Canary Capital Seeks SEC Nod for First Axelar ETF, AXL Price Soars 14%

Canary Capital’s filing for an AXL ETF marks a significant step toward Axelar's institutional adoption. The move follows the firm’s earlier trust launch and signals growing interest in Web3 connectivity.

Asset Manager Canary Capital has filed an S-1 registration statement with the US Securities and Exchange Commission (SEC) to launch an exchange-traded fund (ETF) tied to Axelar (AXL).

This marks the first-ever filing for AXL, the native cryptocurrency that powers the Axelar Network, setting the stage for the token’s institutional adoption.

Canary Capital Files for AXL ETF

The filing, which was submitted on March 5, outlines that the fund’s net asset value (NAV) will be calculated based on the price of AXL. However, specifics regarding the exchange where the ETF will be listed, its ticker symbol, and the custodian remain unspecified.

The proposed ETF builds on Canary Capital’s earlier efforts to bring Axelar to institutional investors. On February 19, the firm launched the Canary AXL Trust. The trust was Canary Capital’s first step into structured AXL offerings, and the ETF filing represents an extension of this effort.

“With Axelar driving some of the most advanced interoperability solutions in Web3, we see in AXL a significant opportunity for institutional investors to gain exposure to the technology underpinning next-generation blockchain connectivity,” Canary Capital’s CEO Steven McClurg said.

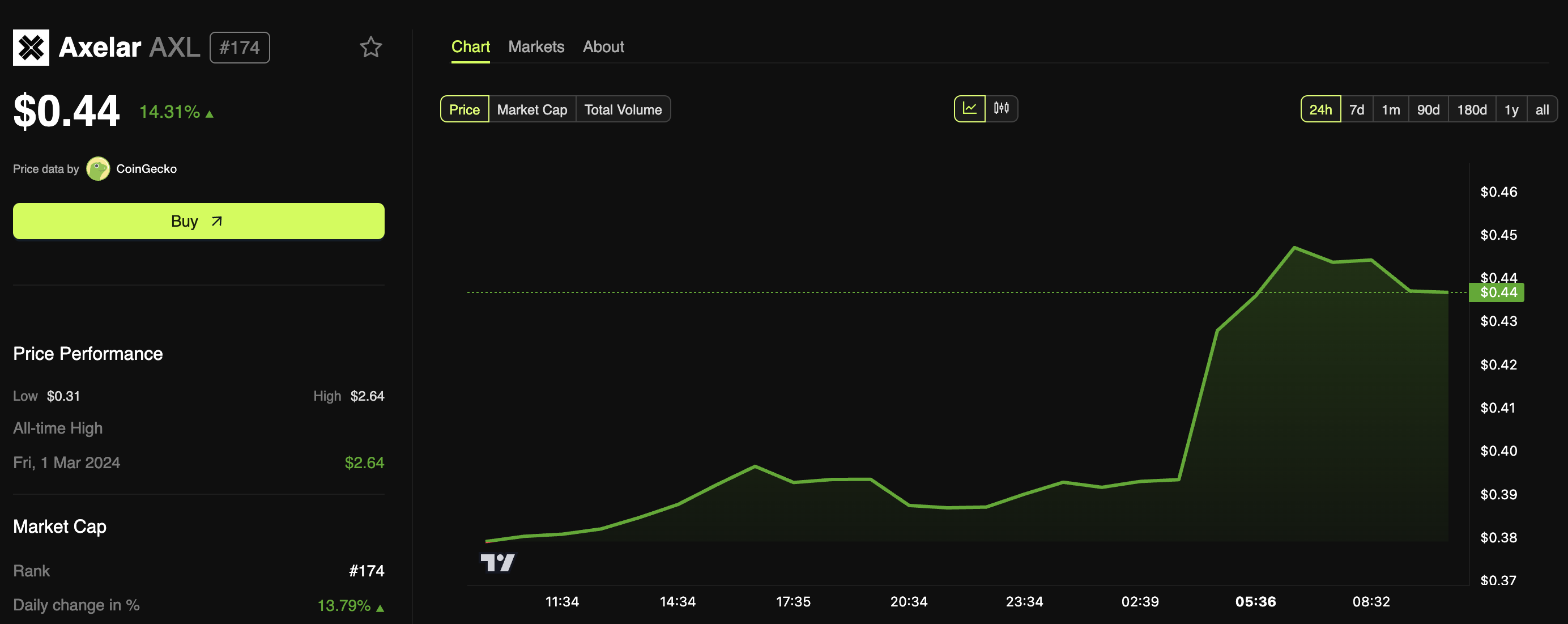

The news of the filing had an immediate impact on the market. AXL’s price jumped 14.3%, reaching $0.44.

AXL Price Performance. Source:

BeInCrypto

AXL Price Performance. Source:

BeInCrypto

Trading volume also spiked to $35.7 million. This marked a 131.8% increase from the previous day. With a market capitalization of $405.5 million, Axelar currently ranks 174 on CoinGecko.

Crypto ETFs Under Donald Trump: Opportunity or Bubble?

Canary Capital’s filing comes amid a broader surge in cryptocurrency ETF applications in the US, a trend that has accelerated since Donald Trump took office. According to Kaiko Research, more than 45 crypto ETF filings are currently pending SEC approval.

While Bitcoin (BTC) and Ethereum (ETH) ETFs have dominated the space, the scope has expanded to include unconventional assets like meme coins. Bitwise and Grayscale have filed for a Dogecoin (DOGE) ETF.

Moreover, the ETF filings from Rex Shares and Tuttle Capital feature newly launched meme coins like Official Trump (TRUMP) and Melania Meme (MELANIA).

Nonetheless, according to Kaiko Research, market depth, concentration, and trading structure present significant obstacles for non-BTC/ETH ETFs. Many altcoins associated with ETF applications suffer from shallow liquidity, making them more susceptible to price manipulation and volatility.

Additionally, most trading activity for these assets occurs on offshore platforms, creating transparency and regulatory oversight issues. The lack of sufficient USD trading pairs for certain assets further complicates their inclusion in ETFs, as these pairs are essential for accurate ETF valuations. Furthermore, the absence of regulated futures markets for many cryptocurrencies limits available trading strategies.

“All of these factors could limit the demand for more crypto-related ETFs going forward. While approval processes might change, market dynamics still have to catch up,” Kaiko noted.

For now, AXL has been added to a growing list of crypto ETF filings. However, its success—and that of similar ETFs—remains to be seen.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Announcement on Bitget listing NFLXUSDT, FUTUUSDT, JDUSDT, RDDTUSDT, QQQUSDT STOCK Index perpetual futures

Bitget Trading Club Championship (Phase 15)—Trade spot and futures to share 120,000 BGB, up to 2200 BGB per user!

CandyBomb x COMMON: Trade futures to share 1,111,111 COMMON!