Key Points

- Tomorrow, over $2 billion in Bitcoin and Ethereum options will expire at 08:00 (UTC).

- BTC is trading above $97,000 and ETH is trading above $2,700.

Deribit revealed tomorrow’s options expiry data in a new post on X. The options’ expiration could trigger more market volatilty.

Bitcoin and Ethereum Options Expiry Details

On February 21 at 08:00 (UTC), over $2 billion in BTC and ETH options will expire.

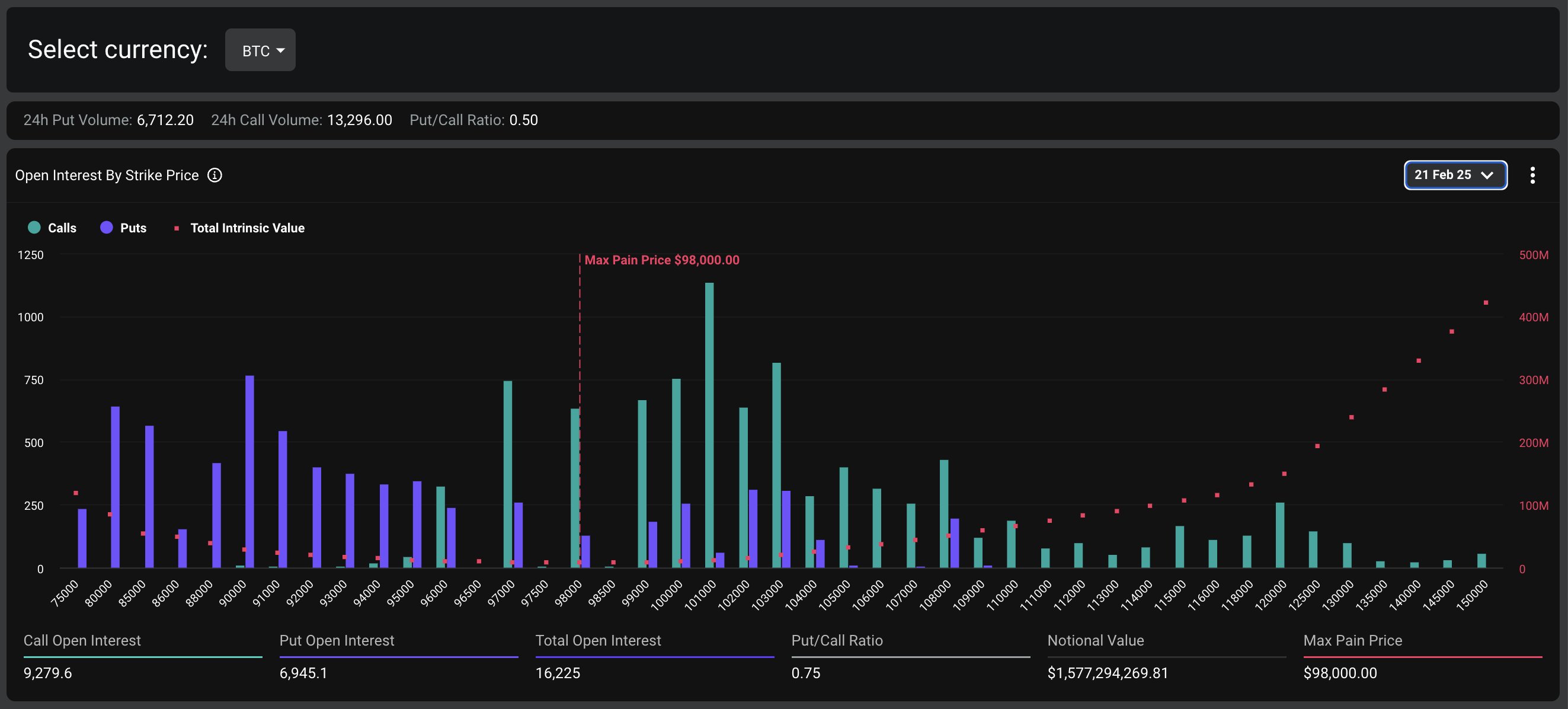

$1.58 billion in Bitcoin options will expire with a Max Pain Point of $98,000, and a Put/Call Ratio of 0.75.

