-

Bitcoin’s recent bullish breakout is fueled by strong ETF inflows and accumulating Long-Term Holders (LTHs), highlighting renewed market confidence.

-

Recent trends indicate a surge in Spot ETF inflows, reflecting a positive sentiment among institutional investors as they re-enter the market.

-

“The return of ETF inflows is a strong indication that large investors are regaining faith in Bitcoin’s potential,” says a market analyst from COINOTAG.

Bitcoin’s bullish trend is supported by increased ETF inflows and LTH accumulation, indicating strong market confidence. Could new heights be ahead?

Investors Reinstate Confidence Through ETF Inflows

Recent data reveals a positive shift in investor behavior marked by significant inflows into Bitcoin Spot ETFs, breaking a month-long trend of outflows. This resurgence is particularly noteworthy as institutions are regaining confidence in Bitcoin, aiming to integrate it into their portfolios for diversification. The renewed institutional interest, highlighted by the first positive net flow in weeks, suggests that Bitcoin could be on the verge of a major upward movement.

The Impact of Long-Term Holders on Price Dynamics

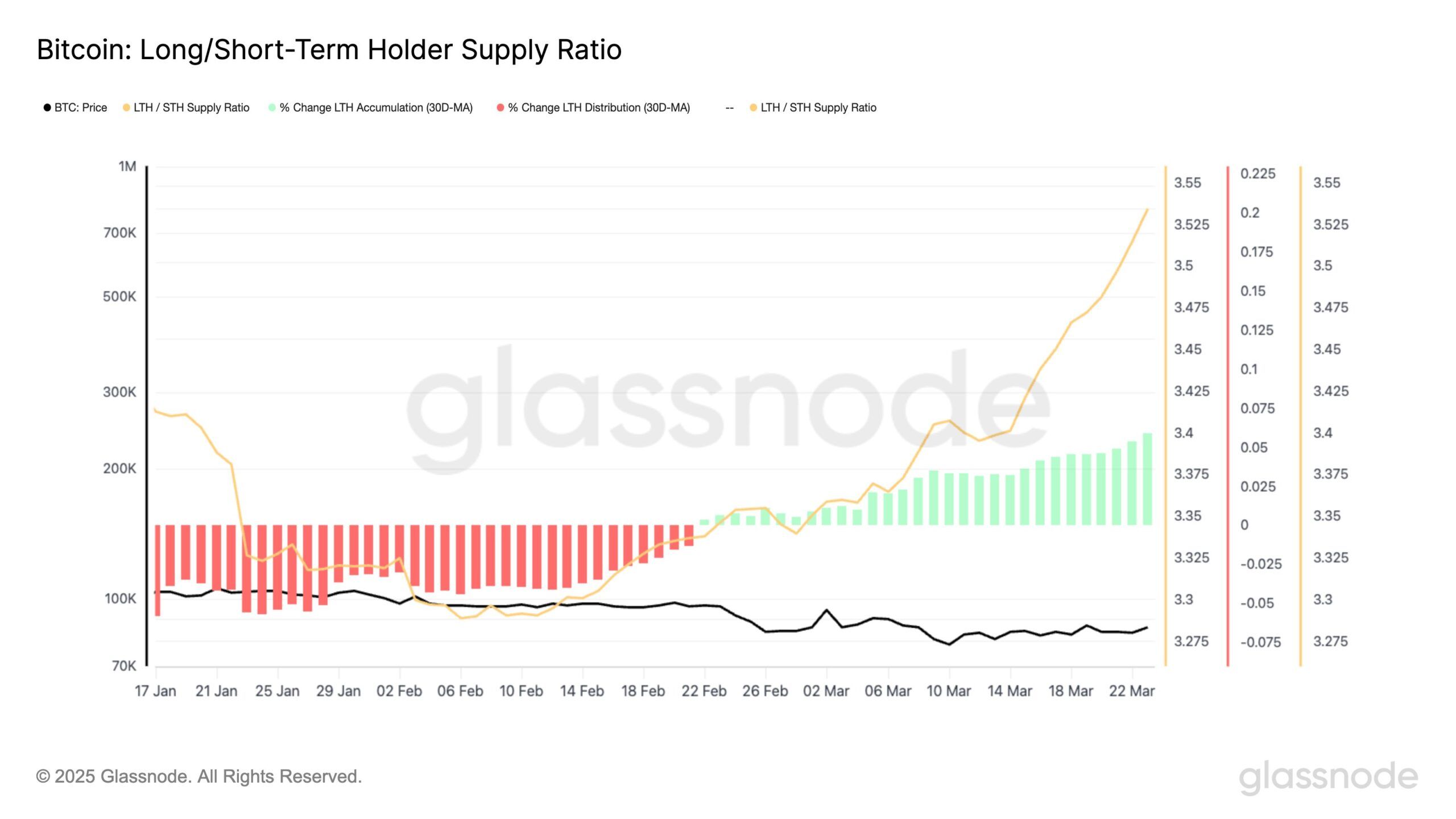

Moreover, the Long-Term Holder (LTH) dynamics illustrate a robust pattern of accumulation. Since February, the LTHs have contributed significantly to the stability and upward potential of Bitcoin’s price. The consistent increase in the LTH accumulation rate, nearing 6%, implies a strong belief among seasoned investors in Bitcoin’s long-term viability. This behavior serves as a stabilizing force, potentially underpinning Bitcoin’s ascent amidst market volatility.

Bitcoin Long/Short-Term Holder Supply Ratio. Source: Glassnode

Key Price Levels to Monitor

As Bitcoin trades around $86,630, it finds itself at a critical juncture. Securing the support at $86,822 is pivotal for maintaining bullish momentum. Analysts suggest that if Bitcoin can hold above this level, reaching the significant resistance of $89,800 will be the next challenge. Breaking through this point could pave the way for further gains toward $93,625 and then potentially targeting $95,000.

Bitcoin Price Analysis. Source: TradingView

Potential Market Challenges Ahead

However, it’s crucial to note that failing to break the $89,800 resistance could lead to a pullback. If Bitcoin struggles to maintain its recent gains and falls below $85,000, it might indicate a shift in market sentiment towards caution. Such a scenario could result in prolonged consolidation and uncertainty in the market, as traders await clearer signals of a sustained rally.

Conclusion

The current market dynamics suggest an optimistic outlook for Bitcoin, driven by institutional interest and sustained accumulation from Long-Term Holders. With critical resistance levels closely monitored, the potential for significant price movement remains. As investors remain vigilant, it is essential to keep an eye on these metrics to gauge the future trajectory of Bitcoin.