Pi Network Outlook: Bearish Pressure and Weak Demand Spells Trouble for PI

While PI has seen a slight uptick, bearish technical indicators signal that the token may face further losses, potentially dropping to $0.62 if key support levels fail.

PI has recorded a modest 1% gain in the past 24 hours, mirroring the broader market rally during that period.

However, despite this short-term uptick, key technical indicators suggest that the token remains under significant bearish pressure, with further losses on the horizon.

PI’s Buying Pressure Fades as Bearish Signals Dominate

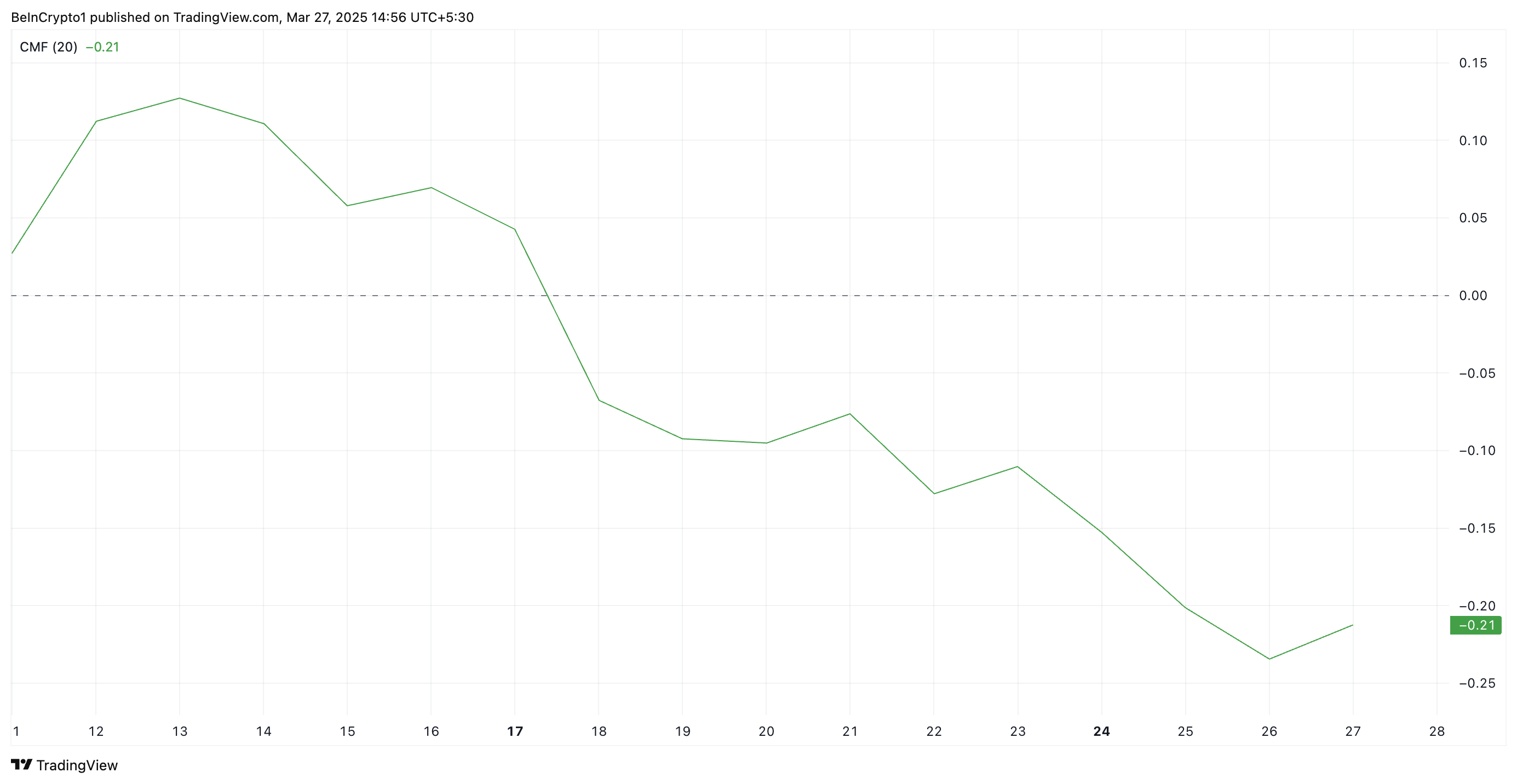

PI’s Chaikin Money Flow (CMF) has maintained a downward trend since March 14, reflecting the weak buying activity among market participants. At press time, the indicator, which tracks how money flows into and out of an asset, is below zero at -0.21.

PI CMF. Source:

TradingView

PI CMF. Source:

TradingView

When an asset’s CMF declines and falls below zero, it signals weakening buying pressure and increasing selling momentum. It indicates that capital is flowing out of PI as traders intensify profit-taking efforts, exacerbating its price decline.

The sustained drop below zero reinforces this bearish outlook and hints at further price declines as long as PI sellers remain dominant.

