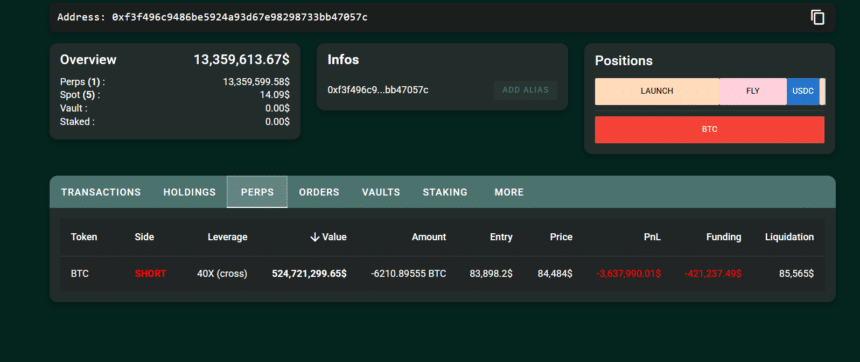

The famous yet anonymous Hyperliquid Whale has set abuzz in the crypto community with increasing its short position on Bitcoin, now its total position size amounting to $524 million.

Earlier today, the position was totaling nearly $430 million but the whale has added more funds of approximately $100 million and increased their trade size.

As per Hypurrscan, the whale has shorted Bitcoin on 40X leverage while using approximately $13 million in margin. They currently have an average entry at $83,898 while liquidation price at $85,565, which is merely $1,000 away from the current Bitcoin price.

Hyperliquid Trader’s $524M Short BTC Position | Source: Hypurrscan

Hyperliquid Trader’s $524M Short BTC Position | Source: Hypurrscan

At the time of writing, Bitcoin price is trading near $84,500 and a quick spike above $85,565 would wipe out this whole short position and the trader would be left with no funds. The trader is currently $3.9 million in loss while having paid $423k in funding fees.

The discussions around this massive short position has stirred a trend within crypto communities with many speculating about its implications. Some analysts believe that this could be a hedge against a large BTC holding, while others suggest that the trader anticipates a sharp correction due to over-leveraged positions in the current market.

While most people are skeptical of this trade, a popular trader and analyst known as Martini Guy, notes that the whale is not dumb and they might be holding even larger positions on centralized exchanges that users can’t see.

“He knows a bunch of people will buy to try and liquidate him. I would expect he has a much larger long position on the exchanges that you can’t see. Whales aren’t dumb,” he said.

Bitcoin has been witnessing increased volatility in recent weeks with traders closely monitoring its price action. Now this $524 million short bet is adding even more selling pressure while possibly triggering liquidation if Bitcoin pumps with sharp spikes before U.S. market closing.