Maker (MKR) Jumps 11%, Reaches Weekly Peak Amid Rising On-Chain Activity

MKR's recent surge to a seven-day high suggests renewed bullish momentum, supported by a spike in active addresses and growing investor interest. MKR could target $1,780 if demand persists, turning recent resistance into support.

MakerDAO’s governance token, MKR, has posted double-digit gains in the past 24 hours, making it the market’s top performer. The surge propelled MKR to a seven-day high of $1,485, where it traded briefly during Thursday’s early Asian hours.

This signals a renewed bullish momentum for the altcoin and hints at a potential sustained rally.

MKR Demand Strengthens as Market Sees Renewed Investor Interest

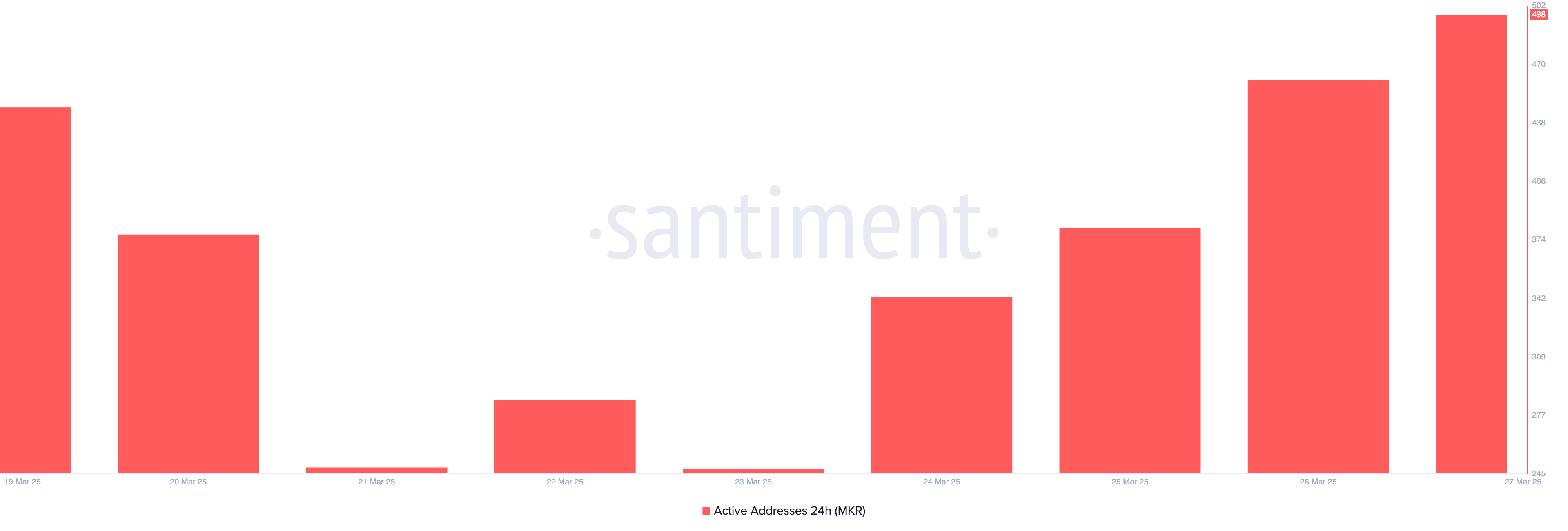

On-chain data reveals a significant spike in MKR’s active address count over the past 24 hours, indicating increased trading activity and investor interest.

MKR Active Address. Source:

Santiment

MKR Active Address. Source:

Santiment

According to Santiment, MKR’s active address count has surged to a seven-day high of 498, marking an 8% increase in the past 24 hours. An uptick in an asset’s daily active address count suggests growing demand as more market participants engage in transactions.

As noted by MKR, the sudden spike in this metric indicates a resurgence in bullish bias toward the altcoin.

If sustained, MKR’s rising active addresses could strengthen the bullish pressure on its price, reinforce liquidity, and strengthen the asset’s overall market presence.

