Bakkt stock tumbles nearly 30% after losing Bank of America and Webull

Crypto firm Bakkt’s share price plummeted over 27% on March 18 after the company revealed that two of its largest clients, Bank of America and Webull, would not be renewing their commercial agreements.

In a March 17 regulatory filing , Bakkt said it had received notice of Bank of America not renewing its commercial agreement when the deal expires on April 22. It also disclosed that the brokerage platform Webull had also decided not to renew its agreement when it ends on June 14.

Bank of America represented 17% of Bakkt’s loyalty services revenue in the nine months ending Sept. 30, 2024, according to the filing. Webull represented 74% of the company’s crypto services revenue across the same period.

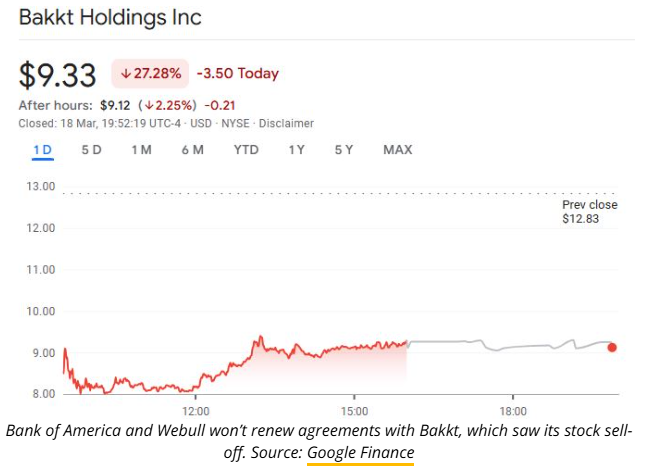

Stocks in Bakkt (BKKT) tumbled on March 18 after the filing, and its share price closed the day down 27.28% at $9.33. BKKT saw a further decline of 2.25% to $9.12 after the bell, according to Google Finance.

Overall, the stock is down over 96% from its all-time high of $1,063, which it hit on Oct. 29, 2021.

Bakkt has also postponed its previously announced earnings conference twice, with the latest reschedul ing slating the call for March 19.

Bakkt was founded in 2018 by the Intercontinental Exchange, which holds a 55% stake and also owns the New York Stock Exchange (NYSE).

At least one law firm, the Law Offices of Howard G. Smith, announced a possible class action against Bakkt, alleging federal securities violations. The potential lawsuit claims that the terminated agreements with Bank of America and Webull, combined with the rescheduled earnings call, caused Bakkt’s stock price to fall, “thereby injuring investors.”

Bakkt, Bank of America and Webull didn’t immediately respond to requests for comment.

In November last year, Bakkt’s share price jumped over 162% to $29.71 and continued to climb 16.4% to $34.59 after a report claimed Donald Trump’s media company was in advanced talks to acquire the firm.

Before that, Bakkt’s parent company considered selling it or breaking the firm into smaller entities in June, according to a Bloomberg report.

It also received a notification from the NYSE in March that it wasn’t in compliance with the stock exchange’s listing rules after its stock spent 30 days closing below $1 on average.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x LIVE: Trade futures to share 500,000 LIVE!

New spot margin trading pair — CAMP/USDT!

Announcement on Bitget listing MSTR, COIN, HOOD, DFDV RWA Index perpetual futures

Bitget to support loan and margin functions for select assets in unified account