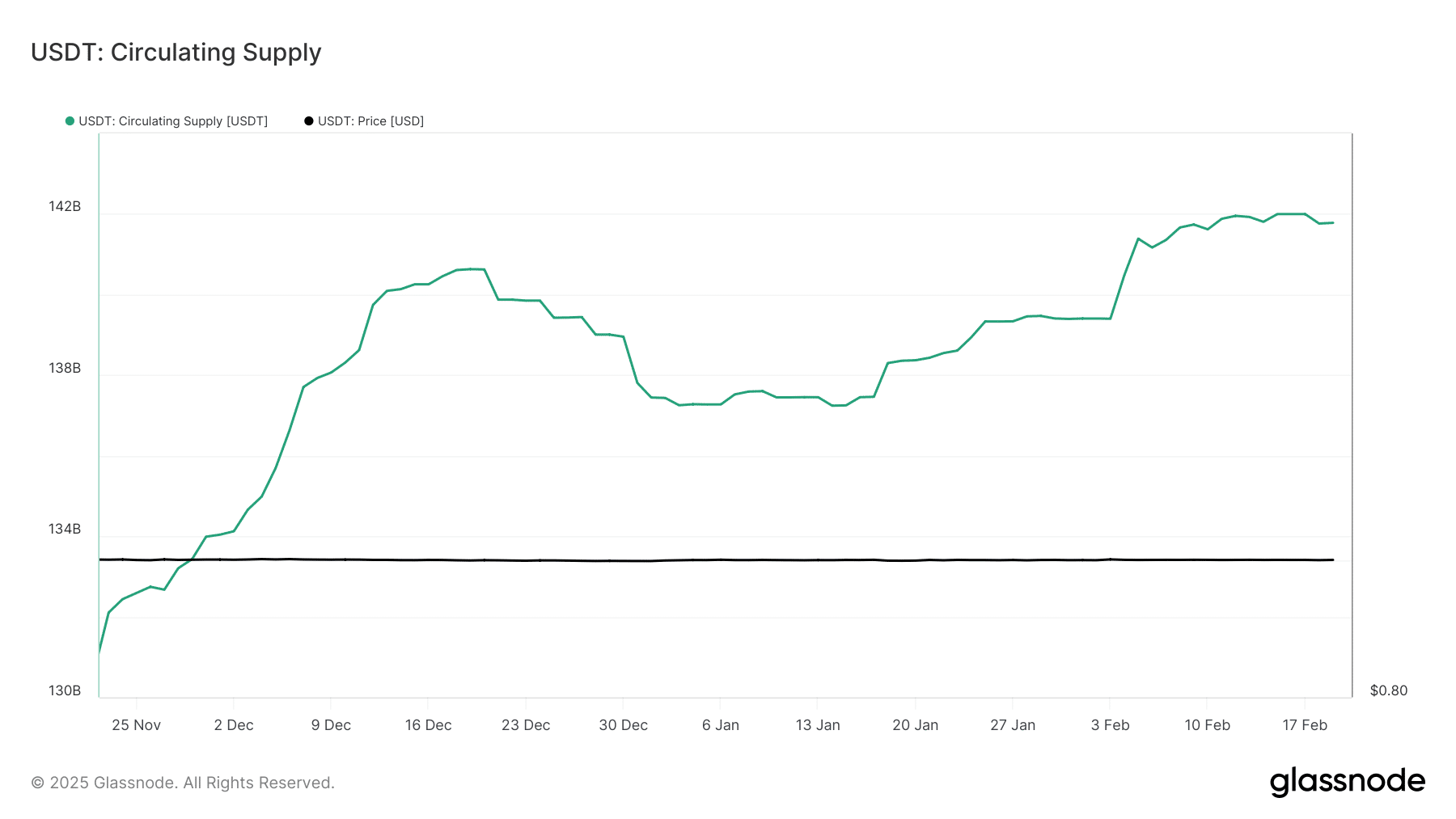

As the Tether supply rises to new peaks, it invites scrutiny into whether this liquidity translates into true buying pressure. Historically, BTC’s price has moved in conjunction with USDT’s circulating supply. The mid-December surge to an all-time high of $108K coincided with a USDT supply peak, suggesting a robust market correlation.

Source: Glassnode

Distinguishing Demand from Leverage in the Current Market

As we delve deeper, it’s essential to consider the implications of rising Estimated Leverage Ratios (ELR). An increase in leverage can be a double-edged sword; while it may amplify potential gains, it simultaneously heightens the risk of liquidations in the event of price corrections.

