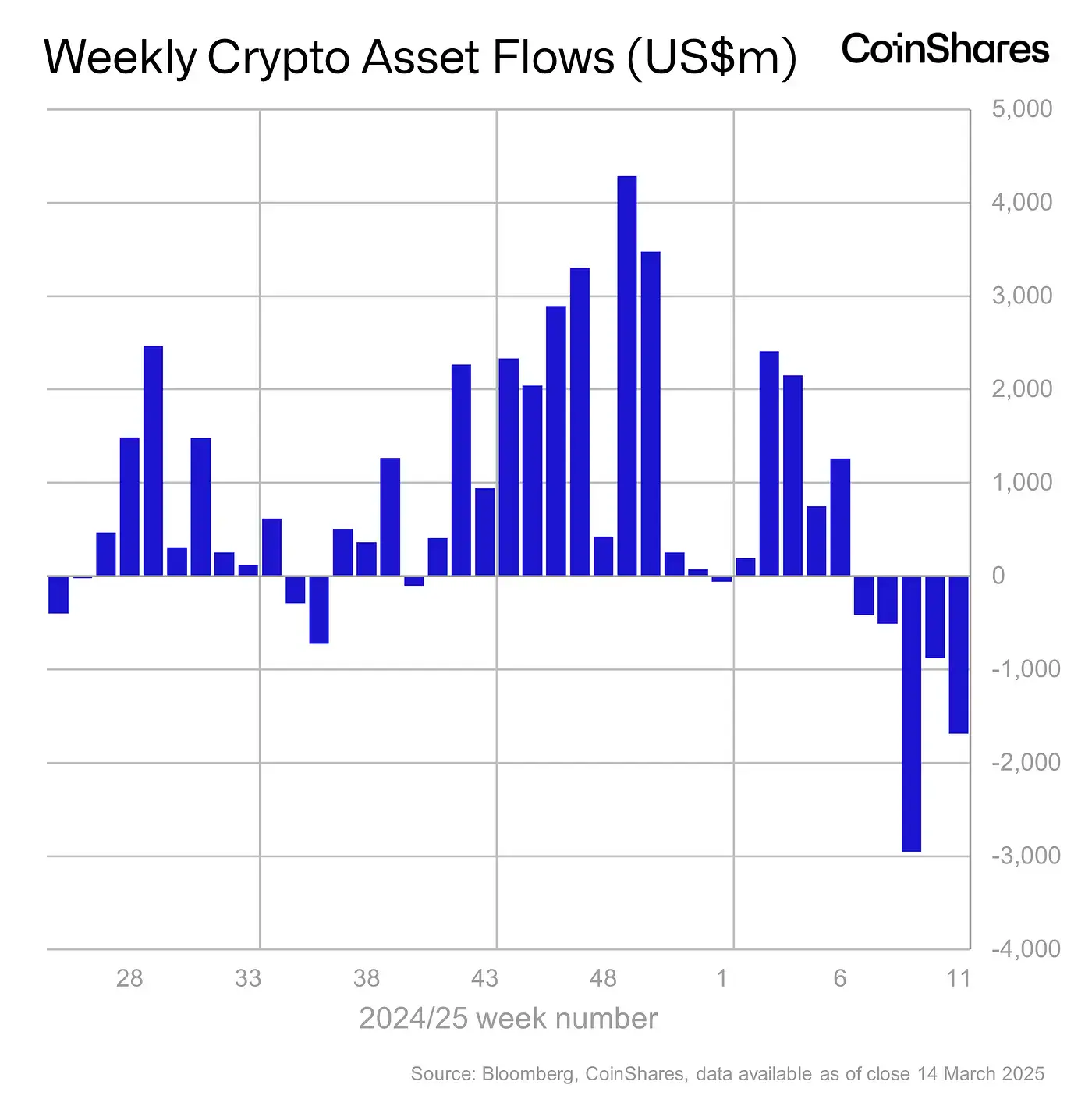

Crypto investment products recorded its worst outflow streak on record with digital asset funds seeing another $1.7 billion exit last week, extending a five-week sell-off that now totals $6.4 billion.

According to Coinshares, the current run marks 17 consecutive days of net outflows, an unprecedented stretch since records began in 2015. Despite the downturn, year-to-date flows remain in the green with $912 million in net inflows. Still, the recent correction has wiped out $48 billion from total assets under management (AuM) across crypto investment products.

The U.S. remains the epicenter of this pullback, contributing $1.16 billion, approximately 93% of last week’s total outflows. Switzerland also saw heavy losses of $528 million. However, Germany bucked the broader trend slightly, bringing in $8 million in inflows.

Bitcoin products were hit hardest, with $978 million in weekly outflows, adding to a five-week total of $5.4 billion. Short-bitcoin positions also declined, shedding $3.6 million.

Ethereum and Solana investment products weren’t spared, posting $175 million and $2.2 million in outflows, respectively. Notably, XRP continued to attract capital, bringing in $1.8 million in fresh inflows. Blockchain equities also struggled, losing $40 million over the week.

While investor sentiment remains cautious, assets like XRP are showing resilience amid the turbulence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。