Solana price action has been under pressure as investors react to the upcoming unlock of 11.2 million SOL tokens by the defunct exchange FTX, set for March 1, 2025.

This event could flood the market, pushing prices down, but some see the dip as a chance to buy low.

Solana Price Dips Below $160

The price crash saw Solana fall below $160 for the first time in 2025, last seen at $159.64 on October 20, 2024. Over the past month, it dropped more than 35%, with a current market cap of $78 billion and fully diluted valuation of $95 billion.

While many are selling off, data from Deribit shows large investors, or “whales,” are using put options—contracts to sell at a set price—to protect against further drops, with 80% of block trades being puts, totaling $32.39 million out of $130.74 million in options activity last week.

Solana price crash below $160 is notable, as it hadn’t traded at this level since October 20, 2024, when it closed at $159.64.

SOL/USDT Chart | Source: Trading View

SOL/USDT Chart | Source: Trading View

At the time of writing, SOL is trading at $158.33, still below the $160 threshold, according to Coinmarketcap data. The token has seen a 7.9% drop in the past 24 hours, over 13% decline over the past week, and more than 35% fall in the past 30 days.

This sustained downward trend reflects growing investor wariness ahead of the FTX unlock.

The FTX Unlock: A Supply Shock on the Horizon

The upcoming unlock by FTX involves releasing 11.2 million SOL tokens, worth approximately $1.77 billion, on March 1, 2025.

This event is expected to flood the market with additional supply, potentially leading to selling pressure and further price drops.

Investors fear that FTX, once a major player in crypto, could trigger a significant sell-off, exacerbating the current price decline. This concern is rooted in the basic economic principle of supply and demand, where increased supply without corresponding demand can depress prices.

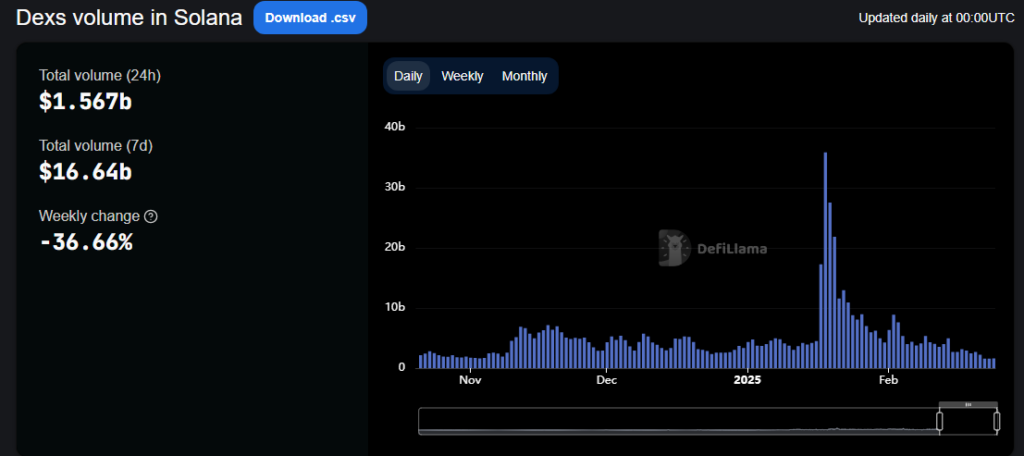

The market’s reaction extends beyond price, impacting Solana’s ecosystem metrics. According to data from DeFi Llama, Solana’s decentralized exchange (DEX) volume has decreased by 36.66% in the past week. With the current weekly DEX volume at $16.6 billion and daily volume at $1.5 billion.

Solana DEX Volume | Source: Defillama

Solana DEX Volume | Source: Defillama

This decline mirrors the price drop, indicating reduced activity across trading platforms. Since February 24, 2025, Solana has lost nearly $10 billion in both market cap and fully diluted valuation. This underscored the broad impact of the unlock fear.

SOL Options Data Signals Caution

Derivatives markets also show signs of caution. Data from Amberdata reveals that SOL block trades on Deribit accounted for nearly 25% of all Solana options activity. These totaled $32.39 million out of $130.74 million.

This is the second largest portion of SOL block trades ever recorded. They were nearly 80% of these block trades concentrated in put contracts.

Put options are often used to hedge against price declines or speculate on further drops. This activity suggests that large investors, or “whales,” are preparing for or expecting additional volatility. Whales are protecting their positions from potential losses.