Date: Tue, February 25, 2025 | 10:47 AM GMT

The cryptocurrency market is experiencing a sharp sell-off, with the total market capitalization shrinking by 8% in the past 24 hours. Bitcoin (BTC) has dropped over 8%, while Ethereum (ETH) has seen an even steeper decline, falling by more than 11%.

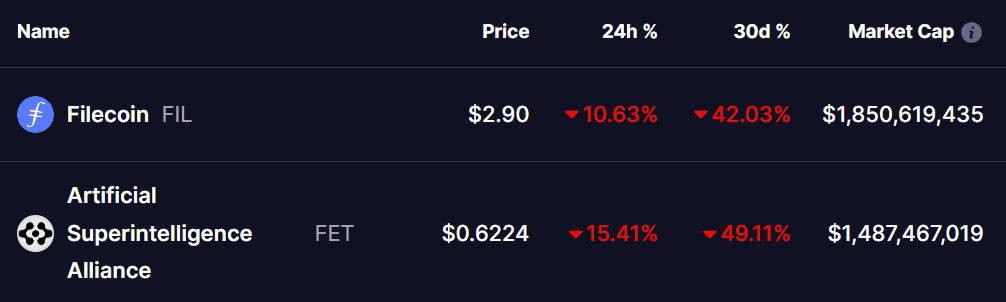

Among the hardest-hit altcoins are Filecoin (FIL) and Artificial Superintelligence Alliance (FET), both of which have experienced substantial losses of 10% and 15%, respectively, extending their past 30-day corrections to over 40%.

Source: Coinmarketcap

Source: Coinmarketcap

Now, both assets are testing key support levels, leaving investors wondering—is a bounce back on the horizon?

Filecoin (FIL)

The weekly chart of FIL shows that the price has been following a descending triangle pattern for nearly a year. After reaching a high of $8.38 in early December, FIL faced strong rejection from the upper trendline, triggering an extended correction.

Filecoin (FIL) Weekly Chart/Coinsprobe (Source: Tradingview)

Filecoin (FIL) Weekly Chart/Coinsprobe (Source: Tradingview)

This ongoing downtrend has now pushed FIL to a major support zone, reaching a low of $2.83—a level that has historically provided strong rebounds. The price is currently holding above this support at $2.89, suggesting a possible bounce.

A successful rebound from this level could propel FIL towards the 25-day SMA, which would indicate further bullish momentum. If FIL breaks above the descending triangle’s resistance, it could open the doors for a larger recovery toward $4.50 or even $8.38 in the long term.

Artificial Superintelligence Alliance (FET)

Like FIL, FET has been trading within a descending triangle for the past year. The most recent downtrend began on December 2, following a rejection at the upper resistance trendline near $2.32.

FET Weekly Chart/Coinsprobe (Source: Tradingview)

FET Weekly Chart/Coinsprobe (Source: Tradingview)

The ongoing decline has pushed FET to a major support zone, at which it is currently trading at $0.62. This level has previously acted as a strong demand zone, making it a crucial area to watch.

If FET rebounds from this support and breaks above the 100-day SMA, it could trigger a bullish reversal, with the next target being the upper resistance trendline of the triangle.

Time to Dive In?

Both FIL and FET are currently showing resilience at their key support levels. However, their next move largely depends on Ethereum (ETH) and the broader crypto market sentiment. The MACD indicators on both charts suggest that momentum is still bearish, but if we see a bullish crossover, it could confirm a potential reversal in the coming weeks.

As long as both tokens hold these critical support zones, there remains a chance for a rebound, offering an opportunity for investors to dive in at current levels. However, a breakdown below support could trigger further losses, making it crucial to watch these levels closely.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions.