Bitcoin’s recent fluctuation in Open Interest signals a potential shift in market dynamics, raising questions about its future trajectory.

-

Bitcoin’s Open Interest drops 14.42%, signaling lower speculation and potential market reset.

-

Fear & Greed Index falls to 26, while analysts watch BTC’s next move ahead of the Crypto Summit.

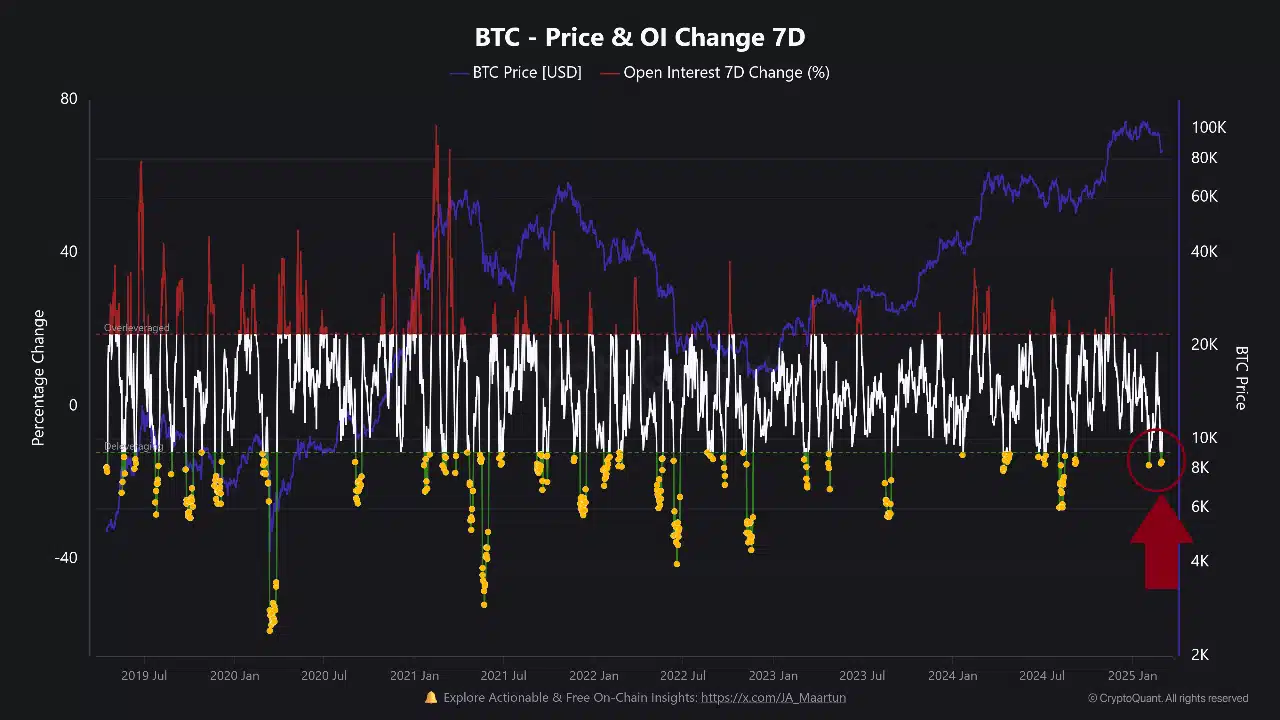

Bitcoin’s [BTC] Open Interest Change (7D) has dropped by 14.42%, signaling a decline in speculative activity among traders.

Open Interest measures the total number of outstanding derivatives contracts, and a sharp decrease often suggests position liquidations or reduced market participation.

Historically, such declines have been associated with potential market resets, creating buying opportunities during price dips.

Source: CryptoQuant

This decrease in Open Interest comes as Bitcoin’s price falls to $83,833, with a 24-hour trading volume of $68.86 billion.

The market has experienced an 8.86% decline in the last 24 hours and a 6.27% drop over the past week. With a circulating supply of 20 million BTC, Bitcoin’s total market capitalization now stands at $1.66 trillion.

