-

The recent decline in the U.S. Dollar Index is stirring optimism among Bitcoin investors, as a potential market rally looms on the horizon.

-

As sentiments shift, traders are eyeing Bitcoin’s price movements, notably its recent ascension above $90,000, signaling renewed confidence in the asset.

-

According to insights from COINOTAG, “If investor sentiment remains favorable, Bitcoin could see significant upward momentum.”, highlighting a pivotal point for the cryptocurrency.

Bitcoin is witnessing a surge as the U.S. Dollar Index declines, prompting optimism for a market rally—investors anticipate significant price movements ahead.

Dollar index drops—Is this good for BTC?

The latest trends reveal a notable decline in the U.S. Dollar Index [DXY], which measures the dollar’s performance against a selection of major currencies. Historically, such declines have signaled an advantageous environment for cryptocurrencies like Bitcoin and a range of altcoins.

Looking back at the previous market cycles in 2017 and 2021, Bitcoin gained significant ground following similar declines in the dollar index, igniting major price rallies. A trend-predictable chart illustrates this dynamic below.

Source: X

Should the dollar index continue its downward trajectory as per historical patterns, the cryptocurrency sector, particularly Bitcoin, stands to gain substantial momentum as the market prepares for a potential upswing.

Impact on Bitcoin price in the market

Recent data indicates a reduction in Bitcoin transactions on the spot market over the previous day. Initially reporting sales of $163.54 million, this figure has since plummeted to $87.12 million, suggesting a shift in investor behavior.

If this ongoing trend persists, it could lead to a resurgence of investor interest, prompting an uptick in net exchange inflows.

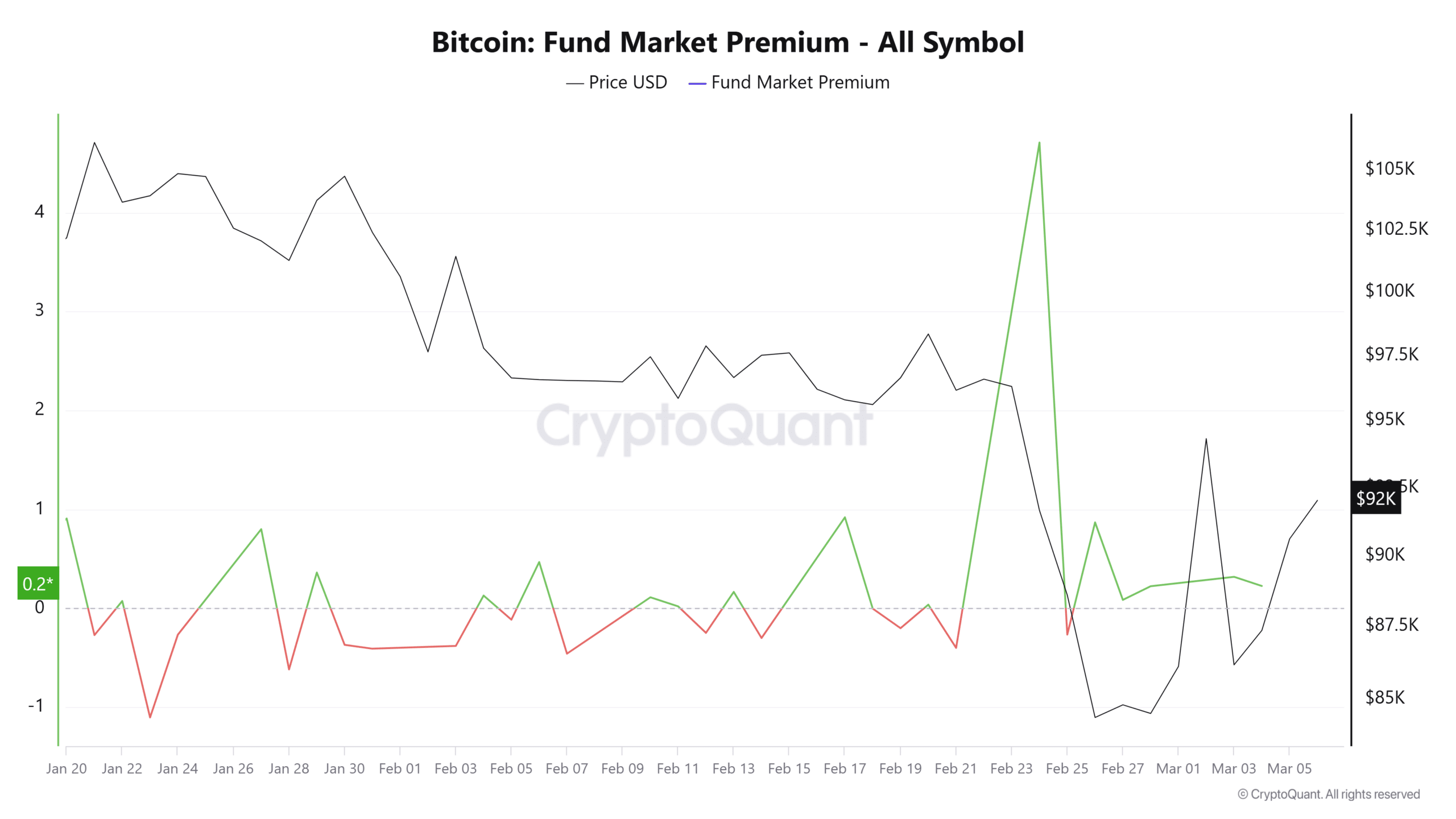

In parallel, the fund market premium—which reflects whether investors are more inclined to buy or sell based on its position relative to zero—stands at 0.2, suggesting a favorable buying sentiment.

Source: CryptoQuant

A thorough examination of the fund market premium showcases that it has maintained a consistent level since the commencement of March, indicating that investors are likely embracing a strategy of accumulating BTC in expectation of a significant increase.

Institutional investors stop selling

In the backdrop of days marked by substantial outflows from Bitcoin exchange-traded funds [ETFs], signs of a sentiment shift are emerging. Notably, institutional heavyweight BlackRock, managing an impressive $50 billion in a Bitcoin ETF via IBIT, appears to have paused its selling activities.

This cessation of selling often acts as a precursor; it suggests that institutional investors are reassessing their positions, likely considering re-entry into the market, particularly under bullish conditions.

Reflecting this renewed interest, Bitcoin ETFs recorded inflows amounting to $22 million within just 24 hours, signaling a revival of institutional enthusiasm in the cryptocurrency landscape.

Conclusion

In summary, the current dynamics around the U.S. Dollar Index and its implications for Bitcoin indicate a critical transitional phase in the market. With institutional investors halting sales and sentiment shifting positively towards BTC, the anticipation for significant upward price movements gains credibility. As we proceed into the next trading days, all eyes will be on how investor behavior evolves in conjunction with economic indicators. Investors may want to keep a close watch on these developments to navigate potential opportunities in the cryptocurrency market.