Deribit notes – BTC options expiry data

Deribit notes – BTC options expiry data

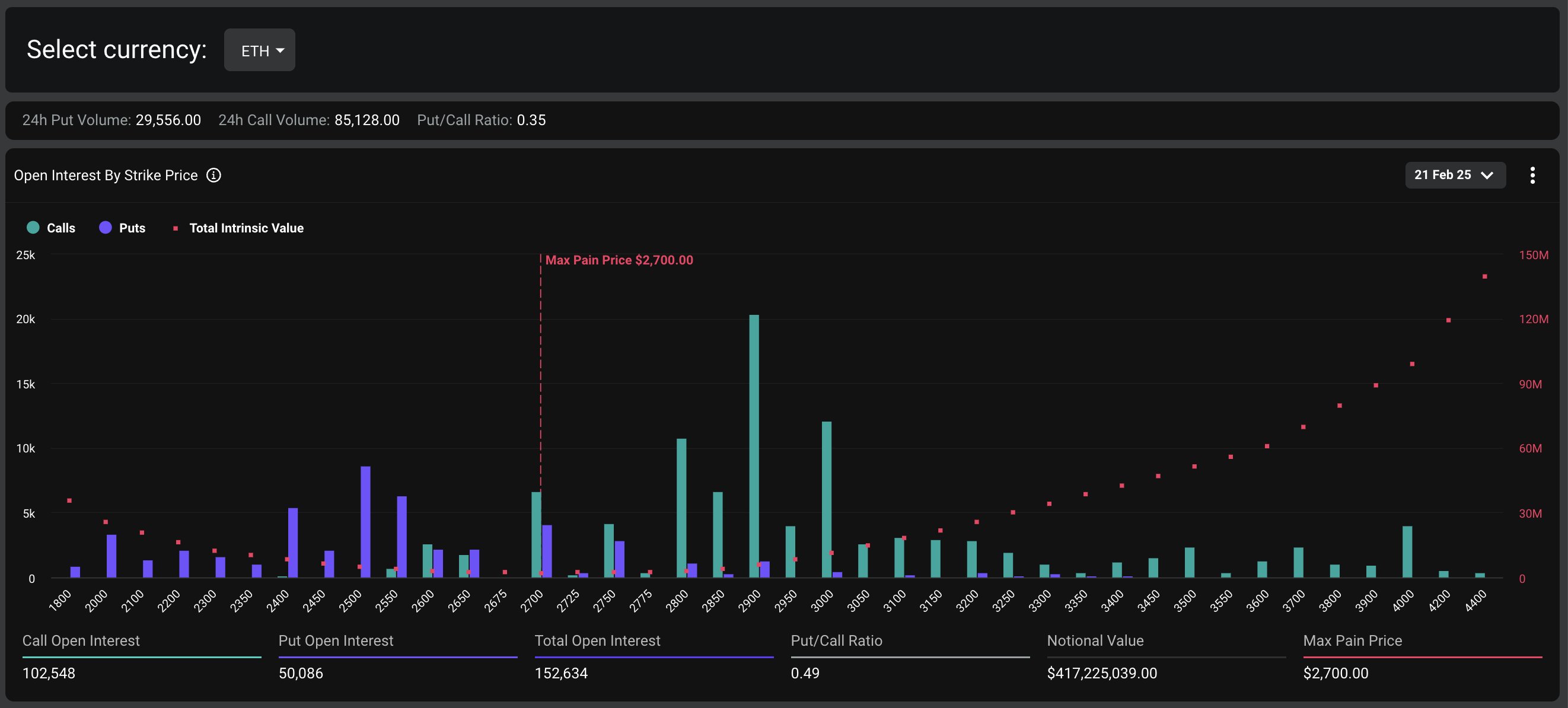

Also, $417 million in Ethereum options will expire tomorrow morning with a Max Pain Point of $2,700 and a Put/Call Ratio of 0.49, Deribit notes .

Deribit – ETH options expiry data

Deribit – ETH options expiry data

After a week of intense volatility, the crypto market is up by over 1% in the past 24 hours, with both BTC and ETH trading in the green.

BTC Trades Above $97,000

At the moment of writing this article, BTC is trading above $97,000, up by over 1% in the past 24 hours.

BTC price in USD todayIn the past seven days, BTC recorded intense volatility. BTC topped $98,600 on February 14, and then recorded an ascendant trajectory, hitting a dip at around $93,400 on February 18.

Since then, the digital asset recorded a price surge, reaching today’s levels.

BTC’s price is supported by continued adoption, with Google being a recent important name that addressed collaborating with the BTC ecosystem since 2024, addressing potential future investments.

Another notable event this week was that FTX began its $16 billion creditor repayments on February 18.

While BTC recorded over $18 million in liquidations in the past 24 hours (over $7 million in long positions and over $10 million in shorts), ETH saw over $19 million in liquidations over the past day – over $8 million in long positions and over $10 million in shorts, CoinGlass data shows.

ETH Trades Above $2,700

At the moment of writing this article, ETH is trading above $2,700, up by 0.3% today. During the past seven days, ETH also recorded high volatility, with a top above $2,800 on February 17.

ETH dipped to $2,600 levels on February 18, before rebounding to current price levels today.

ETH price in USD todayTomorrow’s expiry data could trigger more volatility in the market.