Fear & Greed Index Drops to 26

The Crypto Fear & Greed Index, a widely used sentiment gauge, has fallen from 72 (extreme greed) on February 4 to 26 (fear).

A reading above 70 often indicates overbought conditions, while a drop below 30 suggests that fear is dominating the market.

This shift reflects growing investor caution amid recent market turbulence and fundamental developments.

Source: CryptoQuant

On-chain data from CryptoQuant analyst Maartunn reveals that old Bitcoin wallets have been moving coins in the past day.

The Spent Output Age Bands indicator, which tracks Bitcoin movement based on the last transaction date, shows increased activity among coins that have been held for 7 to 10 years.

While the reason remains unclear, some analysts question — Are long-term holders preparing for market volatility?

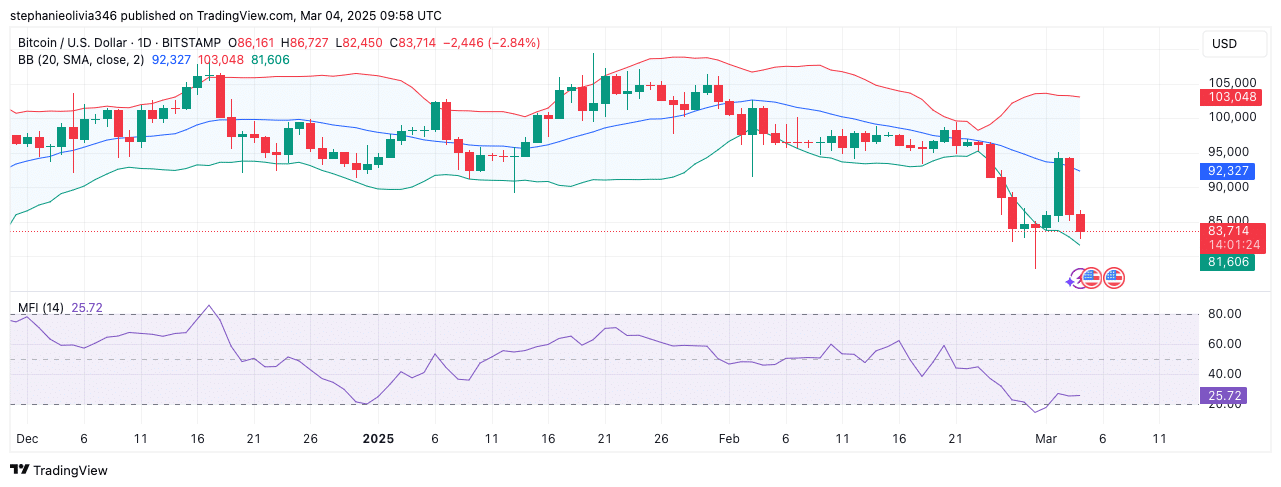

Technical Indicators Suggest a Potential Rebound

Bitcoin’s price is currently near the lower Bollinger Band at $81,606, suggesting oversold conditions that could lead to a short-term bounce.

The middle band at $92,327 serves as the first resistance level, and a break above this could confirm a potential price reversal.

The Money Flow Index (MFI) was at 25.72 at press time, reinforcing that Bitcoin was in oversold territory, which could attract buying interest.

Source: TradingView

However, if BTC fails to hold support at $81,606, further downside movement is possible. A push above $85K could signal a short-term recovery, while continued selling pressure may test lower levels.

White House Crypto Summit Could Drive Market Movements

Market participants are closely watching the White House Crypto Summit on the 7th of March, which could influence short-term price movements for Bitcoin, Cardano [ADA], XRP, and Solana [SOL].

The event may bring regulatory updates or policy announcements that affect market sentiment.

Additionally, the MVRV Z-Score cooldown suggested Bitcoin could be preparing for a move toward the $100K level, resembling its February-March 2024 pullback before reaching new highs.

With political factors playing a role in market movements, traders are monitoring whether Bitcoin is setting up for its next major rally.

Conclusion

In summary, the recent decline in Bitcoin’s Open Interest and the drop in the Fear & Greed Index highlight a cautious sentiment among traders. As market participants await key developments, particularly from the upcoming White House Crypto Summit, the outlook remains tense.