- Ripple CTO David Schwartz criticizes the IMF’s classification of utility tokens as a security.

- Schwartz argues that Bitcoin should also be classified as utility tokens under the IMF’s definition.

- The debate over XRP’s classification comes amid Ripple’s ongoing legal battle with the SEC.

Ripple’s Chief Technology Officer, David Schwartz, has come out strongly against claims suggesting that XRP should be classified as a security under the International Monetary Fund’s (IMF) definition of utility tokens.

The IMF recently released the seventh edition of its Balance of Payments and International Investment Manual (BPM7). This latest version is a significant update, being the first revision since 2009, and notably incorporates the growing role of cryptocurrencies in the global economy.

However, in this update, the IMF’s attempt to categorize these digital assets has sparked controversy, especially concerning XRP.

Related: XRP Not a Security: Ripple Celebrates Landmark Ruling, Warns of SEC Overreach

How Does the IMF Classify Crypto Like XRP?

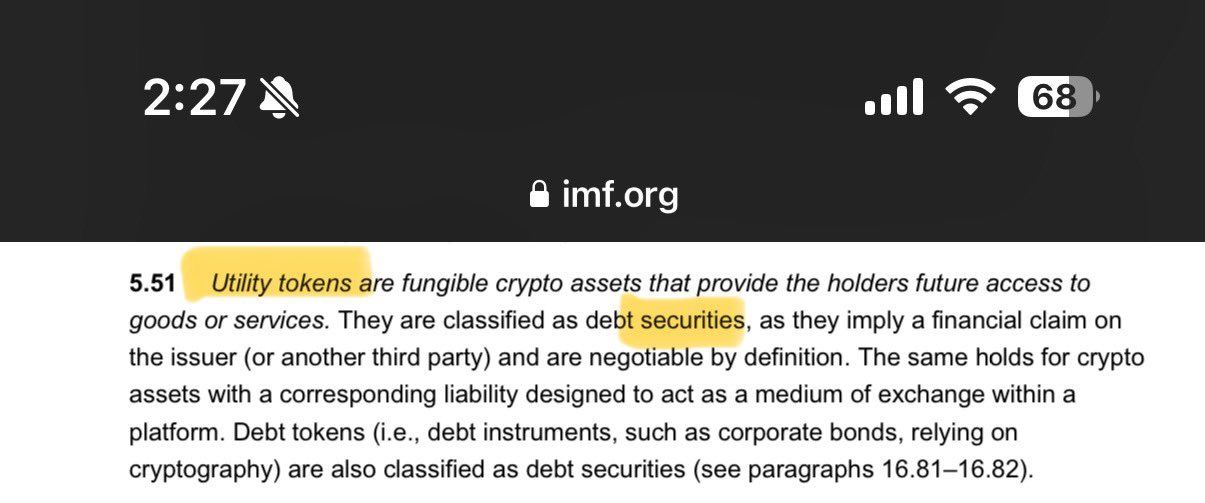

Under this newly updated framework, the IMF classifies crypto assets by whether they create a financial claim or liability on the issuer. In this context, the IMF states that utility tokens, which include many altcoins, provide future access to goods or services and therefore should be classified as “debt securities.”

This classification made some humorously predict that XRP could soon be permanently listed as a security.

Interestingly, the IMF’s approach to categorizing utility tokens could potentially classify not only XRP but also other leading cryptocurrencies like Ethereum and Solana as “debt securities.”

Ripple’s CTO Disagree with the IMF’s Classification

However, Ripple’s CTO, David Schwartz, doesn’t agree with this line of reasoning. He argued that if XRP fits this definition, then other major cryptocurrencies, such as Bitcoin and Ethereum, should also fall under the same category.

“If XRP is a utility token or a security according to the IMF’s criteria because it can be used for future transaction fees, then Bitcoin and Ethereum should also be classified the same way,” Schwartz argued.

Moreover, Ripple’s CTO also pointed out that, in his opinion, no major token really fits the IMF’s definition of a utility token. “I’m not sure what major token, if any, would be an example of that,” he said .

This debate over XRP’s classification comes at a crucial time. Ripple is nearing the end of its ongoing legal battle, where the status of XRP was at the center of the dispute.

Related: Ripple’s SEC Victory: Appeal Dropped, But SEC Silence Leaves “Officially Over?” Question Hanging

Back in 2020, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Ripple, alleging that the company’s sale of XRP violated securities laws.

However, in 2023, District Judge Analisa Torres ruled that Ripple’s sales of XRP to the general public did not qualify as securities transactions. She did, however, find that the firm’s direct sales to institutional investors did violate securities regulations.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.