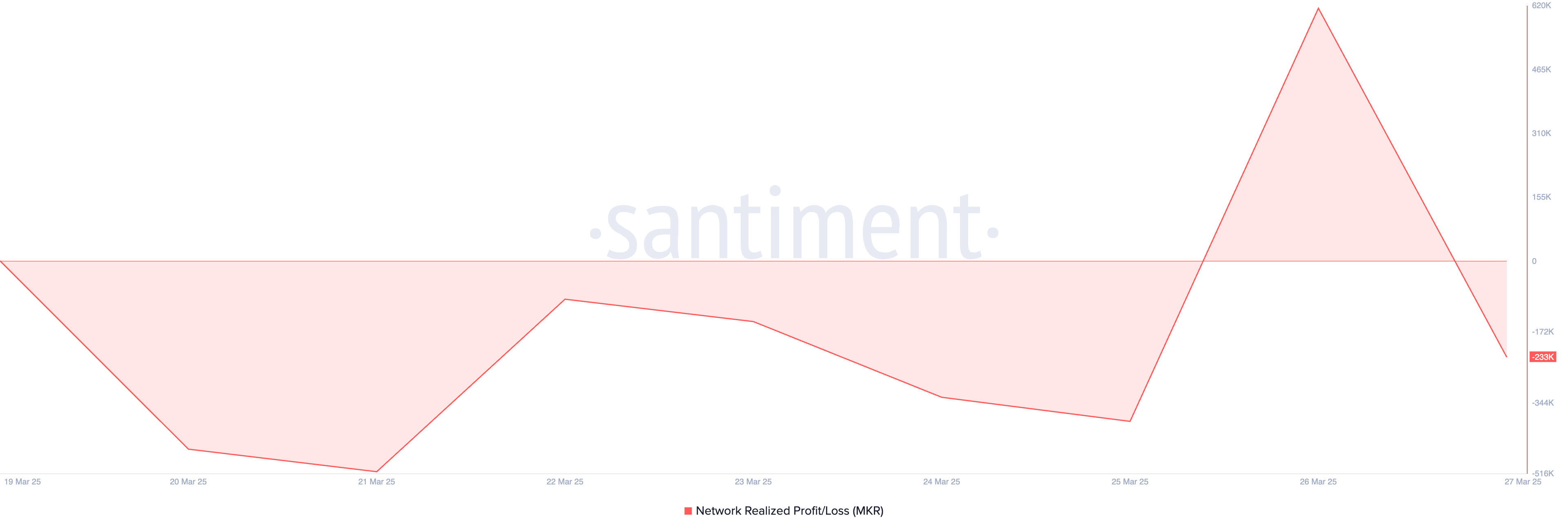

Additionally, the token’s Network Realized Profit/Loss (NPL) has turned negative, indicating that holders are less incentivized to sell at the current price levels as they hold at a loss. At press time, MKR’s NPL is in a downward trend at -233,000.

MKR NPL. Source:

Santiment

MKR NPL. Source:

Santiment

This metric measures investors’ total profit or loss when transferring their assets on-chain. A negative NPL, as seen with MKR, indicates that, on average, investors are selling at a loss.

If MKR’s NPL remains in negative territory, it could weaken selling pressure, as traders may hesitate to offload their holdings at a loss. This reluctance could create conditions for a sustained MKR rally.

MKR Turns Resistance Into Support—Is a Rally to $1,780 Next?

MKR has flipped the key resistance formed at $1,464 into a support floor. If demand strengthens, the bulls will consolidate their strength and attempt to prevent a price dip below this floor.

In that scenario, a strong buying pressure could propel MKR toward $1,780, a price high it last reached on February 27.

MKR Price Analysis. Source:

TradingView

MKR Price Analysis. Source:

TradingView

However, a resurgence in bearish bias toward MKR would invalidate this bullish outlook. In that scenario, the altcoin’s price could break below $1,466 and fall to $1,109.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List DePHY (PHY). Come and grab a share of 6,600,000 PHY

New spot margin trading pair — ES/USDT!

Bitget Trading Club Championship (Phase 1) – Make spot trades daily to share 50,000 BGB

SLPUSDT now launched for futures trading and trading bots