Date: Sat, March 29, 2025 | 10:00 AM GMT

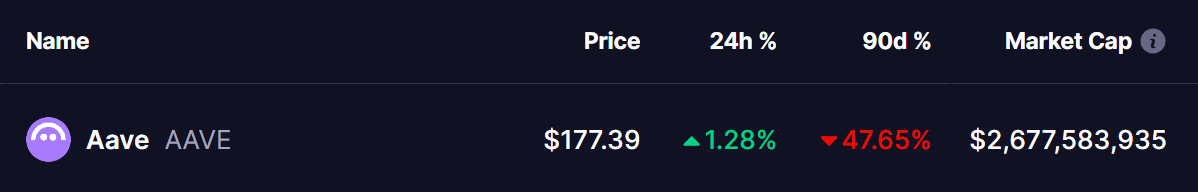

The cryptocurrency market is once again facing strong bearish pressure, wiping out the recovery gains made earlier this week. Ethereum (ETH) has dropped over 6% in the past 48 hours, falling below the $1,875 level. This downturn has affected most major altcoins , but despite the selling pressure, Aave (AAVE) has shown resilience and remains in the green.

However, AAVE has been undergoing a 90-day correction of 47%, pushing its price to test a crucial support level. Meanwhile, a key bullish technical setup is still intact, hinting at a potential reversal in the coming weeks.

Source: Coinmarketcap

Source: Coinmarketcap

Cup and Handle Pattern

On the weekly chart, AAVE has been forming a cup and handle pattern, a well-known bullish continuation setup that often precedes a strong breakout. The pattern began after AAVE faced rejection at $399 on December 9, leading to a correction phase. Now, the price has retraced to test its 50-day moving average (50 MA) at $175—a critical level (marked in the circled area on the chart).

AAVE Weekly Chart/

Coinsprobe (Source: Tradingview)

AAVE Weekly Chart/

Coinsprobe (Source: Tradingview)

If AAVE bounces back from this MA support and successfully breaks out of the handle formation, it could trigger a strong recovery toward the neckline resistance at $400—a potential upside of 122% from the current price.

The MACD is showing early signs of a potential trend reversal. The MACD line is turning upwards, suggesting bullish momentum could be building. Additionally, the shrinking histogram bars in the negative zone indicate that selling pressure is weakening. If a bullish crossover occurs, it may confirm a strong buy signal, supporting a price rebound.

Final Thoughts

A rebound from the 50 MA could trigger a recovery rally, but failure to hold this support may result in further downside. The next few weeks will be crucial, as a breakout from the handle formation could set the stage for a significant price surge.

Traders should closely monitor AAVE’s price action and BTC dominance, as Bitcoin’s trend could influence the overall market movement.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always conduct your own research before making any investment decisions.