Greeks.live: Bitcoin Forms ‘Two-Way Induced’ Price Move, Market in Liquidity Game

On 5 March, Greeks.live Macro Researcher Adam published an English-language community newsletter in which traders were generally bearish, expecting the market to fall further. Traders are focusing on the 87-89k area as a key resistance level and see 82k as a near-term bottom, but there is clear disagreement on whether the market has found a sustainable bottom.

The market is experiencing extreme price volatility, with Bitcoin moving 6k in one day in a ‘two-way induced’ price move. Several traders have chosen to sell calls in the 89-90k range as their preferred strategy in the current environment, with some traders reporting losses of -260% on calls sold at lower levels. The market's bearish skew remains pronounced, suggesting that market expectations are still tilted to the downside despite the brief rally.

The briefing also mentioned that the Trump tariff announcement and subsequent policy reversal is adding to market confusion, with many traders choosing to stay on the sidelines due to unpredictable price action. Some members felt that the market was in a liquidity game and that getting in and out of the market quickly was critical.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Morph: Zootosis to End on August 18 at 8:00

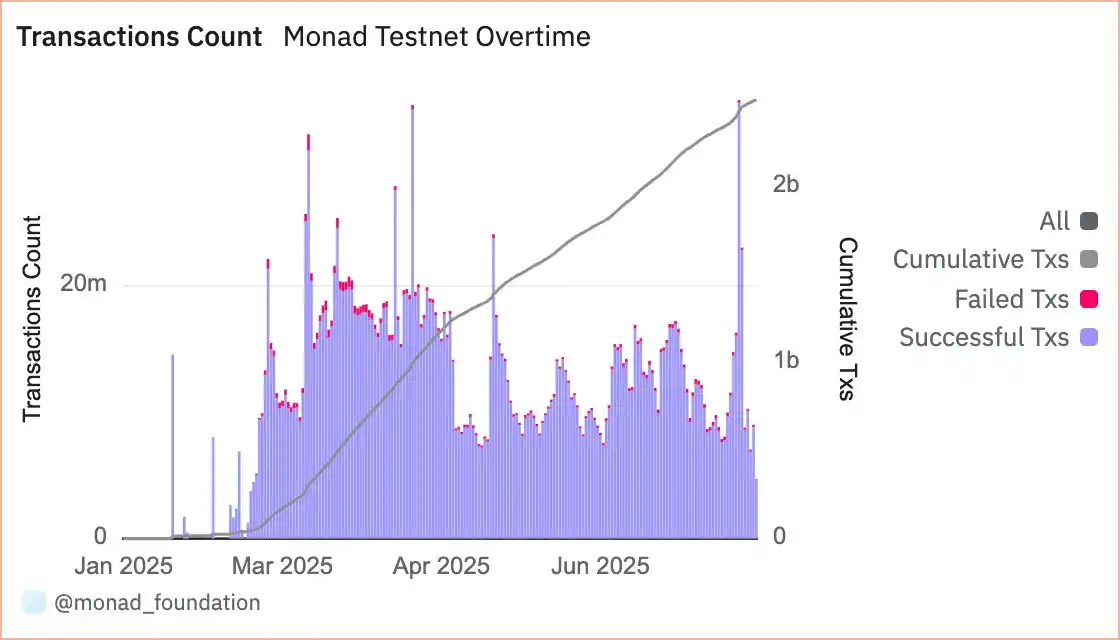

Monad testnet data now available on Dune

Bitcoin Treasury Capital launches a convertible stock loan program worth 105 BTC