Solana’s market activity keeps growing as the key indicators signal a possible breakout. The increasing network circulation, reliable technical evidence and increasing investor optimism support this positive outlook.

Analysts also predict that Solana price faces short-term resistance at $140 with potential for a run-up to $178.

Solana Receives $314 Million

Solana has recorded a significant influx of assets bridged from Ethereum, reaching $314 million in the last 30 days. This recorded 463% higher than Ethereum layer-2 platforms.

The increasing volume of bridged assets increases Solana’s Total Value Locked (TVL) and the associated liquidity creating a positive price signal.

Additionally, higher liquidity usually increases the number of investors which in turn increases the chances of the bulls. Analysts believe the continued migration of assets signals growing trust in Solana’s ecosystem.

Consequently, some market participants believed that this is a change in dominance, as Solana is gaining more supremacy over Ethereum in the DeFi market.

Technical Indicators Point to a Potential $178 Target

Solana price is currently at $ 129, and the technical analysis suggests an upward trend. The 20-day EMA stands as a key level where a breakout above this level is expected to alleviate selling pressure.

If Solana clears this hurdle, analysts expect a push toward the 50-day simple moving average (SMA), where resistance is projected near $178.

However, if it does not sustain its bullish run and breaks down to the $120 region, SOL price could plunge downwards to a deeper correction.

Key support levels exist around $110 and $90, which could provide strong buying interest in case of a downturn. A cup and handle formation which has taken several months signifies that the price target can reach up to $3,800 in case of continuous bullish run.

Solana’s Fifth Anniversary Sparks Market Excitement

Solana’s ecosystem is still lively as the network celebrates its fifth anniversary. This aligns with growth in development activity and new players across both DeFi and NFTs from institutional and retail investors.

Despite some fluctuations that have occurred recently, there is still a high level of optimism regarding the future growth. However, there is still confidence in the market since many investors expect further improvement in the future.

The rejection of the SIMD-0228 has not elicited any negativity as the voting on Solana showed efficiency in addressing governance issues. Further evolution of the network could mean the ability to handle transactions quickly and scale. This could in turn attract more liquidity and institutional investment.

SOL Targets $140 Before a Larger Breakout

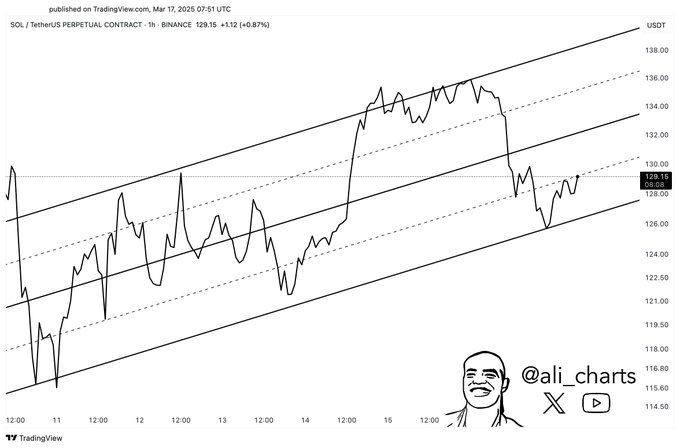

Additionally, Ali Martinez noted that Solana price may initially climb back to $140 before facing further resistance. His chart indicates that SOL price is in an ascending channel with support found at $126 and an upper boundary at $140.

Source: Ali Martinez, X

Source: Ali Martinez, X

Interestingly, if Solana price holds its position within this trend, a breakout will push the price up further supporting the bullish forecast. Investors are eagerly expecting a breakout above the channel’s resistance to push the price up towards the $178 mark.