From Aave to Hyperliquid: Are Token Buybacks the Next Big Evolution in Crypto?

The surge in crypto token buybacks aims to boost scarcity and investor confidence, but regulatory risks and liquidity concerns remain.

Many cryptocurrency projects such as Aave, dYdX, Jupiter, and Hyperliquid have recently announced token buyback mechanisms.

Traditional stock markets inspire the token buyback strategy. But does this strategy help crypto projects build a sustainable economic model and contribute to increasing the price of their tokens?

The Booming of Crypto Projects’ Token Buyback Programs

Token buybacks occur when crypto projects repurchase their tokens from the market. These repurchased tokens can be held as reserves or even burned. In theory, buybacks reduce circulating supply, creating scarcity, which may drive up token prices. Although not a new strategy, BeInCrypto has observed that this trend is rapidly expanding.

For example, in early March 2025, the lending protocol Aave (AAVE) announced the implementation of a new Aavenomics. Aave will repurchase tokens to reduce supply and shift from staking rewards to a more sustainable liquidity model. This included a weekly AAVE token buyback worth $1 million for six months, funded by protocol fees.

In an ideal scenario, this buyback plan could reach a total value of $100 million (3% of the circulating supply).

“We consider it the most important proposal in our history, feel free to have a read and provide feedback,” said Marc Zeller, founder of the Aave Chan Initiative (ACI).

Also in March, the decentralized exchange (DEX) dYdX approved “Proposal #225” to buy back DYDX tokens. The protocol will use platform revenue for the buyback.

Other crypto projects like Hyperliquid (HYPE) and Jupiter (JUP) have similar plans. Estimates suggest Hyperliquid will repurchase $600 million worth of tokens annually, using 50-100% of transaction fees. This protocol dominates decentralized finance (DeFi) despite the market downturn.

Jupiter has committed to using 50% of fees for buyback, estimated at $250 million annually. Recently, this project surpassed Raydium and became Solana’s second-largest protocol.

These are just a few of the most typical crypto projects. Many other projects, including Gnosis, Gains Network, and Arbitrum, employ similar strategies. So, could this reshape the current cryptocurrency market?

What’s Driving This Token Buyback Trend?

Discussing this buyback strategy, an X (formerly Twitter) user commented:

“Buybacks create steady demand and reduce circulating supply, which can stabilize or even increase token prices.” commented Capitanike.

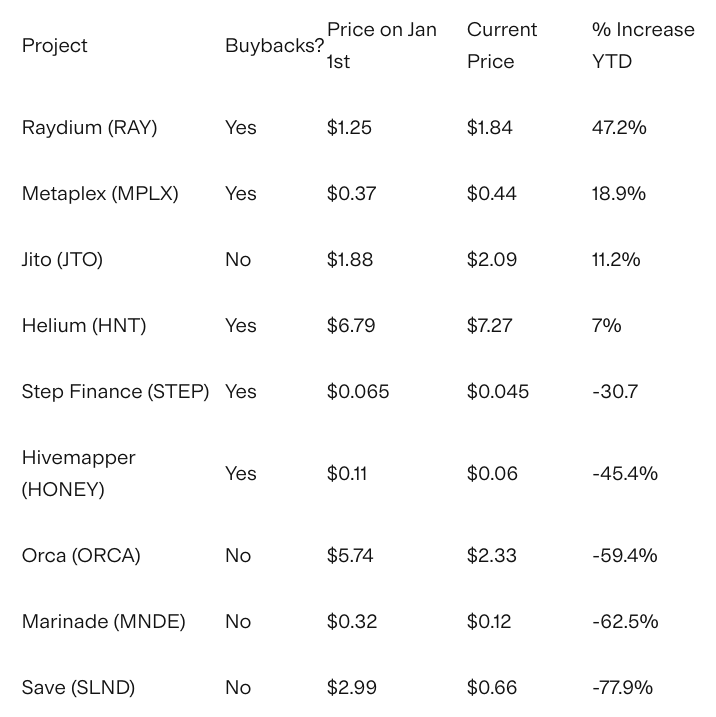

The fundamental economic principle of supply and demand is the key driver. By reducing circulating supply, crypto projects aim to increase token scarcity, which could push prices higher. According to SolanaFloor, projects with token buyback programs outperformed those without buybacks by 46.67% in 2024 (-0.6% vs. -47.15% YTD).

Performance of Projects with Token Buyback Programs Source:

SolanaFloor

Performance of Projects with Token Buyback Programs Source:

SolanaFloor

Secondly, the buyback can signal strong financial health for crypto projects. This is particularly effective in reassuring investors amid market volatility.

Thirdly, unlike the token burn strategy, many projects (such as AAVE and Gains Network) redistribute repurchased tokens to stakers or holders, aligning incentives. This approach could indicate the maturity of a project’s tokenomics model over time.

However, token buybacks are not without weaknesses. As this strategy becomes more widespread, regulators like the SEC may scrutinize it for potential manipulation or illicit activities.

Additionally, an improperly calculated buyback strategy could overly reduce token supply. If a project fails to balance new issuance or staking rewards, it might suffer from decreased trading volume. Moreover, buybacks could potentially mask financial weaknesses.

“What’s more plausible, in our opinion, is that these buybacks serve as proof that the projects raised too much during their ICO, are failing to develop anything useful, and don’t know what to do with their cash balances…” TokenData Research report.

The recent surge in crypto projects adopting token buybacks marks a significant evolution in tokenomics. While buybacks can enhance price stability, investor confidence, and ecosystem growth, they also carry manipulation risks and regulatory problems.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Brazil Set for First Bitcoin Reserve Hearing

Algeria Implements Full Ban on Cryptocurrencies

Japan’s FinTech Sector Could Triple by 2033