Data: Bitcoin spot ETF had a net inflow of 196 million USD last week, with BlackRock's Bitcoin ETF IBIT leading the way with a weekly net inflow of 172 million USD

ChainCatcher News: According to SoSoValue data, Bitcoin spot ETFs recorded a net inflow of $196 million for the past trading week (March 24 to March 28, Eastern Time).

The Bitcoin spot ETF with the highest weekly net inflow was BlackRock's Bitcoin ETF (IBIT), which saw an inflow of $172 million last week, bringing IBIT's total historical net inflow to $39.95 billion. Following closely was Fidelity's Bitcoin ETF (FBTC), with a weekly net inflow of $86.84 million, pushing FBTC’s total historical net inflow to $11.47 billion.

The Bitcoin spot ETF with the largest weekly net outflow was Ark Invest 21Shares' Bitcoin ETF (ARKB), which experienced a net outflow of $40.97 million last week. ARKB's total historical net inflow now stands at $2.63 billion.

As of the time of reporting, the total net asset value of Bitcoin spot ETFs is $94.39 billion, with an ETF net asset ratio (ETF market cap as a percentage of Bitcoin's total market cap) of 5.68%. The total cumulative net inflow has reached $36.24 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Data: Fidelity-linked wallet deposits 14,978 ETH worth $53.57 million to an exchange

Data: Upexi’s SOL Holdings Surpass 2 Million, Over 1.26 Million Added in July

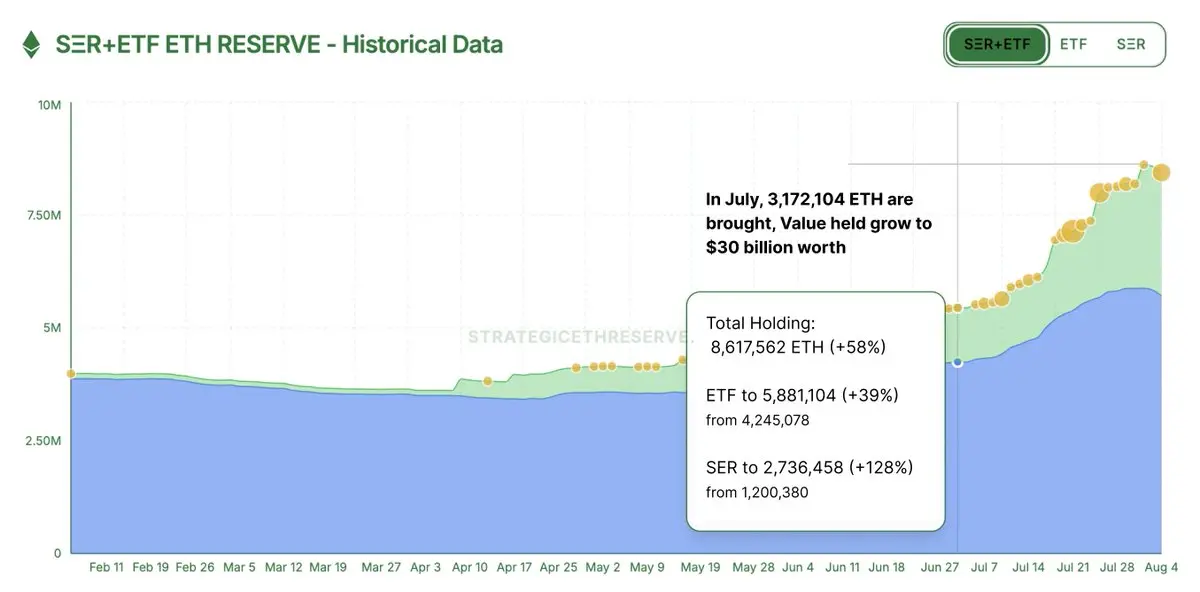

Data: July Market Demand for ETH Reaches 3 Million, Half Sourced from Ethereum Reserve Companies