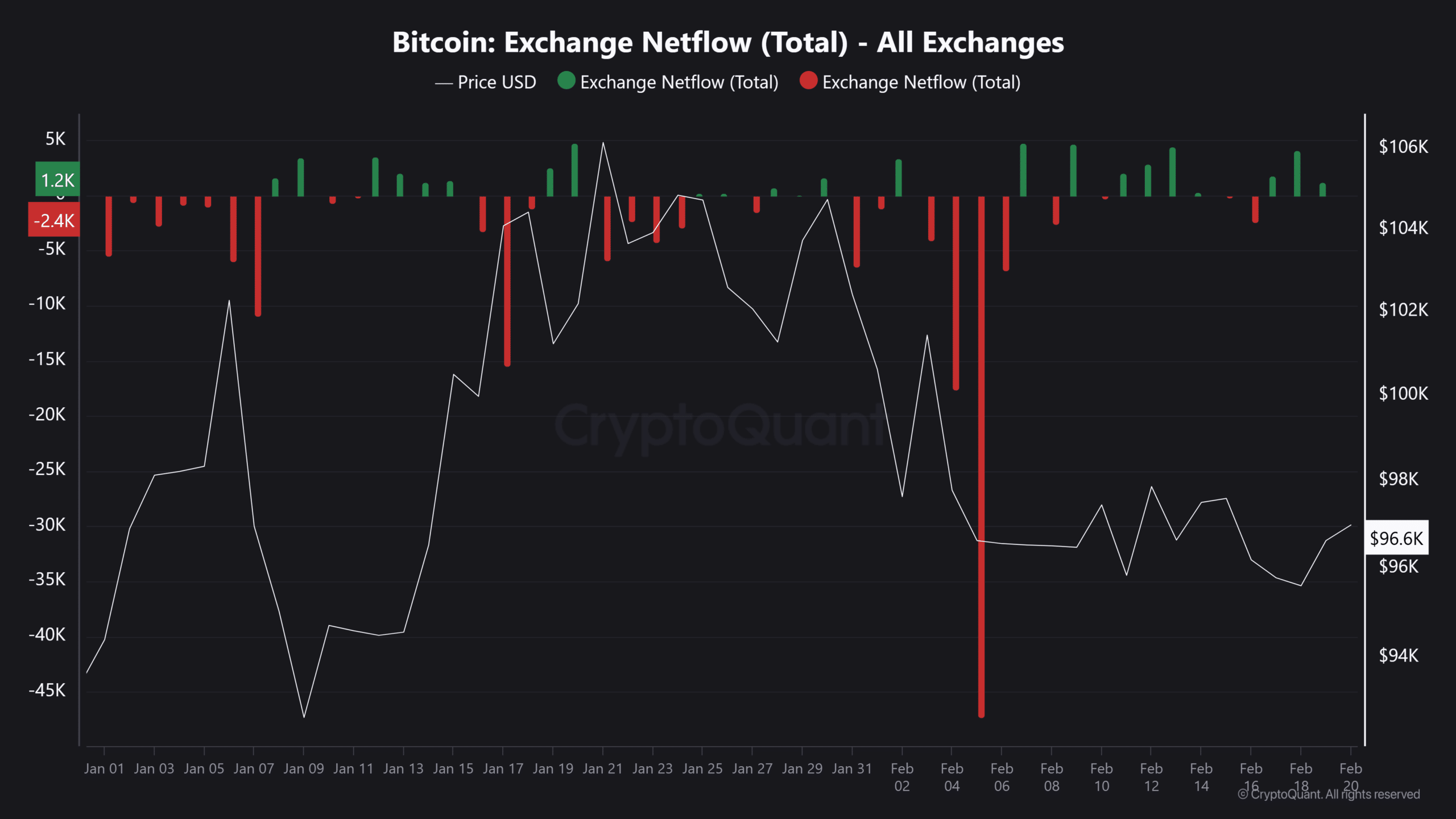

Current observations show that BTC inflows to exchanges have exceeded outflows, indicating a buildup of long positions despite the weak spot demand. This dynamic could exacerbate market fragility, especially when correlated with high leverage. Should prices decline sharply due to unfavorable market conditions, a cascade of long liquidations could ensue, posing further risk to Bitcoin’s market stability.

Source: CryptoQuant

Analyzing Market Sentiment and Future Outlook

While the surge in USDT inflows might suggest a potential rebound for Bitcoin, the prevailing market sentiment remains cautious. High unrealized profits alongside slow ETF accumulation speak to an atmosphere of fear, rather than greed. This points to an aversion to taking substantial risks, even with increased USDT liquidity in the market.

Ultimately, if the current Tether influx is utilized predominantly for speculative trading rather than genuine buying interest, Bitcoin may encounter significant headwinds ahead. Investors are advised to remain vigilant and assess the actual demand patterns as BTC navigates this turbulent phase.

Conclusion

In summary, while the recent influx of USDT could act as a catalyst for Bitcoin’s recovery, the underlying dynamics of leverage and demand must be carefully weighed. With increasing leverage and the potential for mass liquidations if BTC prices fall, caution prevails. The market will need to see a demonstration of real demand, rather than speculative trading, to support sustained price increases. Investors should remain alert to these developments as they unfold.