Inflows Hit 10-Day Streak For Bitcoin ETFs While Ether ETFs Struggle with Continued Exits

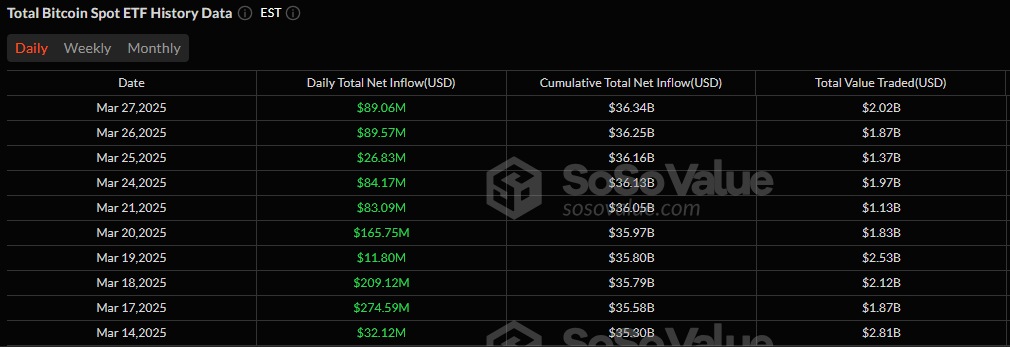

Bitcoin ETFs continued their upward trajectory, marking their tenth consecutive day of inflows with an $89.06 million boost.

Fidelity’s FBTC led the charge, contributing $97.14 million, while Blackrock’s IBIT added a modest $3.97 million. Despite these gains, outflows from Invesco’s BTCO ($6.95 million) and Wisdomtree’s BTCW ($5.09 million) partially offset the day’s total. Even so, total net assets for bitcoin ETFs climbed to $98.29 billion, maintaining their stronghold in the market.

Source: Sosovalue

Investor interest in bitcoin ETFs remained strong, with total trading volume surging to $2.02 billion. The momentum signals sustained confidence in BTC’s price stability and long-term potential.

Ether ETFs, on the other hand, faced continued selling pressure, with a $4.22 million outflow extending their downturn. Fidelity’s FETH saw a $2.01 million exit, while Vaneck’s ETHV lost $2.21 million. Trading volume stood at $142.47 million, with total net assets stabilizing at $6.8 billion.

As bitcoin ETFs maintain their winning streak, ether ETFs struggle to find support. With ten straight days of inflows, bitcoin continues to attract institutional capital, while ether’s recent trend suggests a lack of investor confidence in ETH.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。