Matrixport: Liquidity indicators may struggle to accurately predict BTC trends. Attention should be paid to native crypto driving factors or policy impacts

According to Matrixport's analysis, there is a certain limitation in the correlation between the global liquidity rise and Bitcoin price increase. The global liquidity index measured by the total currency supply (standardized in US dollars) of 28 central banks, although visually related to Bitcoin price trends, its predictive accuracy is questioned due to non-stationarity of time series and scale differences.

The analysis points out that although an increase in money supply may have a lagging effect on the Bitcoin market, this lag time does not have strong theoretical support. In addition, while the correlation between Bitcoin and Nasdaq has slightly increased in recent years, it still remains below the peak of 60% during COVID period. This indicates that Bitcoin trading is more driven by its own rules rather than acting solely as a proxy asset for tech stocks.

Matrixport believes that broad consolidation of bitcoin prices may continue and relying solely on liquidity indicators to predict market trends might not be reliable enough. Instead, focusing on native driving factors of cryptocurrencies or macro variables with direct policy impacts (such as political leaders supporting cryptocurrencies) could be more valuable. Although there may be mathematical flaws in market perception, its wide acceptance can still potentially impact market behavior.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

An Early Bitcoin Holder Deposits 400 BTC into HyperLiquid and Purchases ETH on the Spot Market

CryptoQuant Analyst: Bitcoin Transfers Between $0 and $10,000 Drop to 0.6%

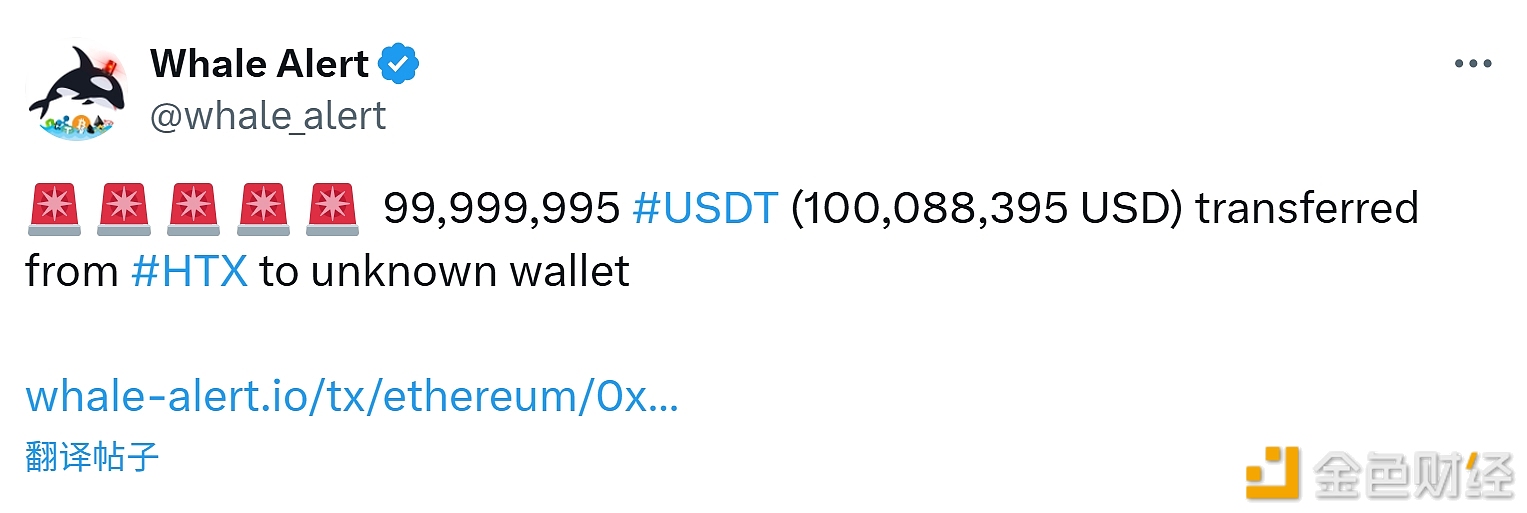

99,999,995 USDT Transferred from an Exchange to an Unknown Wallet