Michael Saylor Proposes $81 Trillion Bitcoin Reserve Plan to US Government

Could Bitcoin secure America’s financial future? Michael Saylor’s bold plan outlines how the US could generate $81 trillion by 2045.

Michael Saylor shared an ambitious proposal for the US government to accumulate a vast Bitcoin reserve that he claims could generate up to $81 trillion in wealth by 2045.

The outspoken Bitcoin (BTC) advocate and co-founder of Strategy (formerly MicroStrategy) shared the blueprint during the White House Crypto Summit.

Michael Saylor’s Bitcoin Accumulation Blueprint For Trump’s Government

Syalor’s plan, presented as a blueprint for economic dominance, calls for the nation to acquire between 5% and 25% of the Bitcoin network over the next decade through consistent, programmatic daily purchases.

“I shared this at the White House Digital Assets Summit,” Salor confirmed.

Saylor’s vision rests on the idea that Bitcoin will appreciate significantly over time due to its fixed supply and growing global adoption.

Under his plan, the US government would begin accumulating Bitcoin in 2025 and continue until 2035, by which point 99% of all Bitcoin will have been mined.

“Acquire 5-25% of the Bitcoin network in trust for the nation through consistent, programmatic daily purchases between 2025 and 2035, when 99% of all BTC will have been issued,” read an excerpt in the blueprint.

Following this strategy, the US could acquire up to a quarter (25%) of the total supply, locking in a dominant position in the global financial system. Saylor argued that such a move would have a transformative economic impact.

Saylor estimates that the Strategic Bitcoin Reserve could generate between $16 trillion and $81 trillion in value for the US Treasury by 2045. Notably, this prediction hinges on the scale of adoption and Bitcoin’s future price appreciation.

The reserve would act as a long-term store of value for the nation, offering an alternative to traditional monetary assets and providing a powerful hedge against inflation.

Also, Saylor said the strategy would secure America’s financial future, strengthen the dollar, reduce national debt, and cement the country’s status as a global economic leader.

Saylor Discourages US Government From Selling Bitcoin Holdings

One of the most striking aspects of Saylor’s proposal is his assertion that the US should never sell its Bitcoin holdings. Instead, he envisions the SBR generating at least $10 trillion annually by 2045 through appreciation and other financial mechanisms.

He claims this would create a self-sustaining economic engine capable of addressing national debt concerns. It would also position the US to fund technological advancements, critical infrastructure, and social programs without increasing taxes or borrowing excessively.

Beyond buying Bitcoin, Saylor’s broader digital asset framework includes sweeping regulatory changes designed to position the US as the epicenter of the digital currency wave.

He advocates for clear, supportive regulations that encourage innovation while ensuring market integrity.

“Hostile and unfair tax policies on crypto miners, holders, and exchanges hinder industry growth and should be eliminated, along with arbitrary, capricious, and discriminatory regulations,” Saylor added.

His plan divides digital assets into four categories—digital tokens, digital securities, digital currencies, and digital commodities. Each of these, he indicated, serves a specific function within the economy.

Notably, if the US government heeds Saylor’s 25% Bitcoin supply purchase, it would hold 5.25 million BTC. This would be more than the 1 million BTC (5% of the supply) Wyoming Senator Cynthia Lummis proposed in the Bitcoin Act introduced in August 2024.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