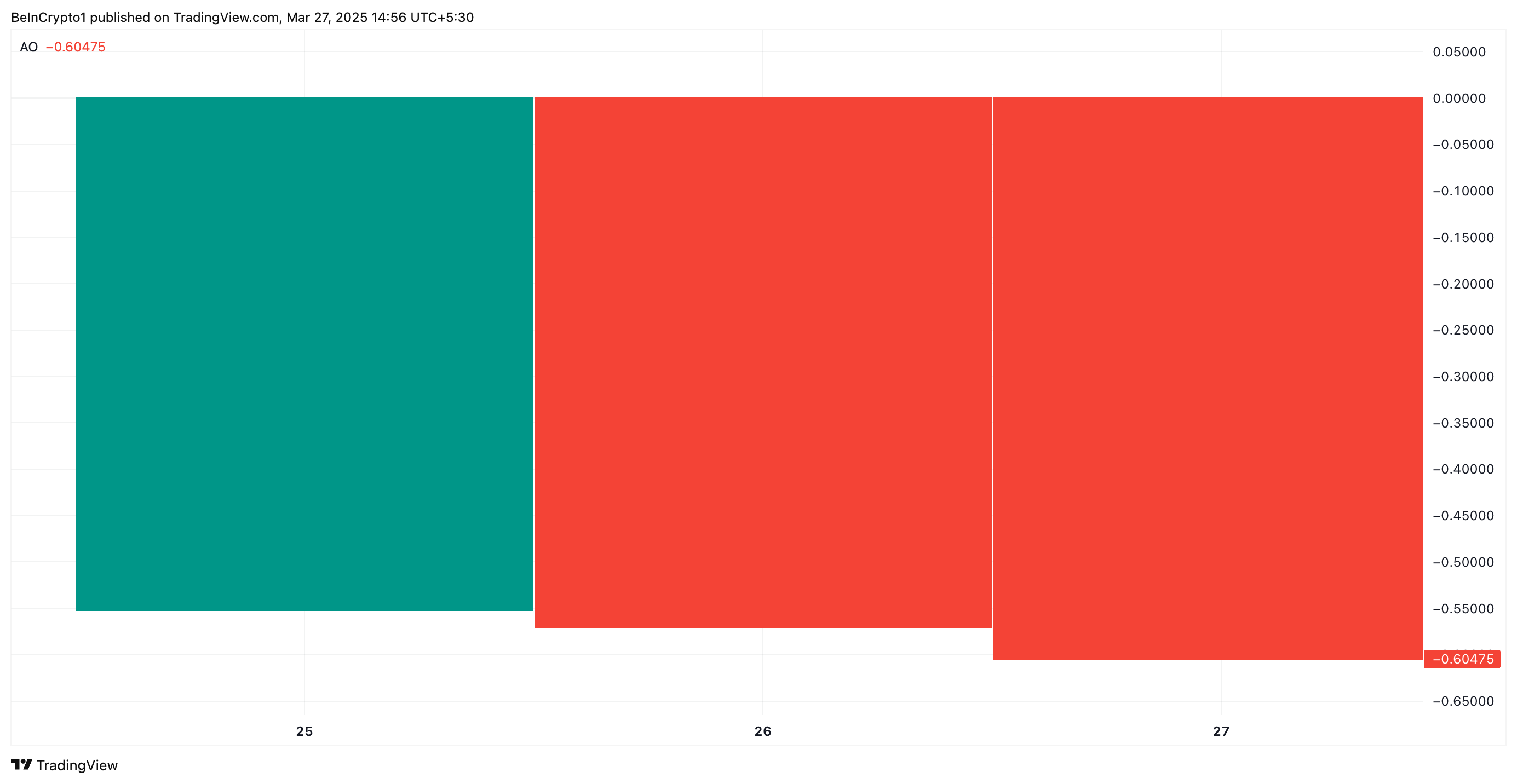

Further, PI’s Awesome Oscillator (AO) has returned a red histogram bar, with its value at -0.60. The indicator tracks short- and long-term moving averages to confirm or deny market trends. It helps traders assess whether bullish or bearish momentum is strengthening or weakening.

PI Awesome Oscillator. Source:

TradingView

PI Awesome Oscillator. Source:

TradingView

When the AO returns a red bar, the current histogram value is lower than the previous one, signaling an increase in bearish pressure. Traders use this as an early warning to exit long positions or prepare for a possible market reversal.

Multiple red bars are starting to appear consecutively on the PI/USD one-day chart, indicating that the buying strength in its spot markets is fading fast.

PI at Make-or-Break Level—Will It Plunge to $0.62?

PI continues to trade within its descending parallel channel as sellers strengthen their control. At press time, PI trades at $0.85, near the lower trend line of this channel, which forms a key support floor.

The channel emerges when an asset’s price moves between two downward-sloping parallel trendlines, indicating a sustained bearish trend. If the price is poised to break below the lower trendline, it signals intensified selling pressure and an acceleration of the downtrend, which could lead to further losses.

If PI breaks below this support floor, it would add more downward pressure on its price and could force it to drop to $0.62.

PI Price Analysis. Source:

TradingView

PI Price Analysis. Source:

TradingView

On the other hand, a bullish trend reversal would prevent this. If PI demand soars, its price could rally past $0.90.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List DePHY (PHY). Come and grab a share of 6,600,000 PHY

New spot margin trading pair — ES/USDT!

Bitget Trading Club Championship (Phase 1) – Make spot trades daily to share 50,000 BGB

SLPUSDT now launched for futures trading and trading bots