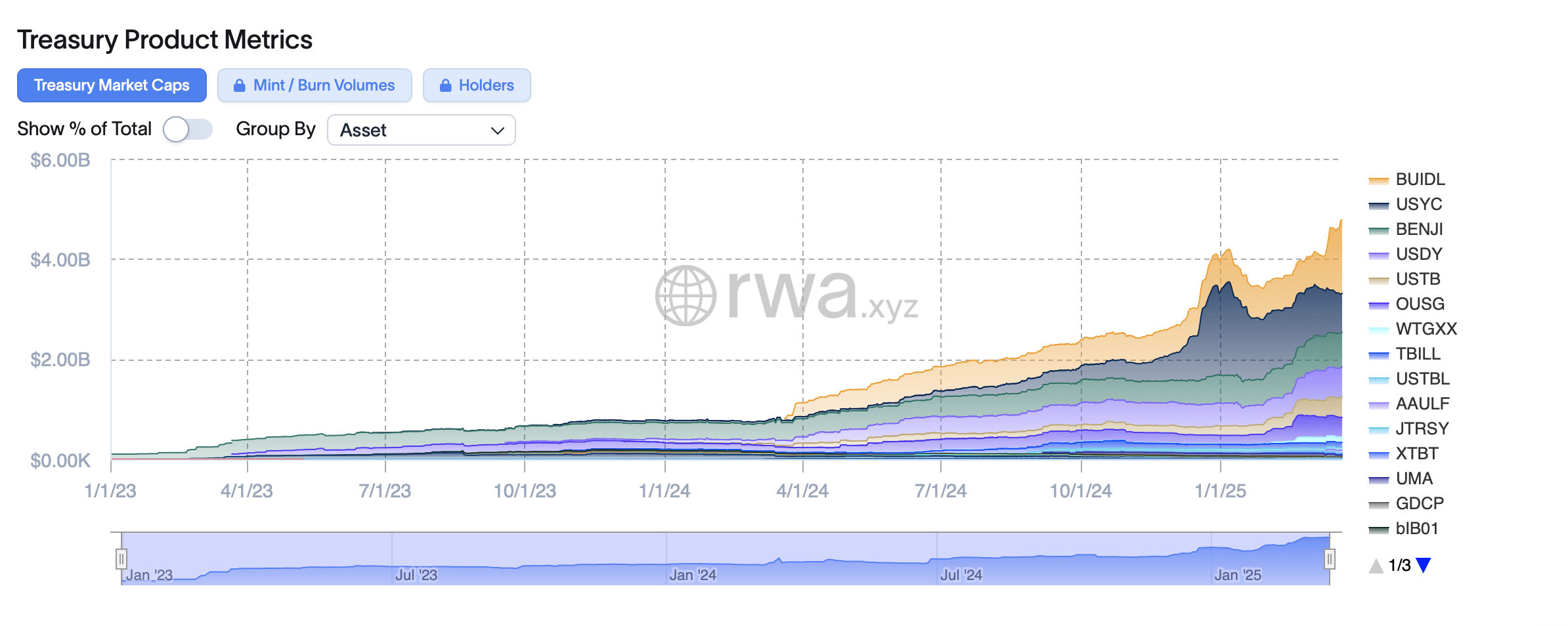

Tokenized Treasury funds have emerged as a pivotal force over the past year, experiencing a meteoric 566% rise in value. By March 2024, the market for these digitized Treasuries was around $716 million, a figure that has since soared to an impressive $4.77 billion. Notably, the sector has grown by $720 million since March 4, 2025, showcasing its accelerating momentum.

From March 2024 to now, tokenized Treasuries have experienced a meteoric 566% rise in growth over the past 12 months. Source: rwa.xyz

Much of this recent expansion can be credited to the influence of Blackrock’s BUIDL, issued by Securitize, which has become a cornerstone of this transformative trend. Eight days ago, Bitcoin.com News highlighted BUIDL’s milestone of breaching the $1 billion threshold, with the fund’s holdings pegged at $1.004 billion. Fast forward to March 22, and the fund’s value has climbed to $1.467 billion, reflecting a substantial $463 million uptick.

In the runner-up position, Hashnote’s Short Duration Yield Coin (USYC) fund boasted $868 million in assets under management (AUM) eight days ago, but has since experienced an $84 million reduction. As of this weekend, USYC’s AUM hovers around $784 million. Meanwhile, Franklin Templeton’s Onchain U.S. Government Money Fund has remained steady since our March 14 report, showing no fluctuations.

On a broader note, March has also brought growth to Ondo’s U.S. Dollar Yield (USDY) and Superstate’s Short Duration U.S. Government Securities Fund (USTB), adding further dynamism to the sector. Ondo’s fund grew from $563 million to $593 million and Superstate’s USTB swelled from $310 million to $393 million. Blockchain’s ability to streamline settlement and redemption processes has magnetized a growing influx of capital into this sector, a trend that shows no signs of slowing down.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。