-

The SEC’s recent decision to discontinue legal actions against Ripple Labs represents a pivotal moment for XRP and the overall digital assets landscape.

-

This dismissal has not only accelerated XRP’s market performance but also catalyzed discussions about the future of cryptocurrency regulations in the U.S.

-

Ripple Labs’ CEO, Brad Garlinghouse, remarked, “This victory is a testament to the resilience of blockchain technology and its potential to reshape the financial system.”

The SEC’s dismissal of charges against Ripple Labs sparks renewed optimism for XRP and the crypto market, signaling potential partnerships and regulatory clarity.

The Ripple Effect: What this Means for XRP

The dismissal of the SEC lawsuit has led to a remarkable **12% surge** in XRP’s value, fueled by a significant increase in trading activity and bullish sentiment among investors. Technical indicators suggest strong buying momentum, with long-term moving averages pointing towards further accumulation opportunities.

Legal clarity has empowered Ripple Labs to explore new **strategic partnerships**, enhancing XRP’s use case in global payments. Notably, Michael Arrington noted on X that XRP has outperformed all major cryptocurrencies over the past 90 days, 180 days, and the last year.

Speculations concerning a potential collaboration between XRP and **SWIFT** also loom, suggesting that such a partnership could contribute to XRP’s long-term sustainability and adoption within traditional financial systems.

FOMC Insights: Analyzing the Impact of FED Decisions

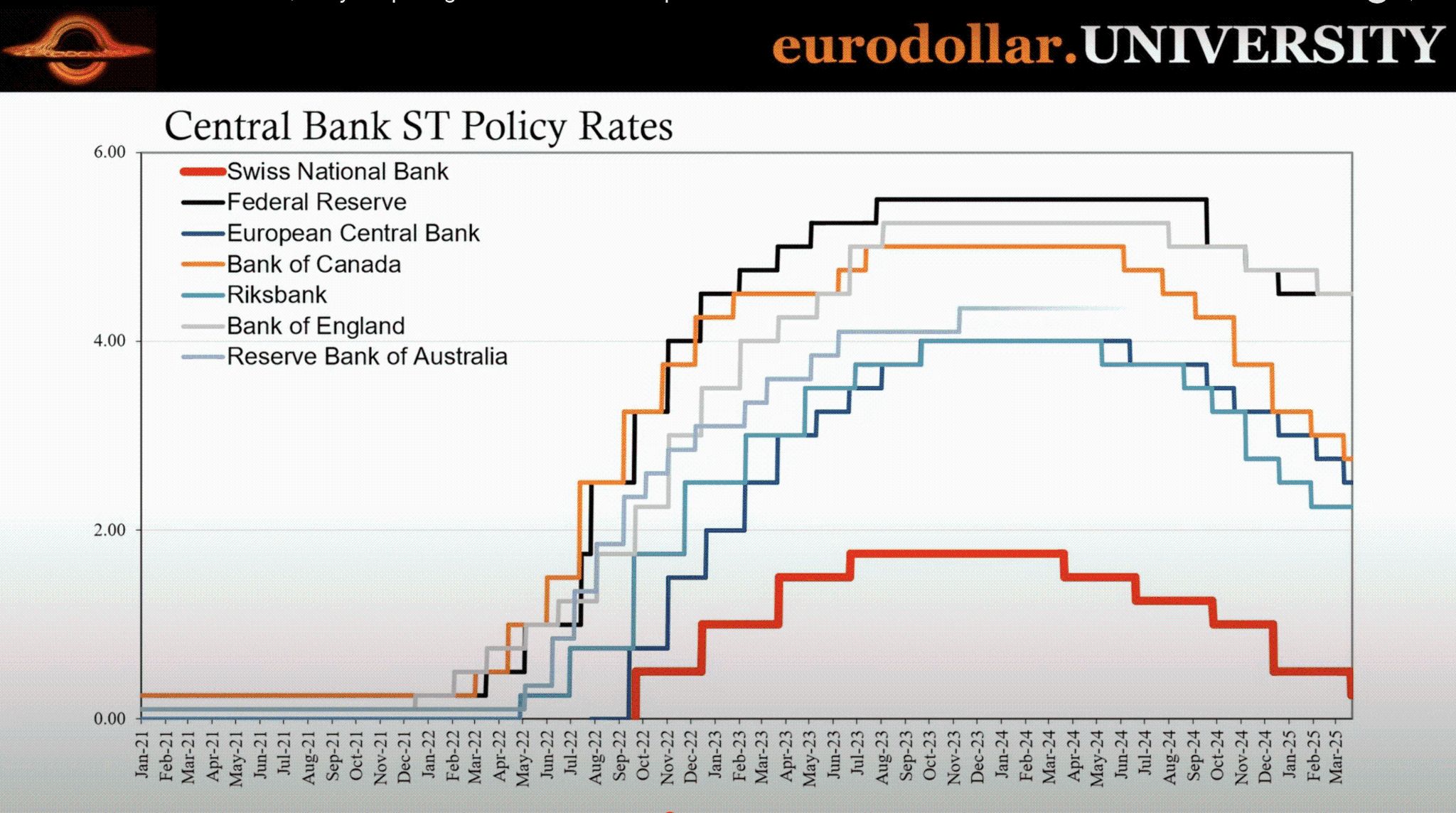

The recent FOMC meeting highlighted critical **economic projections**, stirring a national conversation about inflation and its implications for digital assets. Fed Chair Jerome Powell pointed out uncertainties around economic growth, prompting talks of potential rate adjustments amid rising inflation fears.

Justin Harts captured the sentiment well with his assertion on X: “Central Banks Are Quietly Prepping for Economic Collapse.” This commentary resonates with experts closely monitoring monetary policies as they impact cryptocurrency markets.

Source: X

Digital Assets as a Hedge Against Inflation

In the face of rising global economic uncertainties and renewed tariffs from the Trump administration, digital assets such as **Bitcoin** and **XRP** are increasingly viewed as potential hedges against inflation. Financial institutions are actively exploring **exchange-traded funds (ETFs)** as instruments to facilitate digital assets’ broader integration into traditional finance.

Growing public interest in cryptocurrencies is compelling governments to adopt clear, effective regulations for blockchain and digital assets. President Trump notably called on Congress to expedite legislation regarding stablecoins, emphasizing the need for regulatory clarity to foster innovation.

XRP’s newfound legal status enhances its potential role in international payments, effectively addressing concerns tied to inflationary pressures and economic volatility.

As the discourse around inflation and economic stability intensifies, XRP’s release from legal restrictions cements its position in federal monetary systems, enabling a focus on efficient cross-border transactions.

Conclusion

The SEC’s decision to drop charges against Ripple Labs represents a **transformative shift** for XRP and the cryptocurrency ecosystem. As regulatory landscapes evolve alongside market dynamics, XRP appears poised for new opportunities in collaborations and integrations within traditional finance. Moving forward, stakeholders in the digital asset space will closely monitor Ripple’s next moves and the potential impact of broader economic policies on this burgeoning market.