JPMorgan Chase, Goldman Sachs Abruptly Raise Recession Odds As ‘Bond King’ Says Macro Setup Could Trigger Decades of US Capital Flight: Report

Two Wall Street giants say the US now faces a greater risk of economic contraction amid a deteriorating macroeconomic backdrop.

JPMorgan Chase is raising its recession forecast for the US economy from 30% at the start of 2025 to 40% due to the uncertainty brought by President Trump’s directives including his trade war against China, Canada and Mexico, reports the Wall Street Journal.

Says JPMorgan economists,

“We see a material risk that the US falls into recession this year owing to extreme US policies.”

Analysts at Goldman Sachs also believe the odds of a US economic downturn are on the rise, raising its 12-month recession probability forecast from 15% to 20% as Trump continues to be “committed to its policies even in the face of much worse data.”

The news comes as billionaire “Bond King” Jeffrey Gundlach warns capital flight could hit US markets for years to come. In a webcast presentation, the founder and CEO of investment firm DoubleLine Capital LP says Europe may drain capital from US markets as the region looks to revive industrial production.

“Net investment into the United States: from about $3 trillion years ago to more than $20 trillion. That helps the US outperform ex-US markets.

With European countries needing to re-industrialize, that could lead to these flows to reverse. That could mean years, maybe decades, of European stock outperformance vs. US stocks.”

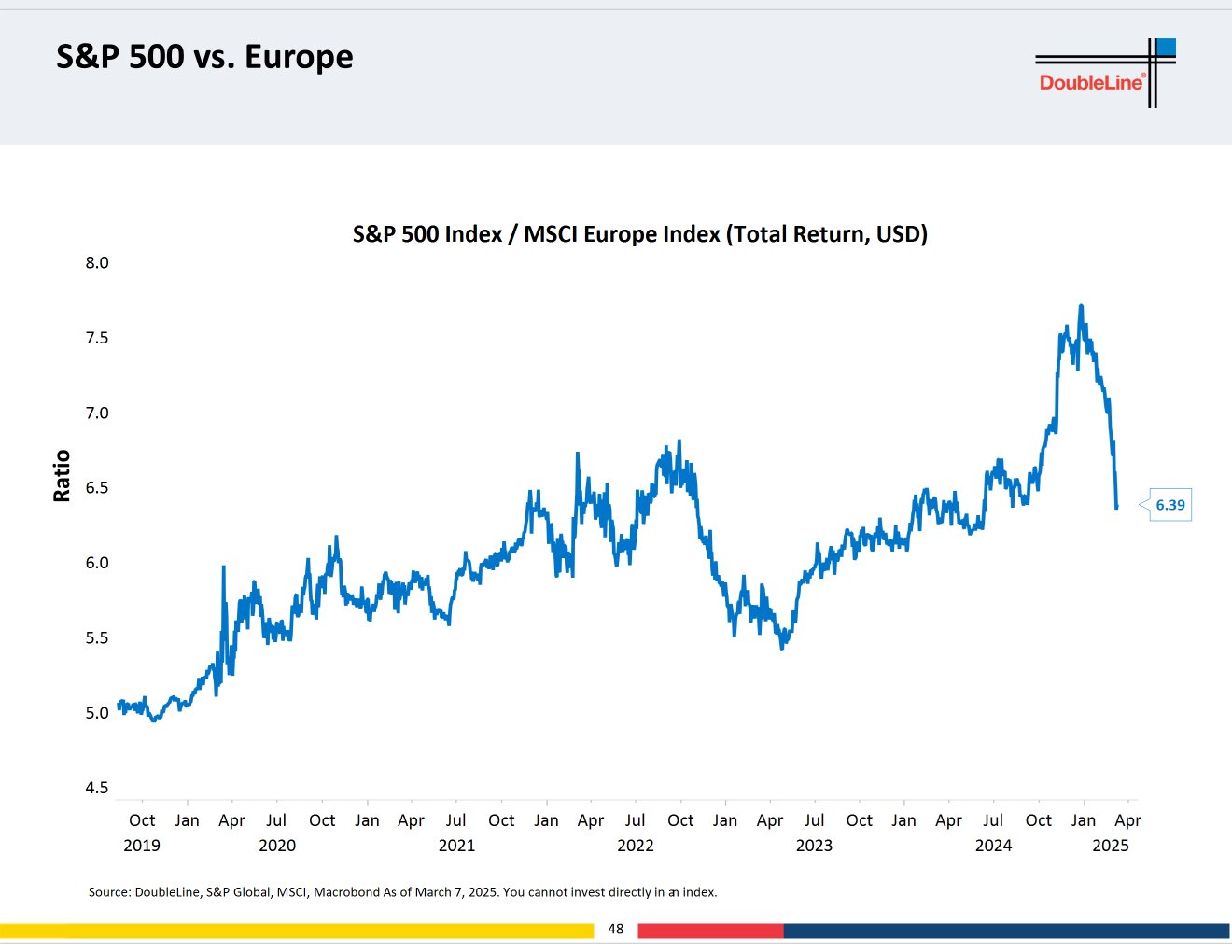

According to Gundlach, we are now seeing signs that European equities are beginning to outperform the S&P 500.

“US stocks vs. Europe have dropped almost to 2021 levels.”

Source: DoubleLine Capital/X

Follow us on X , Facebook and Telegram

Source: DoubleLine Capital/X

Follow us on X , Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget to support loan and margin functions for select assets in unified account

[Initial Listing] Camp Network (CAMP) will be listed in Bitget Innovation and Public Chain Zone

XPLUSDT now launched for pre-market futures trading

Announcement on Bitget listing AAPL, GOOGL, AMZN, META, MCD RWA Index perpetual futures