Bitcoin Dominance Drops to 58.8% After Hitting 61.2% Peak

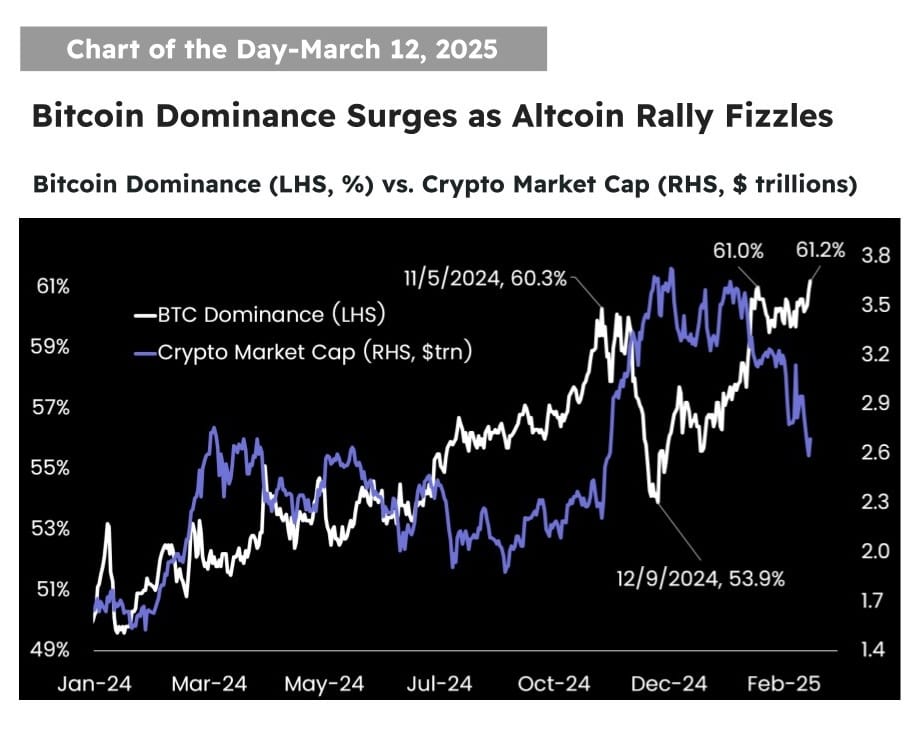

While several media outlets report that Bitcoin dominance has reached a peak of 58.8% on March 28, 2025 – a record since April 2021 – a more nuanced reality emerges. According to our data, BTC hit a dominance peak of 61.2% two weeks earlier. This figure, ignored or overlooked, actually reveals a decline in Bitcoin’s market share. Therefore, is this a precursor to an Altseason comeback?

Bitcoin dominance drops to 58.8% and no Altseason in sight?

On March 12, 2025, Bitcoin had intensified its supremacy in the market with a dominance of 61.2% ! This drop to 58.8% may seem insignificant, but it carries significant meaning. It shows that, although BTC remains the benchmark asset, some altcoins are beginning to regain ground. This fluctuation invites a more nuanced reading of market dynamics:

- The return of capital to altcoins remains marginal, but the decline in dominance suggests a pause in the massive accumulation of Bitcoin.

- The aspirational effect generated by spot ETFs and institutional strategies seems to be slowing down.

- This contraction could indicate either a profit-taking on Bitcoin or a rebalancing towards other crypto-assets.

Bitcoin dominance at 61.2% on March 12, 2025

Bitcoin dominance at 61.2% on March 12, 2025

The Altseason is much awaited

A decline in Bitcoin dominance does not automatically imply the arrival of an Altseason. For it to actually manifest, there needs to be a strong rotation of capital towards altcoins, widespread outperformance (notably of Ethereum ), and a significant increase in volumes. A drop in dominance could also simply reflect a correction of BTC without signaling a lasting enthusiasm for other cryptos.

In reality, Altseason occurs when altcoins explode in a coordinated upward manner, often after a phase of Bitcoin consolidation. Without these clear signals, the current decline to 58.8% remains a simple adjustment, not a cycle change.

Therefore, Bitcoin dominance remains a key indicator. A decrease below 58% could signal a renewed interest in altcoins. But caution: without solid volumes or leading altcoins, this movement of BTC could just be a market mirage, and Altseason could once again be postponed.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — TREE/USDT!

Bitget to decouple loan interest rates from futures funding rates for select coins in spot margin trading

Bitget to decouple loan interest rates from futures funding rates for select coins in spot margin trading

Bitget spot grid feature upgrade