- Tokenizing real-world assets like gold on the XRP Ledger could drive increased demand for XRP, leading to higher valuations.

- Institutional adoption of XRP for asset transactions and liquidity boosts could contribute to a potential price surge.

XRP could be on the edge of a price surge, driven by its role in tokenizing real-world assets (RWAs) on the XRP Ledger (XRPL). This growing use case with tokenized gold attracts attention from institutional investors and financial institutions. As XRP becomes key to this new wave of blockchain innovation, demand for the token is expected to increase, leading to higher valuations.

The idea of tokenizing RWAs on the XRPL is gaining traction within the crypto community. An endorser of this vision, “All Things XRP,” explained in a series of tweets how tokenized gold could drive demand for XRP.

2/ Gold on the Blockchain = More Demand for XRP

Imagine buying and selling tokenized gold on the XRPL. Every trade, every transfer—what's needed?

💡 XRP as a bridge currency.

Institutions and traders will need XRP for liquidity, driving demand up and circulating supply down.

— All Things XRP (@XRP_investing) March 11, 2025

Tokenizing traditional assets like gold makes trading more efficient and secure, which could position the XRP Ledger as the leading platform for such digital assets. As market participants buy and sell tokenized gold on the XRPL, XRP would act as the bridge currency for transactions, increasing liquidity and demand for the cryptocurrency.

Additionally, Ripple, the company behind XRP, is already making moves in the tokenization space. Last year, according to our previous post , Ripple expanded its partnership with Archax to bring RWAs to the XRPL. The effort is part of Ripple’s broader strategy to tokenize assets, with Ripple aiming to bring hundreds of millions of dollars’ worth of RWAs to the network.

Moreover, RippleX, Ripple’s development arm , has teamed up with Zoniqx to expand the tokenization of multiple assets on the XRPL. These partnerships underscore Ripple’s commitment to positioning the XRP Ledger as a leader in tokenizing real-world assets.

More Liquidity Expected for XRP

The tokenization of assets such as gold is likely to attract major institutional players, including banks and asset managers. These entities will require XRP to facilitate transactions, which could create a positive feedback loop that strengthens the XRP network.

The increase in liquidity is expected to drive demand for XRP, possibly leading to a surge in its price. The growing institutional adoption of the XRPL and XRP for cross-border transactions via Ripple’s On-Demand Liquidity service further strengthens the possibility for increased demand.

XRP Price Trends and Market Sentiment

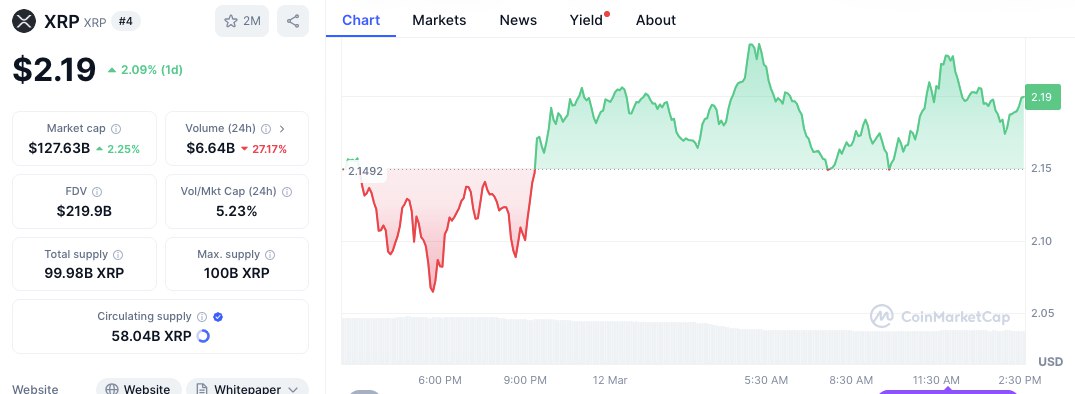

Currently priced at $2.19, XRP has increased by 2.09% over the past 24 hours. Its market capitalization stands at $127.63 billion, reflecting a 2.25% gain. Despite this price movement, the trading volume has declined by 27.17%, showing lower trading activity.

Source: CoinMarketCap

Source: CoinMarketCap

Additionally, XRP’s price movement is currently determined by technical indicators like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD). The RSI stands at 44.23, indicating a neutral market with no clear buyer or seller dominance. A rise above 50 could signal bullish momentum, while a drop below 40 may suggest bearish pressure.

Source: TradingView

Source: TradingView

Similarly, the MACD is in negative territory, indicating a bearish trend, although green bars on the histogram suggest that momentum could be shifting upward. If the MACD line crosses above the signal line, it could signal a bullish reversal, contributing to XRP’s potential price surge.