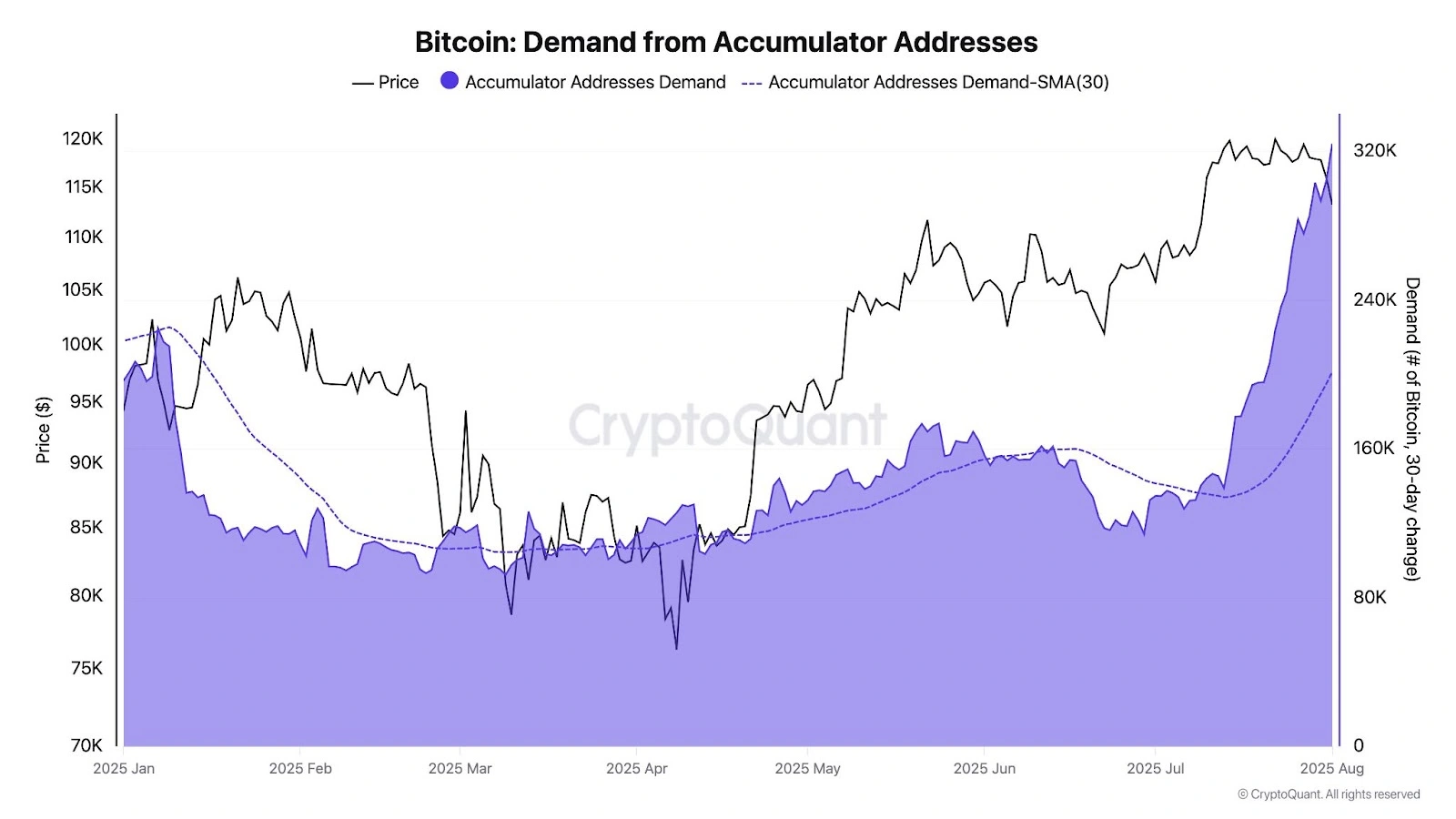

Bitcoin is still in a good place, but short-term holders might be a problem

Share link:In this post: Accumulator wallets continue to buy without selling, reinforcing the bullish sentiment around the Bitcoin market. Declining OTC reserves hint at tightening supply and rising institutional demand. Short-term holders are nearing breakeven, increasing the risk of panic selling.

Sharplink and The Ether Machine lead as whales continue to stack ETH

Share link:In this post: Whales had a field day today, as on-chain data revealed that two Whale addresses received nearly 43K Ether worth over $153M. SharpLink Gaming also bought 18.68K ETH worth over $66.6M, while The Ether Reserve LLC acquired 10.6K ETH valued at around $40M. The Kobeissi Letter noted that ETH added a market cap of over $150 million since July 1.

Google to limit AI data center power usage during peak demand periods

Share link:In this post: Google has signed its first formal agreements to reduce AI data center power usage during peak electricity demand. The agreements with U.S. utilities, Indiana Michigan Power and Tennessee Valley Authority, address the rising energy demand from AI workloads straining power grids. Google’s agreement has introduced AI into demand-response programs and may set a precedent for other tech companies to deal with blackout concerns and higher electricity bills.

SEC Appeals in Ripple XRP Case Nears Deadline