Crypto Products Break Drought With $644,000,000 in Weekly Inflows: CoinShares

Crypto asset manager and research firm CoinShares says institutional investors poured millions of dollars into digital asset investment vehicles last week.

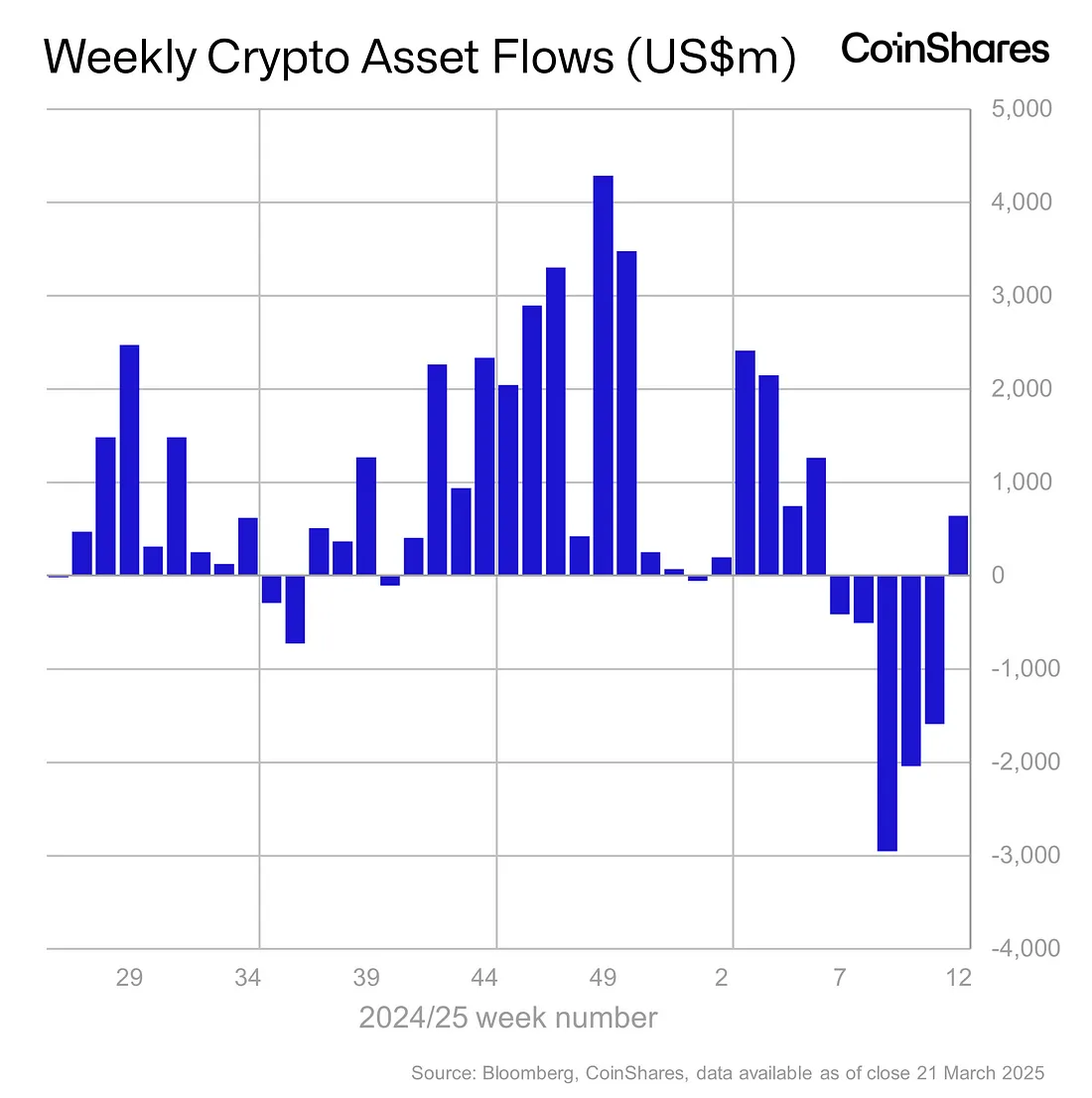

In its latest Digital Asset Fund Flows Weekly Report, CoinShares says crypto products finally snapped their worst run of investor outflows in 10 years.

“Digital asset investment products saw a reversal last week, breaking a five-week streak of outflows, with inflows totaling US$644m. Total assets under management have risen by 6.3% from their low point on March 10th.

Notably, every day last week recorded inflows, following a 17-day consecutive run of outflows — signaling a decisive shift in sentiment toward the asset class.”

Source: CoinShares

Source: CoinShares

The United States provided the majority of inflows at $632 million. However, the US wasn’t alone in pouring money into crypto investment vehicles. Switzerland, Germany and Hong Kong also raked in $16 million, $14 million, and $1.2 million in crypto inflows, respectively.

Bitcoin ( BTC ), as is its custom, enjoyed the majority of inflows at $724 million. This ended a five-week outflow streak, adding up to nearly $5.5 billion.

Solana ( SOL ), Polygon ( MATIC ) and Chainlink ( LINK ) investment vehicles saw inflows of $6.4 million, $0.4 million, and $0.2 million, respectively.

Meanwhile, Ethereum ( ETH ), Sui , Polkadot ( DOT ), Tron ( TRX ) and Algorand ( ALGO ) products suffered $86 million, $1.3 million, $1.3 million, $0.95 million, and $0.82 million in outflows, respectively.

Follow us on X , Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Featured Image: Shutterstock/Sagi Agung W/Mingirov Yuriy

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List DePHY (PHY). Come and grab a share of 6,600,000 PHY

New spot margin trading pair — ES/USDT!

Bitget Trading Club Championship (Phase 1) – Make spot trades daily to share 50,000 BGB

SLPUSDT now launched for futures trading and trading bots